Study: 12% of SHEIN customers would prefer to buy from Forever 21 amidst partnership

share on

Recently, online fashion marketplace SHEIN partnered with retail company SPARC Group to sell Forever 21’s clothing and accessories on SHEIN's platform. The move proved to be a strategic one especially in Singapore where only 4% of the general population would consider buying from Forever 21 as compared to 12% of SHEIN customers across the island.

These were the results from YouGov which carries out a continuous collection of data through rolling surveys. It also revealed that the trend of SHEIN customers being more likely to purchase from Forever 21 was also observed in the Philippines and the US.

Don't miss: SHEIN opens galaxy-themed pop-up in Bugis, launches search for brand ambassadors

While less than a fifth of all Filipino consumers would consider Forever 21 when buying clothing, the number rises to one in three among SHEIN consumers in the Philippines. Similarly, 38% of SHEIN consumers in the US consider Forever 21 for their next fashion purchase compared to 13% of general consumers.

In fact, as part of the deal, SHEIN stands to acquire a one-third interest in SPARC, expand its distribution and test out operations in brick-and-mortar Forever 21 stores across America. This includes shop-in-shops, enabling returns to stores and other initiatives, highlighting that both brands stand to gain from the partnership.

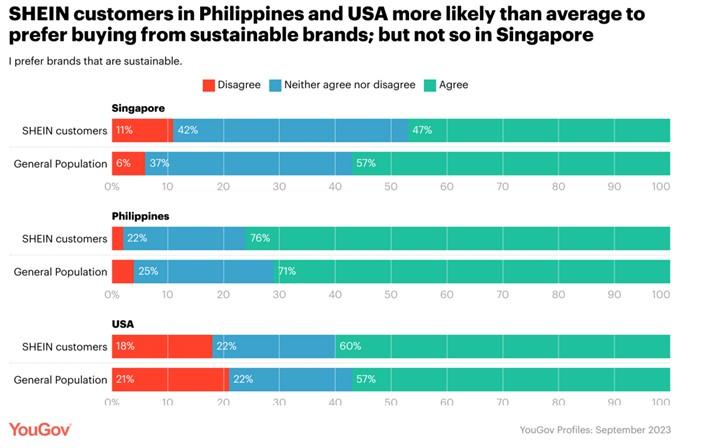

As SHEIN is a fast fashion brand, the common perception would be that its consumers would be less likely to consider a brand’s sustainability efforts. Unsurprisingly, 42% of SHEIN customers in Singapore said they were more likely to purchase from sustainable brands as compared to 57% of the general population. Furthermore, 11% of SHEIN customers in Singapore showed a lack of preference towards sustainable brands as compared to 6% of the general population.

While SHEIN customers in Singapore are less likely to prefer buying from sustainable brands, the reverse is true for those in the Philippines and the US. 76% of SHEIN customers in the Philippines expressed their preference for sustainable brands compared to 71% of its general population. In the US, SHEIN customers were 3% more likely to purchase from sustainable brands.

SHEIN has long been embroiled in sustainability concerns especially when its recent influencer trip to a tour of its Chinese factory received backlash online. In June, influencers and content creators from the US were invited to go on an all-expenses-paid Chinese factory tour and meet its workers to debunk claims that the brand has connections with forced labour in China and unsustainable environmental practices.

The content creators filmed the tours and shared them on TikTok and Instagram, with some saying seeing how advanced Guangzhou factories have gotten was pleasantly surprising, while some said SHEIN has nothing to do with poor working conditions and labour violations.

However, the incident has drawn mixed reactions across global social platforms. Media intelligence firm CARMA saw over 50k mentions across social platforms over the past two weeks, with a total of 34.4% negative mentions. Many people have criticised the company for promoting sustainability while engaging in unsustainable practices, said Charles Cheung, CARMA’s HK GM.

The biggest conference is back! Experience the future of marketing with 500+ brilliant minds at Digital Marketing Asia on 28 - 30 November in Singapore. Uncover groundbreaking strategies that connect leading brands with their target audiences effectively.

Related articles:

SHEIN invests US$85mn to empower communities globally

SHEIN to sell items from Forever 21 in new SPARC Group partnership

H&M sues SHEIN for copyright infringement: Can legal action discourage 'copycats'?

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window