Grab consolidates financial offerings under new brand GrabFin

share on

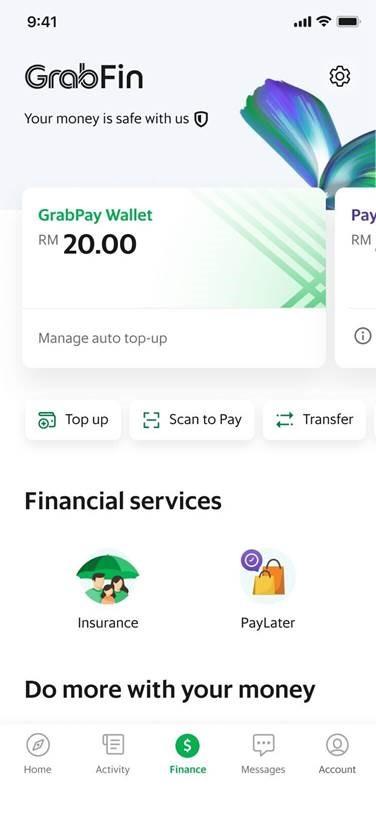

Grab Financial Group, has launched a new brand, GrabFin, for its digital payment, insurance, lending and wealth management offerings. With GrabFin, Grab users will be offered a single entry point to access payment, investment and insurance services on the Grab app. Following its launch in Singapore and Malaysia, the GrabFin brand will be progressively rolled out in other Southeast Asian markets in the coming months.

The new brand will offer everyday financial services that are simple to activate with just a few clicks in-app, as well as enable consumers to choose how they use the product with no lock-in period. According to Grab, the launch of GrabFin represents Grab's commitment to empower Southeast Asia with greater financial access and addresses a consumer preference indicated in a recent Nielsen survey where three in five consumers prefer to access all their financial services on one integrated platform.

The new brand will offer everyday financial services that are simple to activate with just a few clicks in-app, as well as enable consumers to choose how they use the product with no lock-in period. According to Grab, the launch of GrabFin represents Grab's commitment to empower Southeast Asia with greater financial access and addresses a consumer preference indicated in a recent Nielsen survey where three in five consumers prefer to access all their financial services on one integrated platform.

“Grab’s superapp platform, deep tech expertise and data-driven insights position us uniquely to drive financial inclusion across Southeast Asia," Kell Jay Lim, head of GrabFin, said.

He added that the GrabFin brand reinforces the company's promise to empower the six in 10 financially underserved in the region, by providing simple, accessible and flexible financial services in a single platform that they are familiar with and already access daily.

He added that with GrabFin, access to financial services will be as simple as ordering a ride on the Grab app, where its customised products offer consumers flexibility.

Meanwhile, in the lead-up to the launch of GrabFin, Grab has introduced three products targeted at consumers, drivers and delivery partners in the last few years. They include "Travel Cover", a daily travel insurance which also includes coverage for COVID-19; "Grab Daily Insurance" which is a daily insurance for e-hailing drivers; and "Grab Cash Financing", a Shariah-compliant financing product for driver and delivery partners in Malaysia.

More recently, on the financial front, Grab's joint venture with Singtel, and Kuok Brothers - GXS Bank - was one of the five consortiums granted a digital bank licence in Malaysia. According to Bank Negara Malaysia, GXS Bank is to be licenced under the Financial Services Act 2013.

Reuben Lai, senior MD, Grab Financial Group (Digibank) said previously that it will leverage the consortium's combined strengths, including its technology, expertise, data from highly-engaged consumers using everyday services, experience providing financial services across Southeast Asia, and deep understanding of the Malaysian market, to redefine the banking experience for underbanked Malaysians and improve their economic outcomes.

Separately in Indonesia, Grab and Viu have teamed up for a six-part series titled “Cerita Tentang Percaya” (Stories of Belief). The series aims to celebrate Indonesians' resilience and self-belief during the pandemic by featuring real-life stories of Indonesians who pressed on during trying times in the pandemic. Each episode focuses on a different story of survival from the pandemic, and is streamed on Viu.

Photo courtesy: 123RF

Related articles:

#MobExAwards 2021 highlight: Panasonic scores with eye-catching campaign on Grab

Grab Indonesia pushes into OTT branded content via 6-part series with Viu

GrabAds looks to strengthen ties with ad agencies with newly created role

Grab joins list of ride hailing firms increasing fares as fuel costs rise

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window