51% of APAC ad spend goes to digital: Is there a mismatch between biz goals and marketing strategies?

share on

We might be well into 2022, but brand marketers are still finding their footing when it comes to rebalancing their marketing efforts after widespread pullbacks in 2020 - especially with respect to traditional mass reach channels.

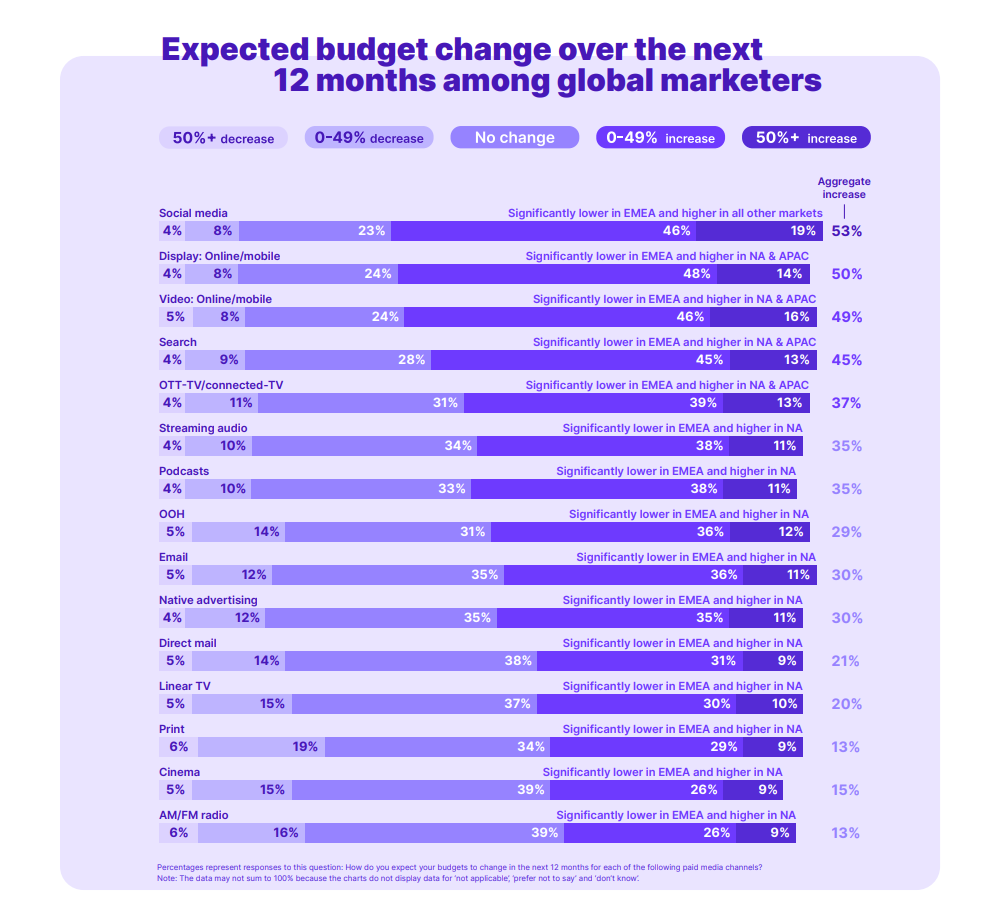

According to Nielsen’s latest study titled "Era of Alignment Future-Focused Strategies”, in 2021, around half (51%) of Asia Pacific marketers’ total advertising budget was spent on paid digital; with social media, online and mobile video, and online and mobile display advertising considered to be the most effective channels. As advertising budgets are expected to increase significantly for these channels over the next 12 months, social media remains the favourite paid marketing channel.

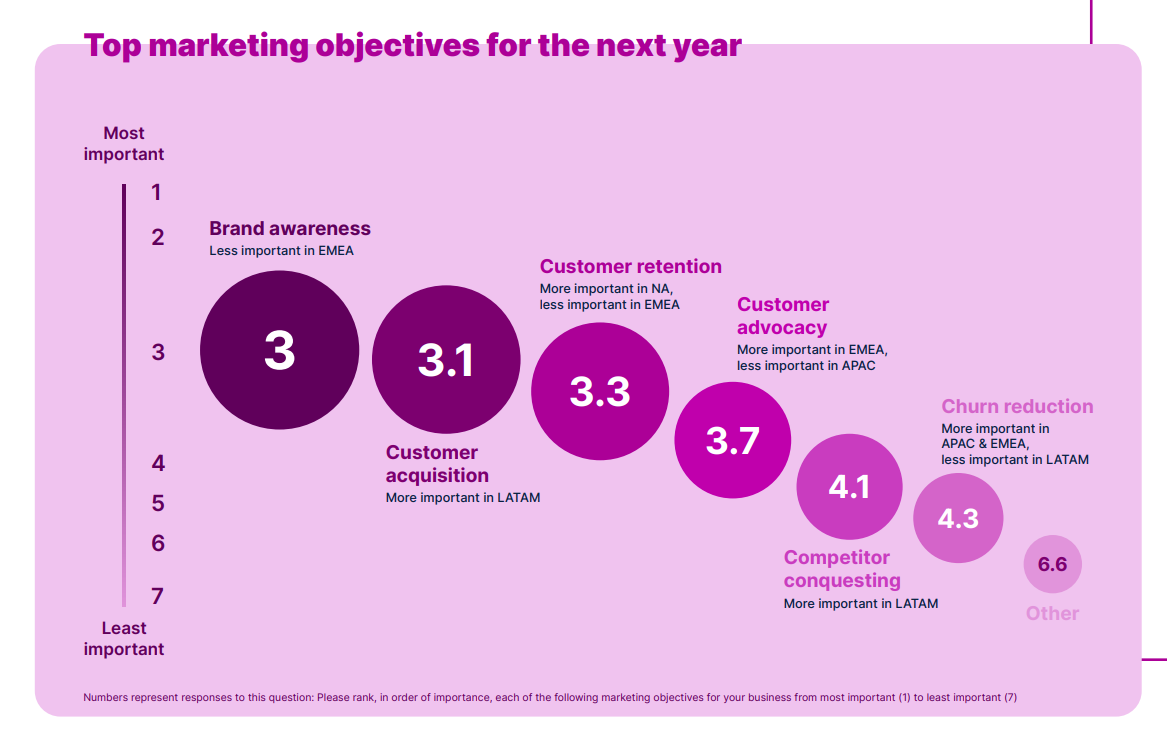

While traditional media formats such as TV and radio are more aligned with brand building and customer acquisition, yet compared with paid digital, Asia Pacific marketers plan on spending less on these mass-reach options, highlighting a possible mismatch between their top business goals and marketing strategies.

What do they want to spend on?

According to Nielsen, despite a notable increase in advertising spend over the past year, marketer objectives, strategies and tactics are largely unchanged from what it was a year ago. Overall, in Asia Pacific, marketers plan to raise ad spending across all channels by at least 34% and the increase in planned spend is more than twice that for some digital channels including social media, online and mobile display, and online and mobile video.

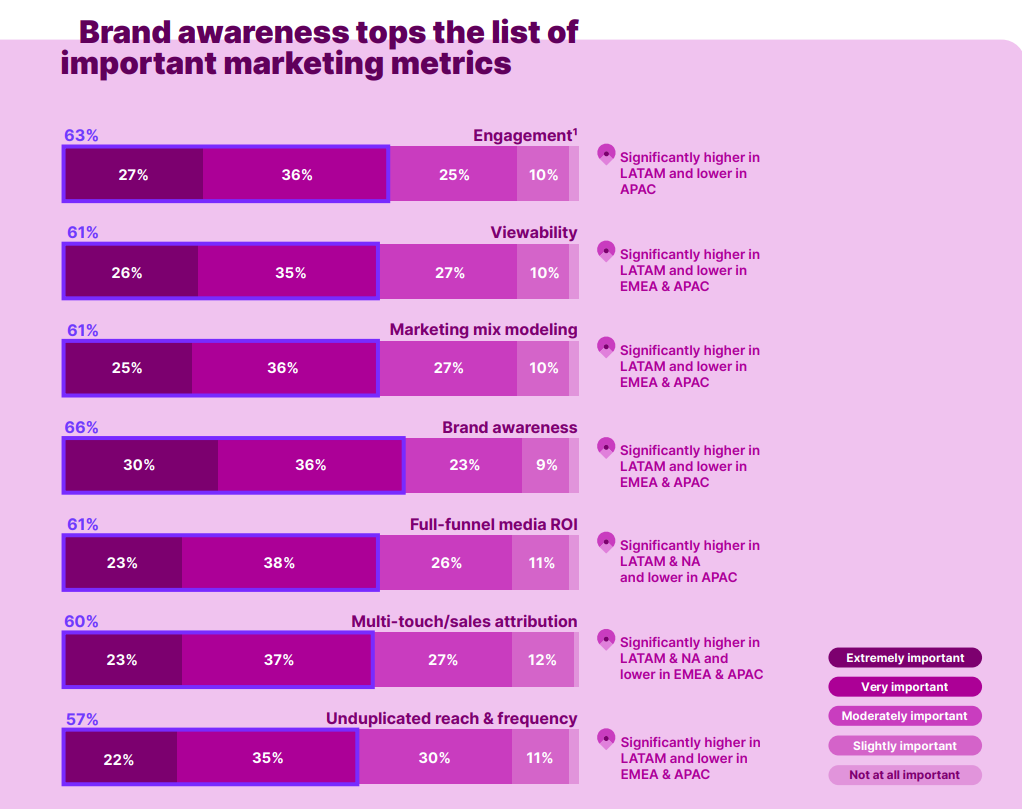

Brand awareness and new customer acquisition remain top objectives, and marketers continue to increase their spending across social media and online channels (display and video) as consumers’ media behaviours evolve.

The study added that the need to drive awareness has never been more important given the prevalence of consumer choice and access.

Moreover, some traditional sources of brand equity are less apparent than before the pandemic simply because of reduced visibility. With many consumers shopping less regularly at physical stores, for example, the frequency of seeing a product on a shelf or a sign in a store window has declined.

Overall, Nielsen data shows that marketing accounts for 10% to 35% of a brand’s equity.

Where are they spending?

Social media remains global marketers’ most bankable channel, as almost two-thirds of respondents say it’s their most effective paid channel. Many brands are finding success with social media, especially on platforms such as TikTok and Instagram. The popularity of these channels and growing brand successes are influencing increased spend, as global marketers plan to boost their social media budgets more than any other channel over the next year.

Social media is by far the most favoured advertising platform in Asia Pacific with 56% of marketers saying it’s the most effective paid channel, especially in the retail sector (64%).

Traditional media options such as TV and radio which might be more aligned with brand building and new customer acquisition, aren’t winning the hearts of marketers in Asia Pacific. In fact marketers in Asia-Pacific plan on spending less on these mass-reach options, highlighting a mismatch between their top business goals and marketing strategies.

The planned spend across social media is also interesting, as the marketers surveyed say they are not prioritising engagement with Gen Z as a key business priority even though their primary increases focus on platforms like TikTok and Instagram.

While 61% of global survey respondents say they are confident in their ability to measure the impact of brand building, their planned limited increases in ad spending across traditional mass reach channels highlights a possible misalignment between top business goals and marketing tactics, said the study. It also highlights the lesser amount of confidence among marketers in the effectiveness of traditional channels when compared against digital ones.

However, when it comes to areas such as online video and connected TV, marketers are increasing their spend accordingly. The stated high confidence in their ability to measure the effectiveness of their brand-building campaigns notwithstanding, it’s not uncommon for brands to find it challenging to quantify the effects of brand building on long-term sales.

Photo courtesy: 123RF

Related articles:

Digital advertising worth US$153m spent across sites with anti-Asian hate speech content, finds Nielsen

Nielsen: 4 consumer trends shaping SEA FMCG market

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window