3 ways to succeed in D2C eCommerce

share on

Consumer brands generally rely on intermediaries such as retailers and online marketplaces to sell their products. While there is potential in a brand.com, McKinsey said that many consumer brands still lack experience with eCommerce and direct consumer relationships. Only 60% of consumer brands, at best, feel they are moderately prepared to tap on eCommerce growth opportunities. However, that does not mean that all is lost for consumer brands in the eCommerce space. Here are three areas that companies have to think about when expanding into the eCommerce space - revenue, cost, and customer-centricity.

1. Revenue

Companies should first plot the role that D2C will play for the brand. For example, does it plan to use D2C to generate incremental sales or achieve brand differentiation? Using Nike as an example, McKinsey said the company uses D2C to further establish its brand to prevent its consumer experience from being diluted by its growing number of third party distributors.

Additionally, brands also adapt their D2C assortment based on the specific requirements of their industry and consumers. According to McKinsey, successful D2C players tend to limit their online product selection to those that offer a good balance of revenue potential, operational feasibility, and consumer benefit. PepsiCo and Kraft Heinz, for example, launched new web shops this year that only offered large items or bundles to ensure that basket sizes are large enough to offset shipment costs. This move also helps the companies avoid conflict with other channels and provide convenience to customers who like to buy their items in bulk.

On the pricing front, online prices should be on par with retail prices. However, McKinsey said brands can justify premiums by dishing out additional benefits, such as free delivery and returns, exclusive merchandise or product personalisation. Some brands have also created unique online pricing schemes to drive frequency and total spend each year, particularly in categories with high repeat-purchase potential. Citing Gilette as an example, McKinsey said the brand urges shoppers to subscribe to razor blade delivery by offering the first kit for free. This model helps the brand foster loyalty among customers and build deeper relationships.

2. Cost

Brands can make the most out of their paid and owned media investments by optimising their marketing cost, such as utilising their own social media channels and outbound CRM. Key efficiency indicators brands should keep an eye on include the customer acquisition cost and the marketing return on investment for individual customers.

When it comes to eCommerce, delivery fees are a main driver of supply chain cost. To keep shipping costs down, brands can consider lighter product packaging for online products and flexible shipping options such as click and collect or delivery to retail partners. Meanwhile, large corporations might want to consider establishing frame contracts with logistics providers for all their brands.

Although it is good to focus on customer acquisition, brands should also not forget about managing customer lifetime value (CLV). According to McKinsey, acquiring a new customer can be up to five times as costly as retaining an existing one. Hence, managing CLV is crucial to D2C profitability and a superior D2C experience typically creates a "lock in" effect. For example, L’Oréal encourages consumers to join its online loyalty programme Worth It Rewards. Over time, product recommendations and offers become even more targeted, incentivising consumers to purchase more. This thereby offers L’Oréal with more information.

According to McKinsey, the D2C business model is viable when the CLV is twice as much as the customer acquisition cost prior to roll out at scale.

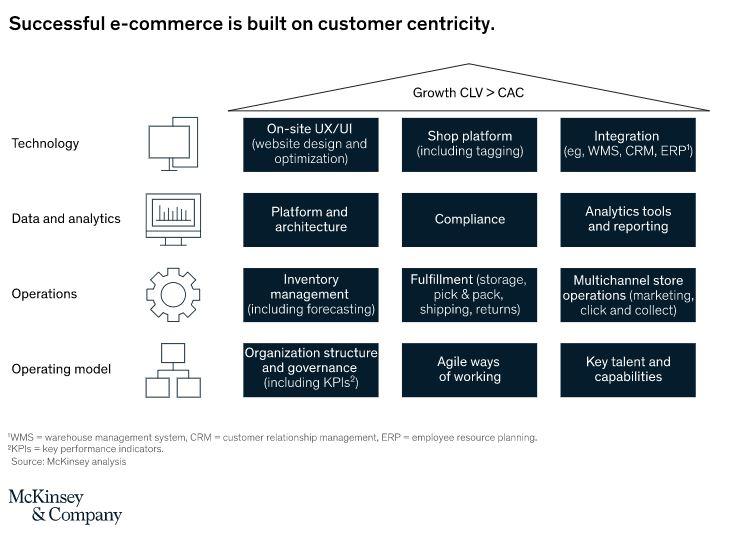

3. Customer-centricity

Without a doubt, a successful eCommerce experience is built on customer-centricity. There are a few main factors that drive technology decisions - cost, flexibility, security, support, and compatibility with existing systems. However, the most important consideration - customer experience - is often forgotten. Renowned comapnies codesign their online store with customers and build it iteratively, testing and refining crucial front-end interfaces, such as the checkout process. According to McKinsey, they also invest in tech capabilities to connect the backend of their eCommerce store to the rest of their IT architecture. And this includes warehouse management, inventory synchronisation, and order handling.

Meanwhile, one of the common reasons for starting up a D2C business is consumers insights generation. However, the challenge that companies will face is capturing and ingesting data from a range of sources before consolidating them in a common data lake that can support analytical models. Companies that succeed in this area focus their analytics on specific use cases that drive value, so that their analytics models can have a clear focus on areas such as interaction preferences and purchase drivers, among others. McKinsey added that these companies also invest in talent to obtain insights and commercial actions from these analytics models.

Another way of succeeding in D2C eCommerce is having an agile operating model so brands can adapt their ways of working to rapidly changing customer preferences. Such an operating model allows for small, cross-functional teams to work in short sprints to iterate on products and services based on customer outcomes.

Also, on the logistics front, D2C requires a logistics setup that is different from what supply chain managers at most consumer brands are used to. In the early stages of D2C, brands tend to outsource logistics to guarantee quality, speed, and the flexibility to scale their operations up or down as needed. According to McKinsey, consumer brands that have their own retail network tend to use stores as eCommerce fulfilment centres.

Citing Nike as an example again, McKinsey said the brand allows online shoppers to collect their purchases at its physical retail stores. During the pandemic, Nike also rolled out contact-free curbside pickup at selected stores.

Enjoyed what you have read? Follow us on Instagram for the latest updates in Southeast Asia's marketing and advertising space!

Join us this 8-11 December as we address the new realities for PR and crisis communicators, explore how brands are dealing with the impact of COVID-19 , and discuss areas of priority for communications. It's an event you would not want to miss out. Register now!

Photo courtesy: 123RF

Related articles:

DMA download: Content creation in the eCommerce era

What to invest in if you are falling behind your competitors in eCommerce sales

Analysis: Can YouTube actually take on Amazon and Alibaba with new eCommerce offering?

Opinion: eCommerce is a core business area all stakeholders need to commit to

eCommerce players are taking growth for granted, says new study

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window