Survey: HK social media ad spending sees 20% YOY surge

share on

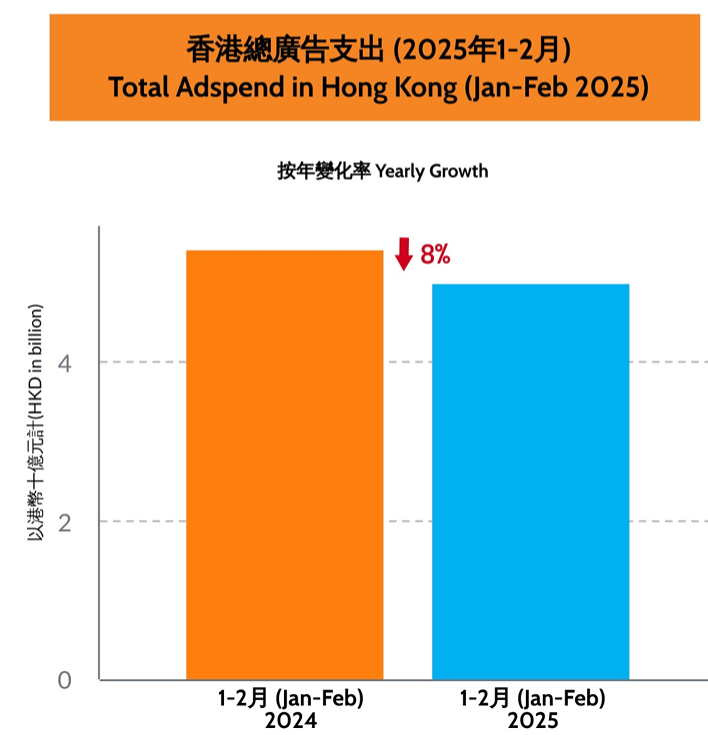

Hong Kong’s ad spending has recorded an 8% YOY drop in the first two months of 2025, reaching a total of HK$5 billion. However, social media ad spending saw a 20% YOY increase, according to AdmanGo.

The decrease in the overall ad spending in the city can be attributed to US tariffs, which have made advertisers more cautious in allocating resource, said the report. Ad spending across industries also fluctuated due to adjustments for the Lunar New Year, with varying degrees of change by sector.

Despite the YOY decline in local adspending, the newly announced Budget includes multiple measures to address the current economic challenges. Furthermore, the government's efforts to promote the mega-events economy, the resumption of multiple-entry Individual Visit Scheme endorsements for Shenzhen visitors and the opening of the Kai Tak Sports Park are expected to benefit the tourism and retail sectors, encouraging advertisers to invest more in promotional initiatives.

In terms of media analysis, the report revealed that search engine marketing (SEM) ranked as the fourth largest medium, capturing a 14% market share, similar to last year's, following social media, mobile and TV. Meanwhile, social media ad spending recorded a 20% YOY increase in the first two months of 2025, marking the highest growth among all media types.

Among all social platforms, Instagram led with a remarkable 50% YOY increase in ad spending. In contrast, ad spending for both mobile and desktop declined YOY. Among traditional media, TV and outdoor ad spending recorded YOY increases, whereas newspapers saw a YOY decline.

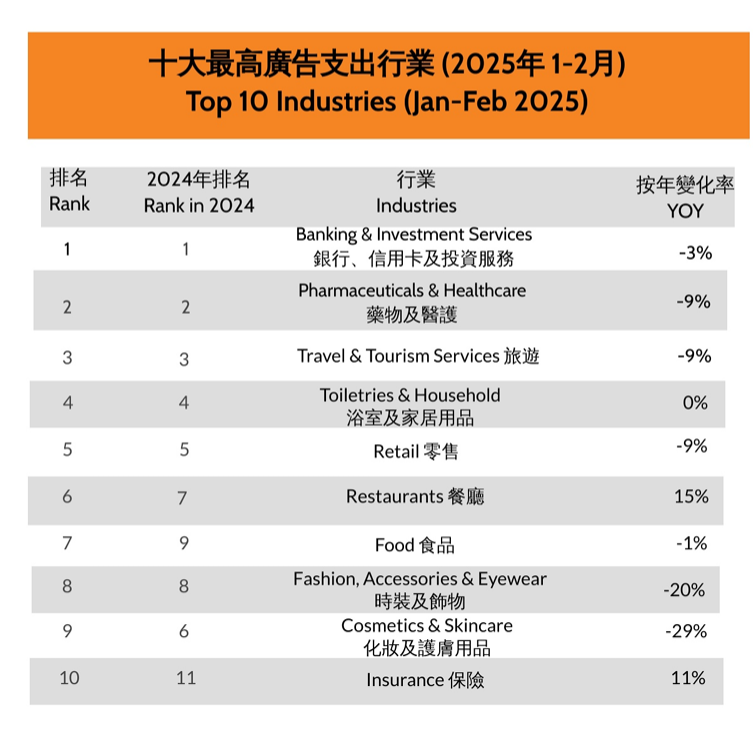

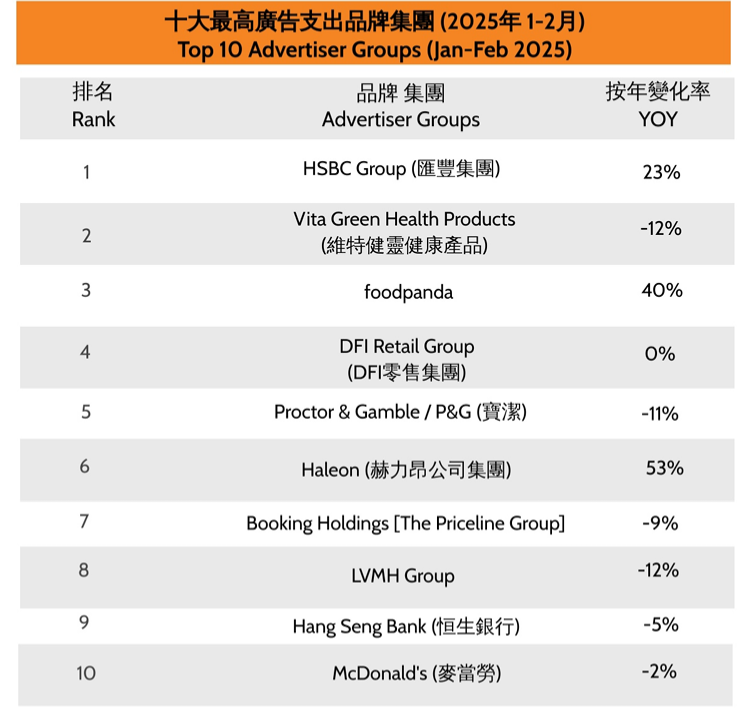

In terms of ad spending across various industries, topping the list was the banking and investment services sector, which recorded a 3% YOY decline in the same period. Among the top 10 advertisers groups, HSBC Group saw 23% YOY increase in ad spending, while Hang Seng Bank recorded a 5% YOY decline.

The second-ranked pharmaceuticals and healthcare industry saw a 9% YOY decline. Among the groups, Haleon primarily allocated its ad spending to promote Panadol and Centrum. The fifth-ranked retail industry recorded a 9% YOY decline in the first two months of 2025, with DFI Retail Group maintaining ad spending levels similar to the same period last year.

On the other hand, restaurants ad spending recorded a 15% YOY increase, ranking sixth in terms of total ad spending. Among the top 10 advertiser groups, foodpanda saw a 40% YOY increase, while McDonald's saw a 2% YOY decline. Insurance ranked 10th among the top 10 industries by ad spending, recording an 11% YOY increase, with media insurance accounting for the largest share.

Meanwhile, ad spending for toiletries and household remained similar to the same period last year, randing fourth among the top 10 industries by ad spending. P&G, which ranked fifth among the advertiser groups, primarily allocated its ad spending to bathroom and household brands such as Pantene, Oral-B and Head & Shoulders.

Join us this coming 17 June for #Content360 Hong Kong, an insightful one-day event centered around responsible AI, creativity VS influencers, Xiaohongshu and more. Let's dive into the art of curating content with creativity, critical thinking and confidence!

Related articles:

Survey: HK search engine marketing ad spending reaches HK$5.3bn

Report: COVID-19 causes Hong Kong ad spend to plunge more than during SARS

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window