Study: SMEs in SG still lagging in areas such as AI and data analytics

share on

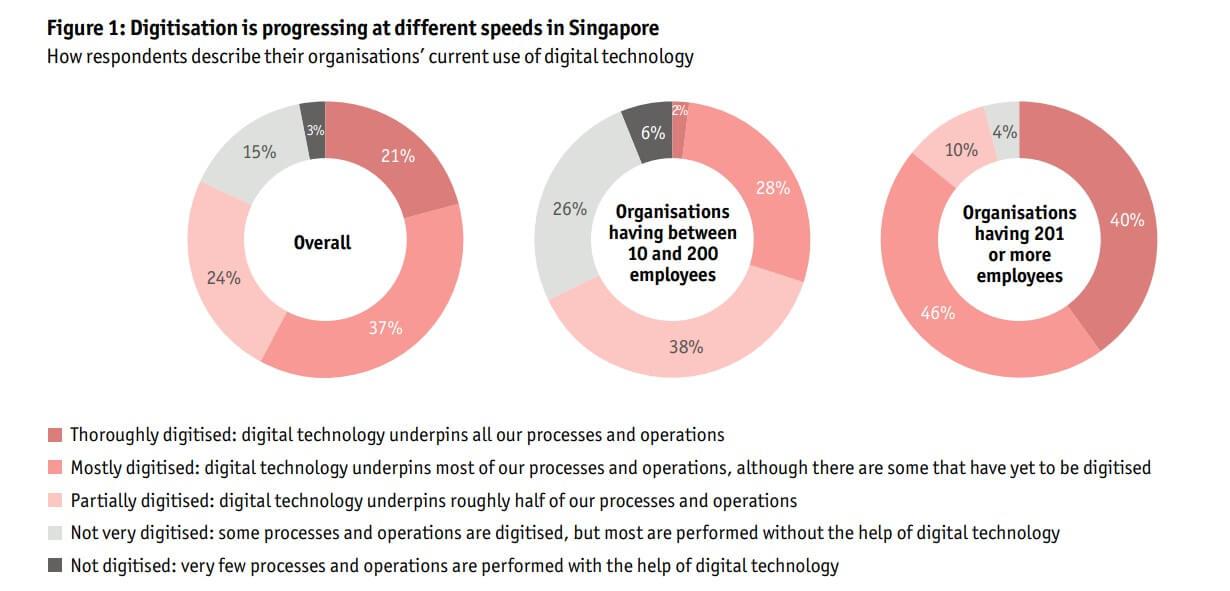

According to a study commissioned by Prudential Singapore, the smaller the organisation, the less digitalised it is likely to be. While businesses are embracing digitalisation to support their operations and employee engagement, the speed in which it is happening is different and that's where smaller firms tend to miss out. Titled “Digital for 100: Business, technology and fulfilling lives,” the research conducted by Economist Impact assessed how companies are leveraging technology to improve internal operations as well as help their employees maintain a healthy lifestyle and build financial resilience.

One in three (30%) respondents working in small and medium-sized enterprises (SMEs) say digital technology underpins most or all its business processes and operations. This number is nearly three times higher (86%) for those working in large firms. Jeff Ang, head of enterprise business solutions, Prudential Singapore, said that while the pandemic has accelerated digitalisation efforts in businesses, more can be done to help SMEs keep pace with large firms in leveraging technology.

“SMEs are a key pillar of the Singapore economy. Engaging and supporting them in their digitalisation, whether through grants or training programmes, will be crucial in helping them stay relevant to customer needs and be more resilient as a business. When SMEs thrive, there will be a positive impact on the economy, resulting in greater growth for all,” said Ang.

SMEs have invested less in advanced technologies compared to large firms

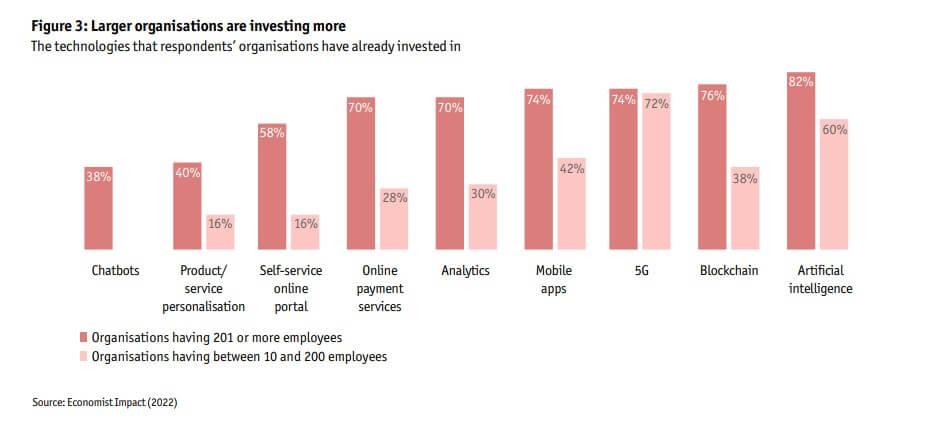

When it comes to investment in advanced technology such as Artificial Intelligence (AI), data analytics and online payments, SMEs are also lagging behind their large enterprise counterparts. The research found that just 60% of SMEs have invested in AI compared to 82% of large firms. When it comes to analytics, it is 30% for SMEs and 70% for large firms. With online payments, it is 28% versus 70%. SMEs surveyed said that the primary reason for not digitalising to a greater degree was a lack of budget.

Acknowledging the gap in digitalisation levels between SMEs and large businesses, Kurt Wee, president of the association of small and medium enterprises (ASME) shared, “Gap has narrowed considerably over the past five or six years.” This is due in part to strong government support, ensuring that SMEs have access to resources and advice that help them to upgrade their digital capabilities. The silver lining is that SME respondents also indicated that their organisations plan to invest in and develop advanced capabilities such as data analytics, blockchain and product/service personalisation in the next two years.

Businesses across the board said that their organisations have already invested in 5G (73%), AI (71%), and mobile apps (58%). They intend to invest in product or service personalisation (47%) and analytics (41%) in the next two years.

“SMEs realise they need to accelerate digitisation, but many bemoan a lack of financial resources and skilled digital talent,” said Tay Ee Learn, chief sector skills officer of the National Trades Union Congress (NTUC) Learning Hub, a social enterprise set up by NTUC. “Although the labour market is tight for everyone in Singapore, SMEs are finding it harder than large businesses, with reputations in the market and greater resources, to attract needed talent,” he explained.

In the survey, lack of budget is the primary reason our SME respondents cite for not digitising to a greater degree thus far.

However, they intend to make up some ground: higher percentages of SME respondents say their organisation plans to invest in and develop most of such capabilities in the next two years, with the top three being data analytics, blockchain and product/service personalisation.

Those SMEs that remain short of budget and technology talent can avail themselves of a platform launched by the government’s Infocomm Media Development Authority (IMDA) in 2021, dubbed “CTO-as-a-service”.

Using technology to boost employee engagement

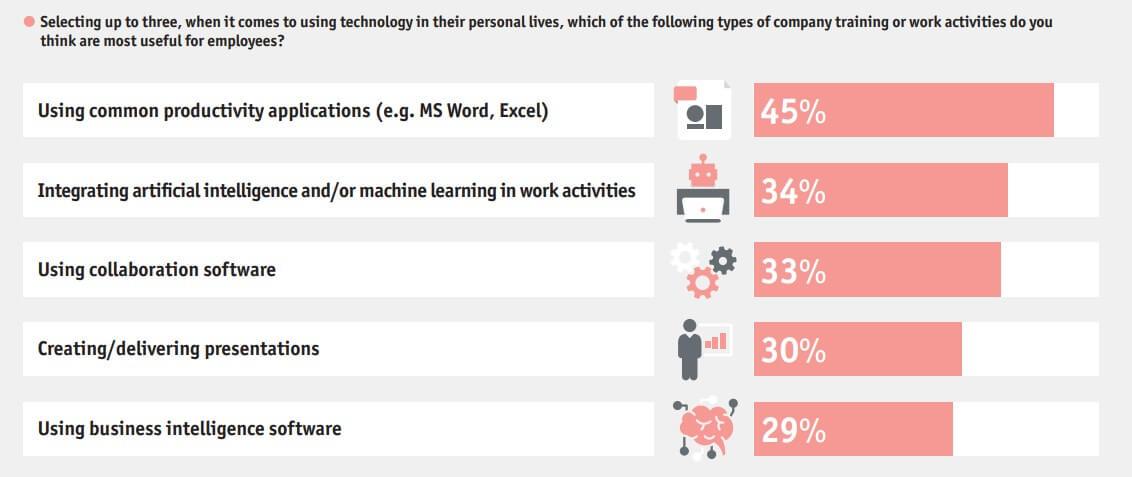

Besides improving internal operations, technology can also support flexible working, improve employees’ physical health and facilitate corporate activities. Nearly four in five (79%) respondents agree that technology, if used effectively, impacts their organisation’s ability to strengthen employee engagement. According to respondents, the most impactful way is by encouraging and supporting digital innovation internally (47%), followed by career development in new technology-based roles (41%). These are the answers that were gathered on how companies can use technology to boost employee engagement.

For nearly half of SMEs (48%), training employees in the use of newly-adopted digital technologies is key to driving engagement. “Digital technologies can help people connect and grow, and create a more collaborative work culture. In any digital transformation, it is important to have everyone on the journey, and ensure they are well equipped to leverage new technologies to help them do their job better, and with greater confidence,” said Ang.

Related articles:

Prudential Asia creates 2 versions of same ad, one with same-sex couple one without

Prudential SG uses AR filter for dollar notes to educate users on investment choices

Prudential and SuperM get Asian consumers dancing to social media challenges

Prudential taps on K-pop stars SuperM to push healthy living across Asia

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window