SEA outpaces China and India in digital retail share, adds 70m online users during COVID

share on

Southeast Asia’s digital retail share grew 85% year-on-year this year, outpacing China (5%), Brazil (14%) and India (10%), according to the annual SYNC Southeast Asia report by Facebook and global consultancy Bain & Company. Over the next five years, Southeast Asia's eCommerce sales is projected to keep pace with these countries, growing at 14% per year.

Since the start of the pandemic, approximately 70 million individuals have become digital consumers in Southeast Asia, equivalent to the entire population of the UK. According to the report, there will be 350 million digital consumers in Southeast Asia at the end of 2021, compared to around 310 million at the end of 2020. This means almost 80% of Southeast Asian consumers will go digital by the end of the year. Meanwhile, digital spending per person is up 60% compared to last year, with overall eCommerce sales set to double by 2026.

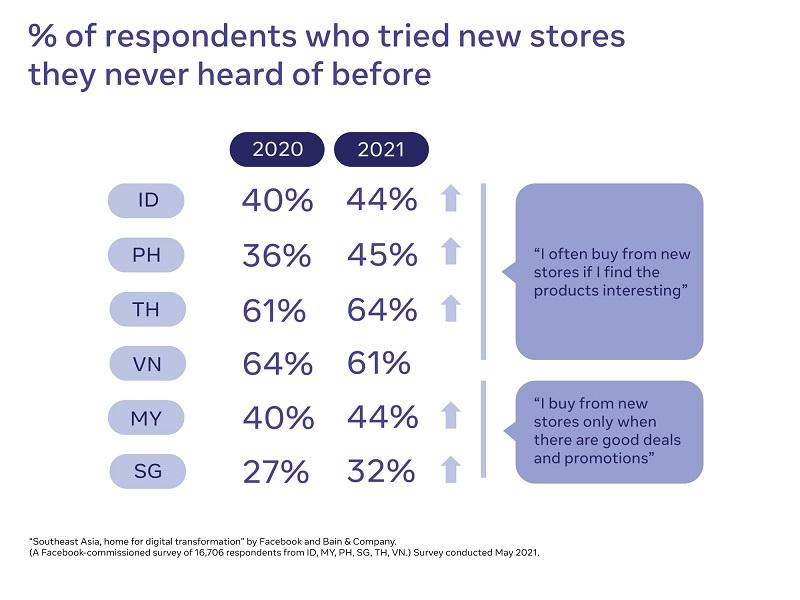

Despite the rise in eCommerce and online activities during the pandemic, only 45% of Southeast Asia consumers are using online as a primary purchase channel. Also, the majority of them (65%) do not know what they want to buy when they go online. However, 51% said they have tried new stores they have never heard before in the last three months, showing that consumers in Southeast Asia are open to the discovery of new products and services. Consumers are also buying across a wider range of categories online, with those surveyed indicating that they shop across an average of 8.1 categories, 60% higher than the 5.1 average in 2020.

According to the report, there is potential for brands to build brand loyalty and growth as the eCommerce market remains fragmented. Consumers shop-hop across an average of 7.9 websites before making a purchase decision in 2021, compared to an average of 5.2 websites in 2020. The greatest increases were seen in the Philippines (4.3 in 2020 to 7.8 in 2021), Indonesia (5.1 in 2020 to 8.2 in 2021) and Thailand (from 5.5 in 2020 to 8.6 in 2021). Despite shop-hopping more, only 51% of consumers switched brands in the past three months across categories compared to the same period last year. In Singapore, for example, only 35% of consumers switched brands in the last three months while only 44% in Indonesia and 45% in Malaysia did so.

Sustainability is also becoming a top concern for consumers and while value for money remains the top reason for switching brands, consumers are now focusing on product quality and, in particular, sustainability and social responsibility. Environmental, social and governance factors were among the top three most cited reasons for switching brands in Southeast Asia as a whole as well as Vietnam. According to the report, 92% of consumers said they are willing to pay more for sustainable and socially responsible products, and over 80% of them are willing to pay a premium of up to 10% for such products. The other reasons included finding more value for money brands, finding a better product, availability, or trying something new.

The home-centric lifestyle is also expected to remain entrenched in Southeast Asia. The report predicts that about 86% of in-home food delivery is expected to remain post-pandemic. Around 72% of respondents said time spent "in-home" would remain the same with consumers spending 75% of the time at home shopping online is also expected to continue post-pandemic. At least 37% of respondents said they expected to work from home even after the situation improved, with almost 90% of executives believing that a hybrid WFH model will become the norm post the pandemic.

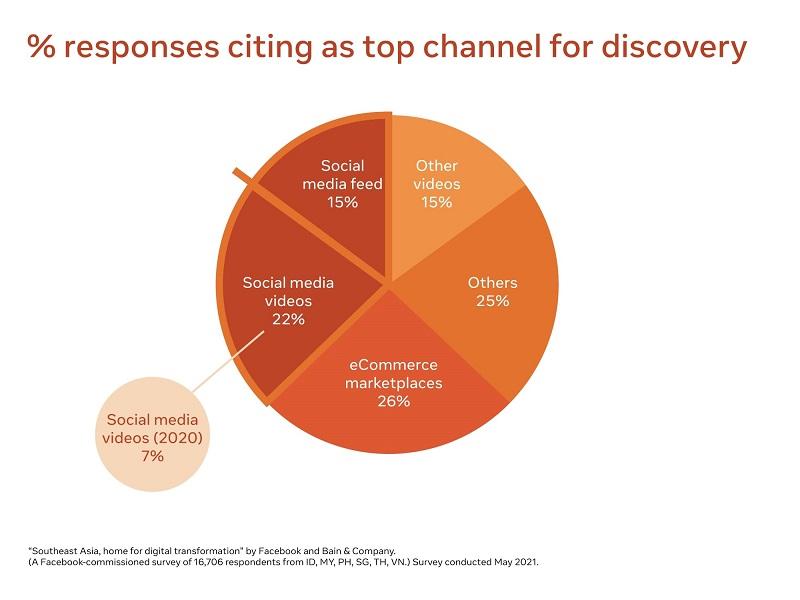

The report also shows that 80% of channels people use to discover what they should buy are online channels, with the remaining 20% being offline channels. In addition, 83% of channels used to find more information about a product or service are online, with digital channels making up for 56% of purchase spend. Social media videos is also rising in popularity as a discovery channel, with 22% of respondents citing them as the top channel for discovery - around triple that of 2020.

This year’s annual SYNC Southeast Asia report is based on a survey of approximately 16,700 digital consumers, with insights gathered from interviews with over 20 CXOs across six Southeast Asian countries; namely, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. Digital consumers surveyed for the report are consumers who are above 15 years old, and have made an online purchase in at least two product categories in the past three months.

Benjamin Joe, VP, SEA at Facebook, said that the pandemic continues to push people online at an aggressive pace as consumers in SEA form new habits related to online discovery, consideration and purchase. “For both new and established brands, these shifts signal the need to rethink traditional eCommerce experiences and find creative ways to inspire and connect with customers online,” he added.

Damian Kim, country director at Facebook Singapore, said that the report findings point to the fact that people increasingly want to feel that they’re making the right purchase decisions. “Now is the time for brands to be brave and reimagine the channels and platforms on which they can stand out and be discovered. We’re hopeful that we can play a positive role in supporting brands in Singapore, and Southeast Asia at large, to experiment with new shopping modes or adopting emerging technology like augmented reality,” he added.

Earlier this year, a study released by DHS Express predicted that 80% of all B2B sales interactions between suppliers and professional buyers will take place in digital channels by 2025. The study cited the impact of the pandemic on the pace of digitalisation and the purchasing behaviour of technology-savvy millennials, who are now of age to be the professional B2B decision-makers, as the main drivers of this global e-commerce growth.

Join ourDigital Marketing Asia conference happening from 9 November 2021 - 25 November 2021 to learn about the upcoming trends and technologies in the world of digital. Check out the agenda here.

Photo Courtesy: 123RF

Related articles:

Study: B2B e-commerce market to grow significantly in coming years

How China's digital economy is laying the blueprint for digital transformation

Three important strategies to transform and future proof your e-commerce business

Opinion: Technology and e-commerce will be the silver bullets for businesses in 2021

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window