Hong Kong is still the crown jewel of luxury retail

share on

I am shocked by comments from various industry and media practitioners who are taking the relocation of LVMH from Hong Kong to China as a sign that Hong Kong is losing its status as the luxury hub of the world.

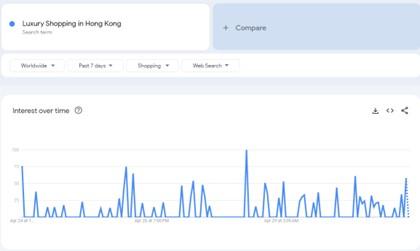

Before I share examples as to why this is not the case, you can see that there has been a significant increase in interest across the world for luxury shopping in Hong Kong in the past seven days, based on Google Trend Data:

Even if you look at luxury brands such as Chanel as an example, you can see that the search trend of people looking for Chanel in Hong Kong has strong momentum.

Figures and statistics say it all. Many people misperceive the moving of LVMH Hub from Hong Kong to China as a signal of Hong Kong losing its shine as the crown jewel of luxury shopping.

Brands are adopting a more localised marketing approach

Many multinationals, and national companies, including luxury brands, are shredding the regional hub model in Singapore or Hong Kong. Instead, they are moving to a local-to-local country-level approach for their marketing and advertising. The creative directions and guidelines are driven from their brand headquarters in Paris, Milan, or New York for luxury fashion and Switzerland for luxury watches. The move can be viewed as a business operational issue rather than a change in consumer shopping behaviour.

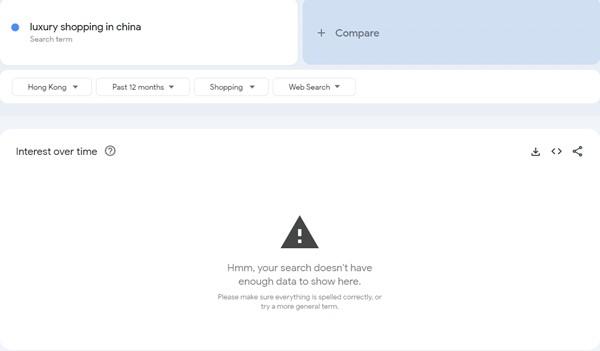

People from Hong Kong don’t look to China for luxury

There are beliefs that Hong Kongers travel to mainland China for luxury shopping. I have yet to hear of anyone travelling to China for luxury shopping, and the Google Trends data below clearly shows that no one is searching to do luxury shopping in China from the city.

Direct to the consumer on eCommerce is reflective of accessibility instead of demand

While there is an increase in direct to consumer on eCommerce for luxury brands in mainland China, this is the same in other markets such as US and UK, where store locations are only available in some possible cities where their target audience lives. Therefore, I cannot concur about a major shift to a direct-to-consumer model for luxury brands through eCommerce or that more brands are adopting a global price strategy.

There are opinions that more and more luxury brands will shift their resources from Hong Kong to mainland China as China has become a dominant force in the global luxury market. There are also speculations that the shift is due to the geopolitical and economic turmoil of the world. Setting up more stores and operations in China has nothing to do with Hong Kong losing its shine as the luxury hub for Asia. It's a reality check on the increase in distribution channels and accessibility for local Chinese to purchase luxury products without going overseas each time, be it to Hong Kong or Paris.

Hub moves and operational changes are dictated by localised brand strategies, not audience trends

The strategic move of LVMH to move its hub from Hong Kong to China is a business decision rather than a consumer behaviour change of coming to Hong Kong for luxury shopping. As the spending in digital increases to over 60% or more for luxury fashion, watches and jewelry, fragrance, and beauty globally, it becomes more fragmented and harder for a central operation hub to run any global or regional campaigns without local adaptions.

Social media (XHS/Douyin/Tiktok vs FB/Instagram vs Snap), taxi-hailing apps (Didi vs Grab vs Uber), delivery apps (Foodpanda vs. Grab vs Deliveroo), music streaming platforms (QQ Music vs JOOX vs Spotify), video streaming platforms (iQiYi vs. YouTube vs. NetFlix), as well as major eCommerce shopping portals (TMall vs. Farfetch vs. Selfridges) are different in each country. While you may still use the major tech platforms like Google, Facebook, and Instagram, the creative and messaging must differ significantly for each market. The entire ecosystem to capture Gen Z's and Millennials' attention are different.

Regulations, touchpoints, index, and data differ across markets

With the government regulations on OOH advertising, you can also see a diversion in how OOH is activated across different markets. On top of the hot trends are PDOOH and 3D billboard; most markets allow scent, music, and lighting in OOH advertising, while other markets, such as Hong Kong, are more regulated. The second reason for the change from a hub approach to a local-to-local approach is the difference in digital touchpoints, media index, and the availability of second party data. Platforms such as Amazon Clean Room, ask each local luxury advertising and marketing team to relook at what should be done locally, for Gen Z and the millennials.

The future generation view and buy luxury differently from past cohorts

Our proprietary PHD Luxury research study shows that Gen Z in Hong Kong is moving from treating luxury goods as aspirational to compatible, based on shared values between luxury brands and individuals. Gen Z is moving from "targeted" to "exploratory", being able to mix and match between brands that reflect their unique identities. They are also moving from just "buying" to "buying into" the community and the message surrounding the luxury brands. These make it more challenging and increase the need for a local approach in luxury advertising and marketing to remain relevant to Gen Z customers.

Hong Kong’s rich culture and heritage drive spending for tourists

While some people believe Hong Kong should continue to use "shopping" to help rebuild its Asia's world city image, I believe it will lose the edge to other markets worldwide if the city still leverages old tactics from the 90s to focus on "Dinning and Shopping". The drop in flight ticket prices and the chance mindset of consumers has encouraged a worldwide exploration of different countries. Hong Kong Tourism Board and Brand Hong Kong have strategically dialed up the arts and culture of Hong Kong while setting dining and shopping as a backdrop. Tourists increasingly want to experience and immerse in the local culture and heritage. Once you drive people to Hong Kong, our array of dining and shopping experiences will entice tourists to spend in the city.

Hong Kong allows access to the latest and most extensive range of luxury products

Hong Kong is and will always be the crown jewel of luxury shopping in the mind of worldwide tourists. If you are familiar with the luxury markets, Hong Kong always has the widest variety and the latest runway fashion items available in its store. The window merchandising display, the store design, and the impeccable services provided by the luxury store staff are unequivocally first-class. On top of that, Hong Kong always has access to the latest items available. For example, you can find more limited editions of fashion and fine watches from Tag Heuer, Breitling, Omega, Cartier, CHANEL, to Hulbot, Audemars Piguet, and Patek Philippe in Hong Kong than anywhere else in the world. No place such as Hong Kong has the first access to the watches announced in LVMH watch shows in January 2023 or the Watches and Wonders in late March 2023.

Takeaway for brands

- Omnichannel solutions with interactive and personalised experience is Key

- Leverage the quality, the durability, the craftsmanship, and the heritage of your brand to tell a story

- DEI and ESG are not going away. Messaging on diversity, equality, and inclusiveness will be key moving forward

In summary, our industry is overreaching about LVMH moving its hub from Hong Kong to China as a reason to invest more in China. This is where the investment should be when you have a massive market with a growing appetite for luxury items beyond the first and second tiered cities. Hong Kong is and will always be the place for luxury shopping for mainlanders and global tourists, especially with our tax-free model. With Hong Kong Tourism Board and Brand Hong Kong reimaging, Hong Kong as an arts and culture hub will bring even more opportunities and sales for luxury brands in the city.

The writer is Antony Yiu, CEO, PHD Hong Kong.

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window