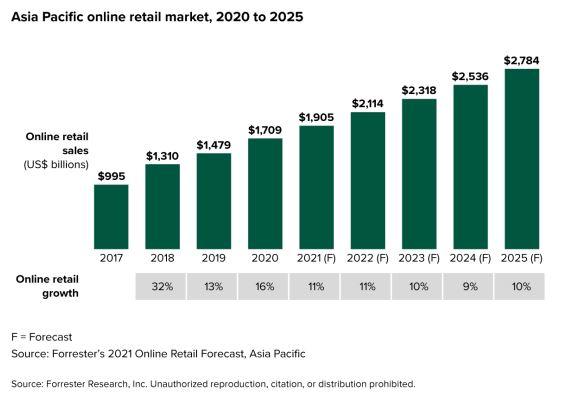

APAC online retail predicted to reach US$2.8 trillion by 2025

share on

Online retail in the APAC region is forecasted to reach US$2.8 trillion by 2025, an increase from US$1.7 trillion last year, according to a Forrester report titled “The 2021 Online Retail Forecast, Asia Pacific”. ECommerce growth for 2021 is forecasted to be at 11%, a slight dip compared to 16% in 2020.

Overall, year-over-year eCommerce growth in Asia Pacific last year was lower compared to other regions but it still managed to add US$230 billion. Australia grew by 31% last year followed by Japan (21%), South Korea (19%) and China (15%). Meanwhile, India witnessed the slowest growth in Asia Pacific last year at just 5%, mainly due to the sudden shut down in the second quarter of last year.

Grocery is predicted to be the fastest-growing category (26%) in 2021 followed by personal care (21%), and media such as books, music and videos (14%). According to Forrester, grocery is predicted to maintain 2020’s growth momentum to reach US$473 billion by 2025, overtaking consumer electronics, the top category in terms of dollar volume, for the first time in 2024.

According to the report, the consumer electronics category suffered most from the pandemic with a 5% growth. Consumer electronics, the largest category accounting for 16% of all online retail in APAC, has been the top contributor to online retail growth since 2009. However, the category’s contribution fell from the top spot in 2020, the first in a decade, according to Forrester. Clothing followed a similar trend to other regions as consumer spending moved to essential goods.

Asia Pacific also saw an additional 154 million online buyers last year, which according to Forrester was the highest number of new users ever in a single year. This accounted for 69% of new buyers added globally in 2020. Marketplaces registered a sharp surge in buyers, translating into higher sales, as well.

Online retail trends that emerged

To stay afloat, companies pivoted to digital during the pandemic, especially those in the non-essential categories. As a result, Forrester saw four new trends emerge.

1. Rise of new vertical players

South Korea, for example, witnessed pure-play grocer Market Kurly raise US$150 million last year. According to Forrester, the country's online grocery market has the highest global penetration at 21%. In India, Flipkart, which had limited presence in grocery pre-pandemic, introduced a 90-minute delivery service to leverage on the fast-growing category. Tata Group also entered the eCommerce scene with the acquisition of online grocery player BigBasket. At the same time, India's Reliance Retail launched JioMart grocery to serve grocery demand in over 200 Indian cities. Reliance Retail operates over 1,500 physical stores in India and has a valuation of US$100 billion.

2. Retailers improve reach with offline stores

The year 2020 saw a push in strategy for the underserved tier-three and tier-four cities. Alibaba bought a controlling stake in China's largest supermarket chain Sun Art Retail, which has 76% stores outside urban areas. According to Forrester, this allowed Alibaba to penetrate the underserved non-urban customer market. At the same time, Japan's Rakuten invested in Walmart-owned supermarket chain Seiyu to tap into the offline channel to grow. Meanwhile, Amazon and Reliance are currently in a legal battle over the latter's plan to acquire Future Retail, which currently has 1,800 stores in India. According to Forrester, the logistics arm and the large physical footprint that come with the acquisition offer an advantage to Reliance, providing broader depth in categories and faster delivery times.

3. Livestreaming

Livestreaming has been popular in China for a while and 2020 boosted the growth of this medium globally. LVMH, for example, shifted from its traditional store-focused strategy to roll out an extensive catalogue on JD.com and also debuted on livestreaming platform Little Red Book. Meanwhile, Forrester said farmers were also using livestreaming sessions on Douyin in China to sell fresh produce and some of them earn more than US$1 million per monoth. Taobao Live also hosted 2.5 million sessions from farmers during the 2021 financial year.

Outside of China, South Korea's Naver had 45 million views on its livestreaming platform four months after its launch mid last year. Another South Korean digital giant, Kakao, also launched its livestreaming service named Kakao Shopping.

4. Social commerce gains traction outside China

India's pure-play social commerce retail, Meesho, reportedly saw monthly users grow from 0.5 million to 5.5 million from 2019 to 2020. It also witnessed monthly orders jump by 500% during that period, Forrester said.

Social commerce also added grocery to its list of offerings. Alibaba, for example, pumped in US$750 million in e-grocery start-up NiceTuan, which focuses on community buying. Tencent has also backed community buying app specialising in grocery named MissFresh. It also raised an additional US$360 million last December after raising US$495 million in mid-2020.

Join our Digital Marketing Asia conference happening from 9 November 2021 - 25 November 2021 to learn about the upcoming trends and technologies in the world of digital. Check out the agenda here.

MARKETING-INTERACTIVE's Asia eCommerce Awards recognises and rewards excellence for brands, eRetailers and agencies in their eCommerce efforts across Asia. Join our Asia eCommerce Awards 2021 to showcase your work and inspire the industry. Click here to register today!

Photo courtesy: 123RF

Related articles:

SEA outpaces China and India in digital retail share, adds 70m online users during COVID

Opinion: How retail media networks offer brands a chance to bounce back from the pandemic

Opinion: Be everywhere your customers are: 3 keys to retail

How can HK physical retailers compete with the convenience of online purchase?

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window