7 ad spend shifts to note in 2021 with the rise of OTT and CTV

share on

In 2021, programmatic budgets will surge with the rise in connected TV (CTV) streaming, along with advancements in addressable technology that are finally bringing linear inventory into digital buying workflows. This is according to a report by video advertising platform SpotX, titled “2021 global video advertising trends”. Gathering insights from industry leaders across companies such as Acxiom, AMC Networks, CCI, Discovery, DISH Media, GroupM, Samsung Ads, The Trade Desk, TransUnion, SpotX shares seven trends for about what’s next for TV and video in the upcoming year.

1. The accelerated shift in consumer viewing habits will hasten the development of a post-cable ecosystem

The rise in connected TV (CTV) is evident. SpotX found that in the APAC region, 68.5% of consumers regularly watch over-the-top (OTT), predominately through mobile devices. In more developed markets like Japan, Singapore, and Australia, it is found that CTV is gaining popularity. Meanwhile in the US, 40% of adults are now CTV consumers. In Europe’s biggest markets, there is 50% reach in CTV viewership, representing 61.5 million households.

CTV audiences are also found to be more mature than expected, with a median age of 45 in the US, and 43 in Europe. Meanwhile, OTT viewers in APAC are somewhat younger, with a median age of 32.

OTT viewers in APAC were also found to spend an average of three hours per day watching video content, and the majority reported watching an additional one to two hours since the COVID-19 outbreak began.

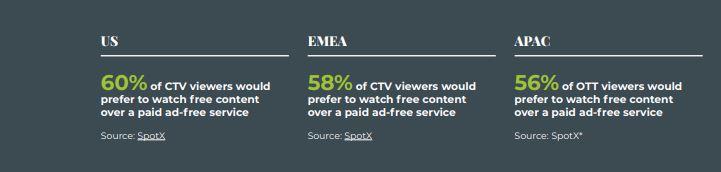

With the streaming wars providing so many options for consumers, signs of fatigue are emerging as viewers limit the number of services they are willing to pay for in “subscription stack.” Most viewers are now open to ad-supported services, and are increasingly seeking out free or low-cost ad-supported video on demand alternatives as they feel increased strain on their wallets. According to SpotX, 56% of OTT viewers in APAC prefer to watch free content over a paid ad-free service.

- Ad spend is following these new consumer habits and will flow into OTT and CTV faster than expected

The shift in budgets from linear to digital will kick into high gear over the next year. Now that advertisers understand how to activate data for efficient audience targeting while still achieving scale in OTT, the industry see more advertisers recalibrate their media plans toward digital. According to the report, CTV advertising in particular will grow rapidly in the US and European markets, while mobile adoption in Asia will encourage increased OTT spend.

The report showed that 47% of brands are looking to increase OTT spend in Southeast Asia between 10% to 20% through May 2021.

There is also an upward trend in 2020 to 2021 for these categories: arts and entertainment, health and fitness, education, hobbies and interests, as well as finance.

Although many advertisers curtailed their budgets in the spring of 2020, consumer demand has rebounded dramatically in recent months, with important nuances as behavior adapts to ongoing pandemic restrictions on work and travel. Many of these in-demand verticals are fueling growth in OTT ad spend as advertisers follow the eyeballs and move budgets to streaming platforms. SpotX also foresees consumer spending remaining strong through the end of the year, after which it is likely to soften in Q1 of 2021 when the effects of pent-up demand and holiday shopping beginning to level out.

- Device manufacturers have new opportunities to build their ad businesses, increase market share, and influence the viewer experience

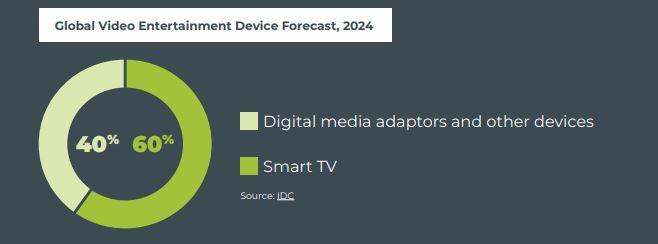

SpotX has seen an upward of an 800% spike in smart TV ad inventory from March through October 2020, and these devices now account for 38% of all internet-connected TV spend on its platform (up from 10% in 2019). Within the coming year, it foresees that original equipment manufacturers (OEMs) may generate more profit from their data and advertising offerings than from their physical device sales.

Historically low prices of smart TVs are also leading to faster worldwide consumer adoption. It is forecasted that by 2024, 60% of consumers globally will have smart TVs, while 40% will still be using digital media adaptors and other devices. The connected capabilities of these smart TVs also enable manufacturers to collect glass-level measurements and package that data for advertisers. As more consumers access streaming apps directly through the TV rather than auxiliary streaming sticks or boxes, OEMs have an opportunity to own a greater share of the user experience.

- With programmatic, addressable linear TV is ready for scale

The report also found that there is a “massive opportunity” to apply digital technologies and audience data to make broadcast ads targetable and more relevant. The category is finally taking off, with more inventory available and the programmatic pipes built out, expect to see more linear TV budgets transacted digitally. For programmers, this means tapping into the growing pool of programmatic TV spend that is expected to reach US$6.69 billion by 2021 in the US, up from US$2.77 billion in 2019.

- Data-layered campaigns will continue to become more prevalent with an increased focus on accuracy and measurable opportunities

There was a 145% year-on-year increase in data-layered OTT campaigns on its platform this year as of October 2020. OTT’s digital nature, and its critical mass of viewers across demographics, allows advertisers and media owners to activate data-driven campaigns at scale. In 2021, great progress will be made in standardising measurement across CTV devices. Once all devices have standard identifiers and data management platforms increasingly support these identifiers, brands will be able to improve targeting and measurement across platforms.

Data accuracy is non-negotiable. Across all devices and campaigns, buyers want assurance that they can reach their intended audiences with a message that will resonate, and they will turn to data providers who demonstrate rigorous methodologies for ensuring data quality. One of the key challenges to navigate in the upcoming year is balancing data accuracy with the scale necessary to achieve campaign goals.

As buyers demand greater validation of their audience-based campaigns, they will also look to first-party data. Advertisers are eager to run more efficient campaigns by targeting specific, authenticated audiences based on demographic filters, interest profiles, or purchase history. Media owners are working with data management platforms to activate their own first-party data and increase their inventory value. Moving first-party data to the supply side can provide more complete forecasting, which helps scale data-driven campaigns as they execute.

Additionally, there is also a resurgence in contextual targeting. Growing privacy concerns, along with rising CTV viewership, is leading to a boom in contextual targeting as advertisers look to pair their message to the right viewer in non-cookie environments. Improved standardisation of video categories along with new technology that goes beyond text analysis and leverages machine learning to analyse cross-screen video content will help power contextual campaign growth.

- Expect a surge in programmatic campaigns

While advertisers used to treat TV and OTT ad buys separately, they are increasingly considering them together, and the trend is clearly moving towards all TV being transacted digitally. The efficiencies of programmatic buying and the opportunities to apply data to reach specific audience segments are huge benefits that are accelerating the shift of traditional TV budgets to digital channels. Spend across all programmatic deals on the SpotX platform has increased by an average of 92% year-on-year in 2020, and is projected to jump 154% year-on-year in 2021, according to the video advertising platform.

Given the uncertainty around live sports and TV premieres, advertisers have also opted for scatter buys transacted via programmatic pipes, rather than committed upfronts. The industry has even seen the development of a new generally accepted format, the “programmatic upfront,” which is a programmatic guaranteed deal tied to a period of time.

Meanwhile, agencies are increasingly negotiating both traditional and programmatic deals at the same time to optimize their rates and coverage across channels. As these deals become more commonplace, it’s important that everyone is aligned on the specific parameters around any given programmatic guaranteed campaign, and that all technology partners involved possess the capabilities to execute on the deal points and validate that those commitments are met. Buyers are also optimising their supply paths by focusing on fewer, more strategic partnerships with sellers and technology partners to help simplify these transactions.

- Both the sell and buy sides will more thoroughly evaluate partners as supply and demand path optimisation requirements increase in priority

This past year illuminated the need for brands and media owners to build more resilient value chains. Strategic leaders on both the sell and buy sides are looking to cull their vendor list and focus on fewer, trusted partnerships.

As buyers gain tighter control over their supply chains, they are not only seeing cost savings, but also improved quality in their buys, particularly in brand safety, viewability, and fraud. Advertisers need to look beyond impression-level data of particular ad placements and take a broader look at the brand suitability of their various technology partners.

Media owners are also streamlining advertisers' experience. Buyers are eager to move their budgets to OTT, but the landscape over time has ballooned to involve multiple vendors, resellers, and other technology partners. This adds more fees to the process for both buyers and sellers and ultimately causes more complexity. Therefore, media owners looking to distinguish their premium offerings and protect rate cards can simplify the selling process through demand path optimisation, which limits access points to their inventory and establishes efficient, transparent paths for trusted partners.

Commenting on the report, Kelly McMahon, SVP, global operations at SpotX, said: “As we move further into the connected decade, incumbents and new entrants alike will invest in the future of video, while new technologies will quickly emerge to support the evolution.” McMahon added that SpotX’s goal with the report is to provide media owners, advertisers and TV manufacturers with the actionable insights they need to position their marketing strategies, align investments, and capture growth in 2021 and beyond.

(Photo courtesy: 123RF)

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window