Trust Bank reinvents saving with loveable animated characters

share on

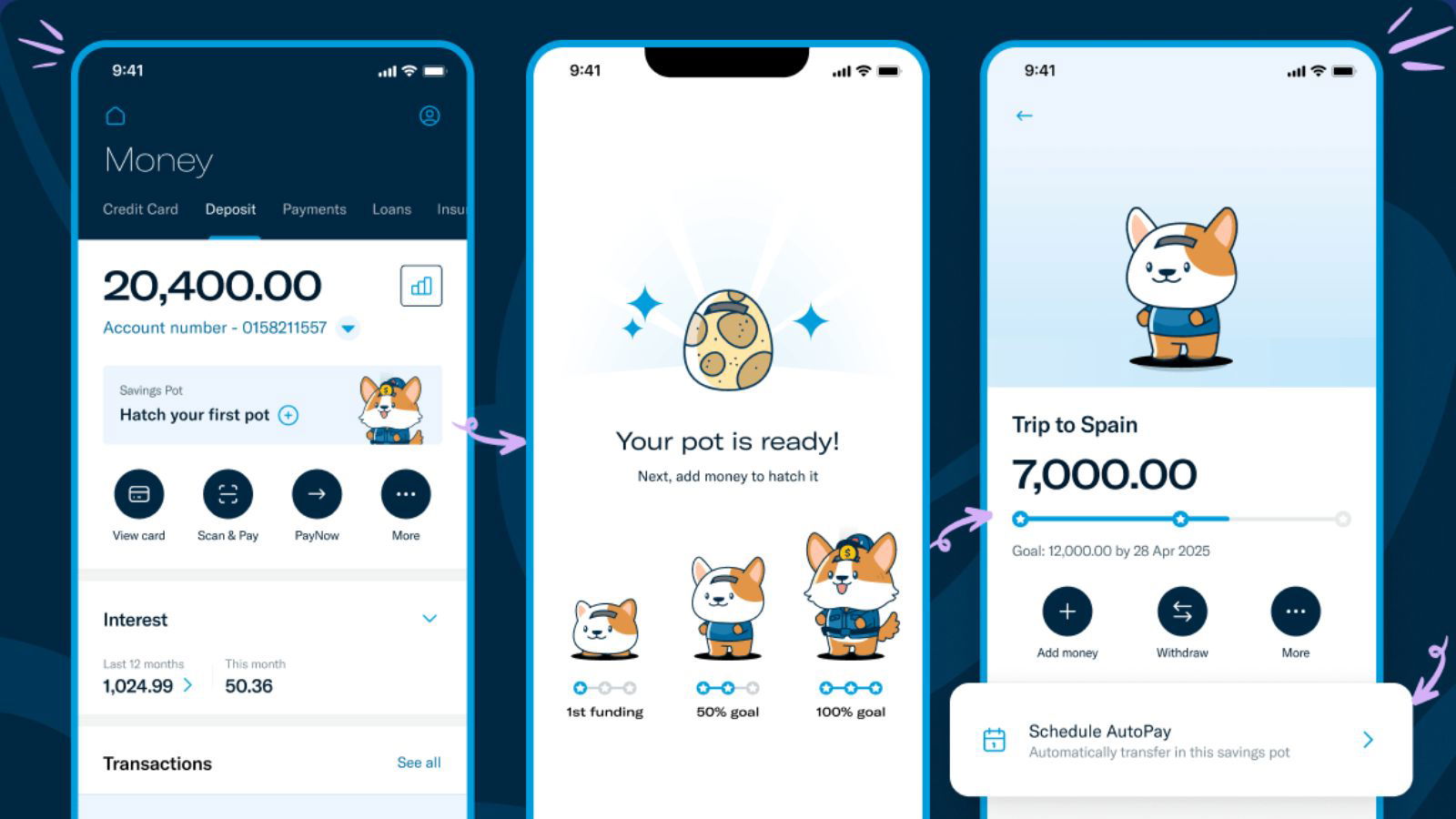

Trust Bank is redefining the way customers save with its new "Saving Pots" feature on its Trust app. Based on customer feedback, the new feature aims to foster healthy habits by making saving easy, rewarding and engaging for all customers.

With three taps, customers can create up to five personalised pots and tailored targets for their savings goals. As of date, over 75,000 savings pots have been created, with the most popular used for emergency funds, travel and dream home.

Using Trust Bank's AutoPay feature, customers also have the flexibility to choose how much, when and how often they would like to add funds to each pot. In addition, saving pots have no minimum deposit requirement and no lock-in period, allowing customers to withdraw funds from their Pots with no penalties.

Don't miss: Trust Bank puts a million dollars up for grabs in new campaign

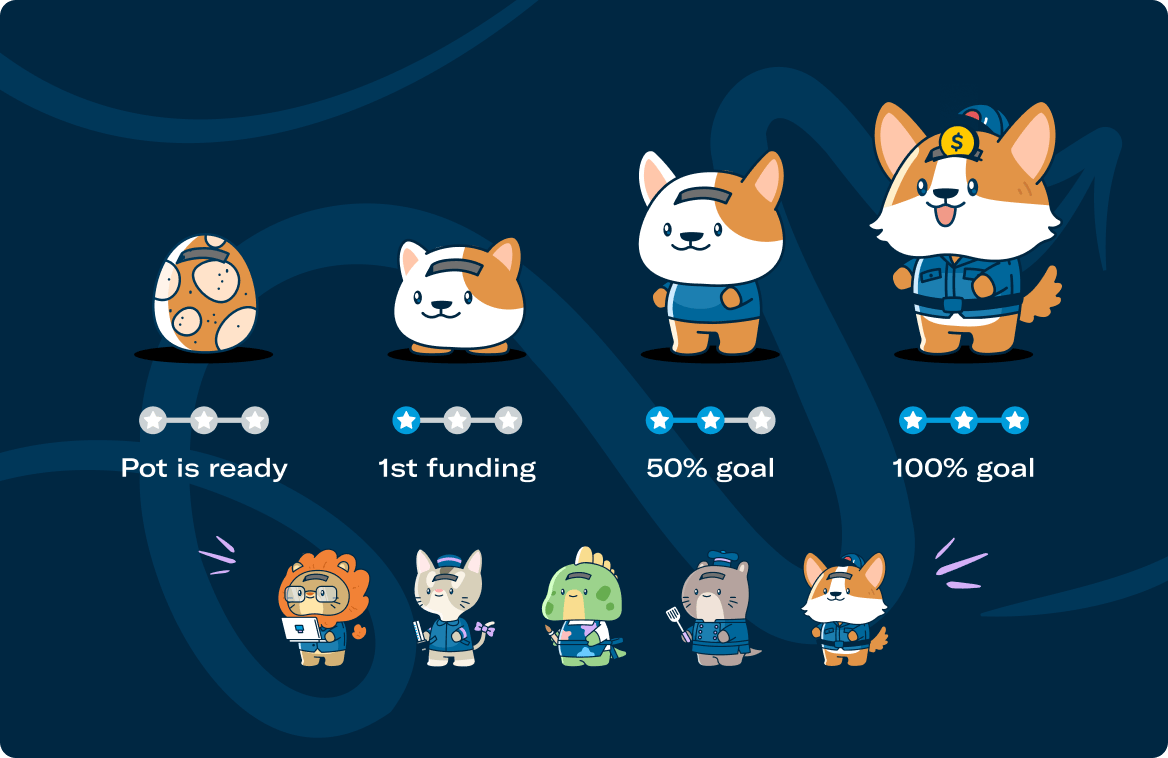

Drawing inspiration from the digital pets concept, the new feature uses animated characters, including a lion, cat, dog, otter and monitor lizard, to represent each savings pots. The pot will first start off as an egg, and each character will hatch and grow as savings are put in, encouraging consumers to reach their savings goal.

The money saved using saving pots also reap the same interest rates as a user's Trust savings account and contribute to possible upgrades to Trust+ exclusive privileges.

“Saving money can be a daunting task. That’s why we launched saings pots to provide our customers with an easy tool to automate savings and track their progress towards their financial goals in a simple and delightfully different way. It also gives customers flexibility to refine and strengthen their saving strategy and goals anytime, anywhere," said Evonne Low, head of deposit and payments at Trust Bank.

“While saving money is a top priority for many, building healthy savings habits can be complex and tedious. Trust savings pots were developed directly using customer feedback and in a uniquely innovative way to offer customers an easy, automated, rewarding and fun way to grow their savings with greater control over their money," said Aditya Gupta, chief product officer at Trust Bank.

Trust Bank is no stranger to quirky features. In March 2023, the bank aimed to change the way customers track their monthly spending with the introduction of a new money Insights feature on its Trust app.

The feature uses animated characters to represent spending categories and will grow and expand alongside a user's spending on their Trust card. Termed "funalytics", the feature was created following studies by the bank's customer research team which looked into the usage of bars and pie charts on banking apps to help customers track their spending.

According to the bank, the research indicated that users tended to find these charts unhelpful despite efforts to make them as detailed as possible. Additionally, because most Singaporean consumers have more than just one bank card, spend insights from just one card is not sufficient to give a user a full picture of their finances.

Related articles:

Trust Bank names new chief marketing officer

Trust Bank gives out blue ice cream while rapping its way to first birthday

Trust Bank redefines analytics with fun animated characters

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window