TikTok versus Instagram: Where are brands posting more?

share on

In an analysis of sister TikTok and Instagram accounts across 330 brands from January to June 2022, a report by Emplifi finds that brands post more often on Instagram (68%) than on TikTok (32%) in relative posting frequency. While reach and interactions were higher on Instagram, video content had greater engagement on TikTok. Nonetheless, both platforms have shown an upward trend over six months in terms of engagement rate, peaking in June 2022, reconfirming user interest for engaging video content.

“Brands need to connect with their audiences where they are and social media is an integral part of the marketing mix,” said Emplifi CMO, Zarnaz Arlia. “It’s no secret that TikTok's surge in popularity is continuing – we’ve found that brands post more often on Instagram than TikTok, and video content has higher engagement on TikTok. It will be interesting to see how this trends in the months ahead. What is certain though is that in today’s world, having and maintaining a solid presence on both TikTok and Instagram is essential.”

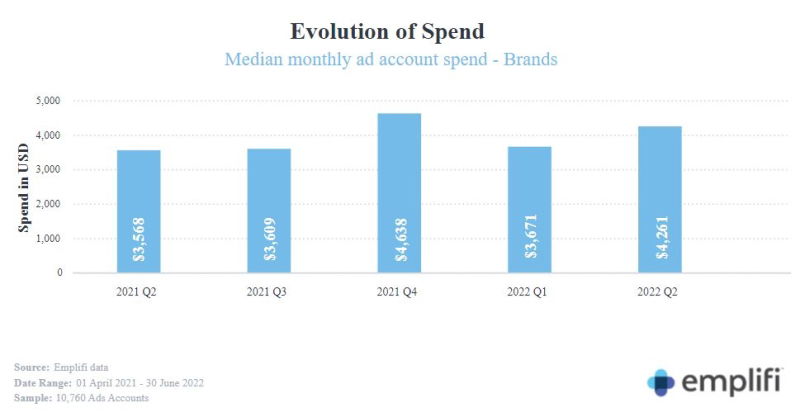

Overall, after a notable post-holiday drop in the first quarter of 2022, APAC brands’ median monthly ad spend rebounded by 6.5% in second quarter of 2022, climbing to US$1,684 per ad account – although the figure is still 60% lower than in the fourth quarter of 2021.

With this quarter's rebound, the region’s median monthly ad spend has increased 7.12% year-on-year (YoY), implying that brands are allocating more budget to reach their target audiences via paid social, said the latest study by Emplify.

Southeast Asia (SEA) saw a similar trend, with a 6.85% increase in quarterly ad spends, and a 10.61% YoY jump to US$1,603.

Global numbers were much more promising as monthly ad spend bounced back by 18% in Q2 2022 and increased by 19% YoY.

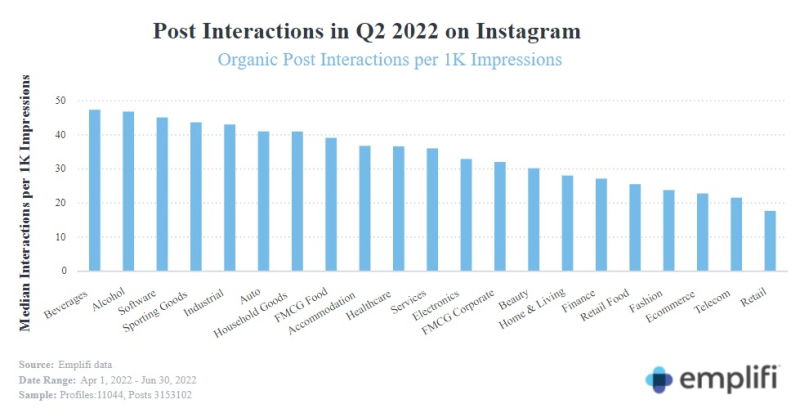

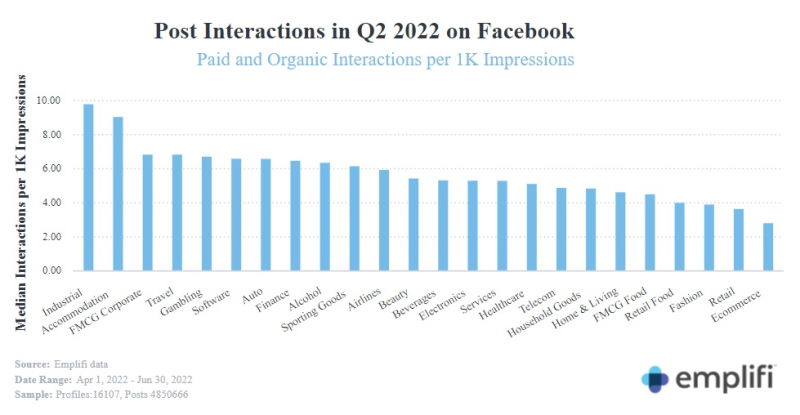

Instagram continues to show much stronger engagement than Facebook in APAC, with about 33 interactions per 1,000 impressions. Numbers have remained relatively consistent over the past year at about 30 to 32 interactions. APAC brands only generated 5.6 interactions per 1,000 impressions on Facebook, an 18% decrease YoY.

In the APAC region, ad investments represent a clear sign of the times, with ad spend connected to the airline and accommodation industries experiencing a 7.12% increase YoY as business and leisure travel recovers. Strong pent-up demand is driving the travel recovery in APAC, with airlines seeing more than a six-fold YoY increase in international passengers to 9 million in June 2022.

Response matters

Despite the travel boom, Emplifi’s analysis of airlines' use of social media for customer care shows a striking disparity in how brands have performed when customers post questions and complaints. The global airline industry is one of the strongest regarding the speed at which they answer customer questions on Twitter (1.7 hours) and Facebook (5.4 hours), coming second only to telecommunication brands. However, a large proportion of comments are going unanswered.

The ability of brands to respond to customer questions on social media is a key differentiator between the platforms.

Response rates in APAC are the highest on Facebook; more than 80% of direct messages are responded to in less than an hour. Instagram’s response rate was the lowest at 43% and the platform was the slowest to respond at 3.4 hours. Twitter had a higher response rate (68%) with an average response time of 2.3 hours – a 60% drop in response time as compared to Q1 2022

A closer look at 11 airlines in APAC found that on Twitter, there was a 31% response rate to customer questions from 1 January 2022 to 23 June 2022. While on Facebook, for the same period, there was only a 27% response rate, but the average response time was much lower at 1.23 hours.

“We are certainly seeing a travel resurgence across the region. As the world recovers from the pandemic, the travel demand will only continue to rise. Airlines should look to solutions that analyse changing customer behaviour and help enhance customer satisfaction. Having a finger on the pulse of the customer is key to delivering seamless, timely, and outstanding customer experience, regardless of the industry,” said Varun Sharma, vice president, APAC & Japan at Emplifi.

Social media makes up a huge part of the digital marketing budget. In line with this, MARKETING-INTERACTIVE is bringing back Digital Marketing Asia, with a dedicated social media stream, in its 10th year! Join us for 3 days of hyper-focused presentation topics across 6 tracks on 15 - 17 November and connect with 1000+ of the world's brightest minds in the marketing world to learn and upscale from 85+ speakers from the hottest regional and global brands. Click here to register now!

Related articles:

Study: Indonesians bank big on social media for news consumption

Study: Are social media giants protecting LGBTQ communities enough?

What role can social media play for former political leaders?

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window