Study: Uncovering growth areas as SEA to become US$1 trillion digital economy by 2030

share on

The Southeast Asia region is on the path to become a US$1 trillion digital economy by 2030. According to Google, Temasek and Bain & Company’s sixth edition of the e-Conomy Southeast Asia (SEA) Report - Roaring 20’s: The SEA Digital Decade the growth is propelled by a fast-growing base of digital consumers and merchants, acceleration in eCommerce and food delivery, SEA is estimated to reach US$174 billion in gross merchandise value (GMV) by the end of 2021.

This region’s digital economy is further expected to reach approximately US$360 billion by 2025, outgrowing the earlier projection of US$300 billion.

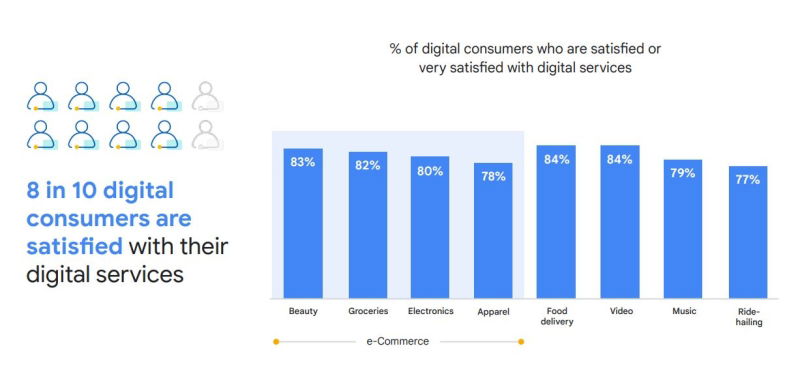

SEA is also touted to be entering its ‘digital decade’ as the internet increasingly becomes an integral part of consumers’ daily lives. The region now has more than 440 million internet users, and importantly, 350 million of them, or about 80%, are digital consumers who have bought at least one online service. Since the pandemic began, SEA has added 60 million new digital consumers, of which 20 million joined in the first half of 2021 alone. Catalysed by the pandemic, existing digital consumers ventured further into online services, and started buying services in new verticals since the outbreak began. Existing users are also relying more on digital services and spending more across most verticals. This increased adoption of digital services is showing no signs of reversal, as 9 in 10 new users in 2020 continue to use them in 2021.

The report’s section on Southeast Asia’s small and medium enterprises, or digital merchants, shows that these enterprises have turned to digital platforms to survive the pandemic. Digital financial services emerged as critical enablers, with over 90% digital merchants now accepting payments digitally. In the next five years, eight in 10 of those merchants anticipate more than half of their supply purchases and sales will come from online sources.

While talent continues to be an unresolved challenge, a set of emerging enablers that require multilateral solutions between consumers, merchants, platforms, and regulators, will drive the growth of SEA’s digital economy. These enablers include a commitment to sustainability, robust and business-friendly data regulation, data infrastructure to support larger and more frequent data flows, as well as an equitable system to protect gig workers and consumer interests while spurring innovation.

Florian Hoppe, partner and head of digital practice in Asia Pacific, Bain & Company said, “It is clear that SEA’s internet economy has rebuilt tremendous growth momentum. GMV has increased 49% year-on-year, as seismic consumer and ecosystem shifts accelerated by COVID-19, continue to drive a massive digital adoption spurt for everything from online shopping and food delivery to digital payments and digital lending.”

Hoppe added that the region has generated tremendous investor interest over the past two years, and Bain & Company believes the "roaring 20s" will really put SEA’s internet economy on the global map, as it charts a unique growth path and reshapes all industry sectors in the region. Managing this growth sustainably in the interest of all stakeholders will be a key mission for all ecosystem participants.

Food delivery tenacity

SEA’s tenacious growth is primarily driven by eCommerce and food delivery eCommerce is expected to propel the SEA internet economy forward in the next decade. In a strong lead-up to 2030, eCommerce GMV could exceed US$120 billion by end 2021 (a near doubling from 2020) with the potential to reach US$234 billion by 2025. The food delivery sector emerged as a bright spot, growing 33% y-o-y to reach US$12 billion in GMV. It has now become the most penetrated digital service, with 71% of all internet users ordering meals online at least once.

Travel to recover

While online travel growth remains muted, it is likely to see a recovery in the medium-to long-term, driven by pent-up demand and vaccination progress. Online media witnessed a healthy 32% growth to US$22 billion in 2021. In particular, the pandemic ushered in a new generation of gamers, bringing with them a willingness to spend.

Digital merchants on the rise

Around one in three digital merchants believe that they would not have survived the pandemic without going online. The research found that 60% use digital tools to enhance operational and back-office productivity, while 90% accept digital payments. Going forward, digital lending services are likely to grow due to an appetite for consumer financing options and supply chain financing. While digital merchants recognise the positive impact of online platforms such as job creation and business opportunities, long-term profitability remains a top concern.

Digital financial services

Since the pandemic began, digital financial services have seen healthy growth, specifically in the adoption of e-wallets and A2A (account-to-account), fuelled by both merchant adoption and consumer usage. By 2025, digital payments are forecasted to reach over US$1.1 trillion in gross transaction value (GTV), up from a forecast of US$707 billion in 2021. Digital lending could see a 50% increase in outstanding balance from US$26 billion in 2020 to US$39 billion in 2021, led by a rebound in lending appetite and growth in usage of buy-now-pay-later services.

Funding resurgence and the race to IPO

Investments in SEA’s internet economy are expected to reach an all-time high in 2021. Deal value came up to US$11.5 billion in the first half of the year, surpassing the US$11.6 billion for the entire 2020. Investors see SEA as a lucrative investment destination for the long-term, especially in sectors such as eCommerce and digital financial services, which continue to attract the majority of investments (more than 60% of deal value). Increased deal activity and larger valuations that led to bigger funding rounds have spurred the induction of 11 new consumer technology unicorns in 2021, bringing the total number to 23. More tech companies are exploring IPOs as viable pathways to raise capital or allow early investors to monetise their holdings, especially in view of strong valuations and novel listing approaches such as special purpose acquisition companies (SPACs).

Healthtech and edtech promise

Healthtech and edtech continue to be nascent sectors to watch. Healthtech is seeing strong investor interest as consumers are increasingly embracing convenience and accessibility. While edtech has shown healthy growth potential, many investors are taking a ‘wait and see’ stance, as scalability remains unclear.

Drivers and enablers of a $1 trillion GMV internet economy

ECommerce and online grocery will form a significant part of the region’s digital GMV in 2030. Transport and food, as well as online media, could unlock the next wave of value and contribute as much as eCommerce does today if demand grows beyond the urban markets.

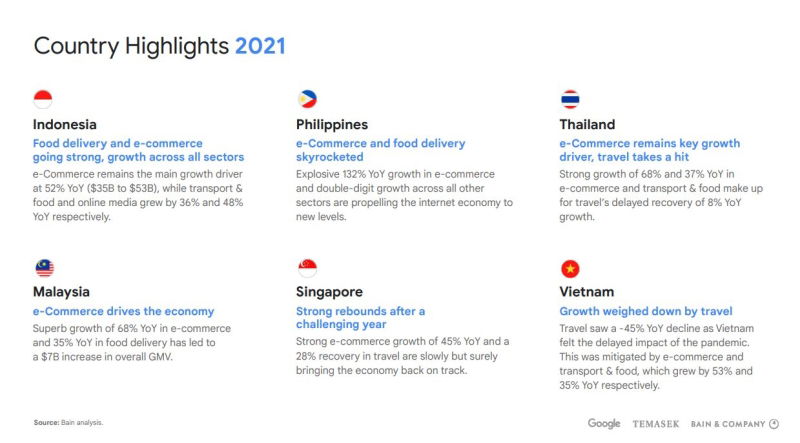

The internet economies of all six countries will continue to grow rapidly. Indonesia alone, by 2030, could potentially be two times of SEA’s GMV today, while Vietnam could grow eleven times to become a US$220 billion digital economy.

In 2021, all the countries covered in the report experienced strong, double-digit growth. Indonesia contributed 40% of the region's total GMV at US$70 billion; while the Philippines led with an impressive 93% growth to become a US$17 billion digital economy.

Rohit Sipahimalani, chief investment strategist; head of Southeast Asia, Temasek said the pandemic has led to accelerated and enduring digital adoption in Southeast Asia, which has propelled its internet economy to new heights. “Temasek looks forward to increasing our investments in the region’s digital champions, using our capital to catalyse solutions and growth that will enable these companies to take maximum advantage of the digital decade,” said Sipahimalani.

"The phenomenal growth we see in Southeast Asia reinforces our view that the region will define the future of global digital ecosystems. Google’s commitment is to shape a digital decade for everyone in Southeast Asia, playing our role in creating equitable and responsible growth for the region to achieve its potential of US$1 trillion in GMV by 2030. We’ll continue to build for the future of the internet in this region, ensure equitable growth for all workers and businesses, and provide inclusive and safe access for online communities," said Stephanie Davis, vice president, Google Southeast Asia.

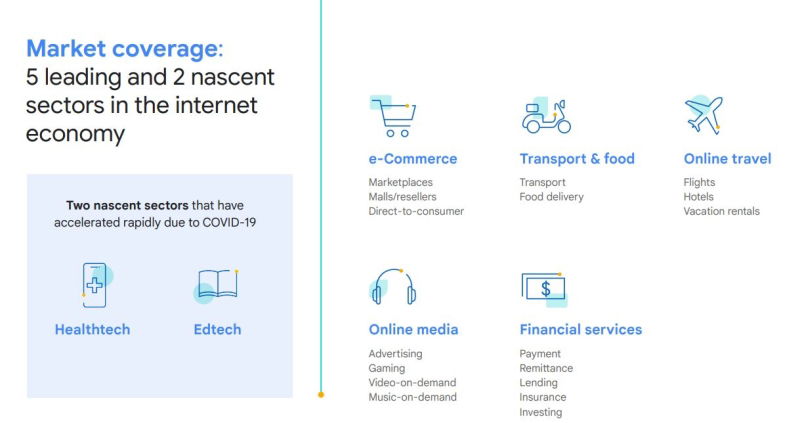

The annual report sheds light on the internet economy in the region, covering Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. The report dives into trends across five leading sectors ‒ eCommerce, online media, transport & food, online travel and digital financial services and two nascent sectors - healthtech and edtech. The report also reviews the tech investment landscape across the region and reveals what investors are looking for in the current environment.

Join our Digital Marketing Asia conference happening from 9 November 2021 - 25 November 2021 to learn about the upcoming trends and technologies in the world of digital. Check out the agenda here.

Related articles:

Demand 'exceeds' supply for senior candidates with digital marketing skills in MY

'Less digitalised' ASEAN firms unambitious in pursuing further digital adoption, says study

Enhancing your B2B marketing strategy in a digital performance era

Study: How top eCommerce players gain momentum globally

Study: Marketers struggle to close capability gaps within media strategies

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window