Study: How to market to the 4 types of wellness conscious consumers in SG

share on

The healthcare market in Singapore alone is worth $30 billion in 2020, a 9% increase on the year before. Havas Group Singapore and tech company Ogury have partnered to uncover the state of health and wellness in Singapore. The study illustrates the different types of wellness consumer personas in Singapore and the opportunities it presents for brands to customise their advertising strategy. The four key categories are as follows:

1. The Young and Restless (18 – 24): Mental wellness is of key priority to this group.

Members of this group tend to be less preoccupied with their physical health in comparison to other personas.

When they think of wellness and self-care, often they prioritise mental wellness. Factors such as social and academic pressures influence their mental state heavily.

This group tracks life goals – in wellness and other areas — using apps and productivity tools. They try to curate their lives for public consumption, with peer pressure tending to cause them anxiety. The Young and Restless often manage this anxiety by leaning into activities that offer them an escape from their stress. Using games, comics, social media and online communities are their prefered outlets.

The Young and Restless turn to friendship and social circles to support emotional wellness. Social apps such as Bottled and Meet-Up are popular. Having a partner tends to help them cope better in trying and stressful times. For these consumers, physical wellness is about looking good, being fit and active. As in other aspects of life, they want to excel; with a preference for team sports, which is their main driver for physical fitness over individual activities, such as running.

They are 23% more likely to be pop, art and culture enthusiasts, compared to other personas, and 69% have music as their top-interest. Gaming is a key means of relaxation. For instance, 36% own the popular PUBG Mobile game. They are 21x times more likely than the average Singaporean to use an app to decorate their home. This audience shows a 22-fold affinity with the chatbot counselling app Wysa and 47-fold affinity with the meditation app Tide.

The ability to play sports is considered a test of physical wellness, with 45% participating in team sporting activities. Habit-tracking 18-24 year olds have a ten-fold affinity with calorie-tracker app Sweatcoin, which is owned by 11% of this audience and an incredible 102-fold affinity with sleep app Sleeptown.

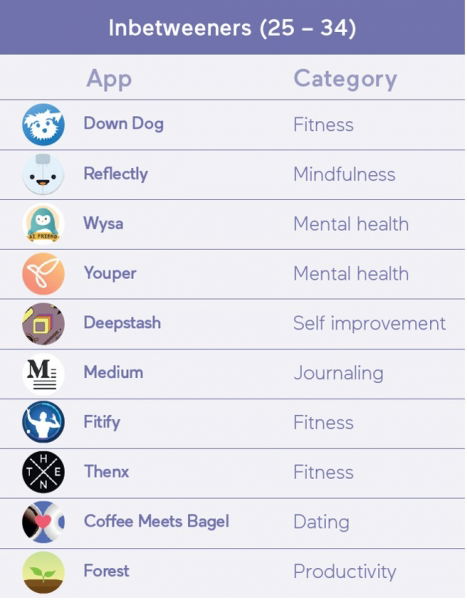

2. The In-betweeners (25-34): Physical wellness is a priority.

Entering a new phase in life, this group wants to look and feel fit. They make physical wellness a priority to boost confidence and self-esteem. Nutrition and fitness are important as they seek to improve their physical health.

Usually stretched for time, they search for the ease and convenience of micro-mobility to get around, using e-bikes and urban car sharing to be even more efficient with their time.

For Inbetweeners, physical wellness is a balance between exercising and eating healthily. They are keen to reach fitness targets, something they often use apps for. They strongly believe that you are what you eat. Along with securing the right job and dating, finances are top of this demographic’s mind. But qualitative interviews also show a tendency to delay financial management into the future. Spending decisions are heavily influenced by what they can buy now.

For Inbetweeners, mental wellbeing is essential to both personal and professional life. To cope with stress, they focus on productivity, and believe in self-improvement by taking on hobbies, reading and learning new skills, be it a new language or coding.

External validation for physical fitness is reflected in the fact that 38% of this group have a high interest in beauty and cosmetics. They are 2x more likely to engage in outdoor activities, adventure and extreme sports. Fitness-led Inbetweeners keep fit through HIIT and functional training. Inbetweeners with an interest in healthy eating and nutrition are 9.5x more likely to own the Get Juiced SG app. Dieting app Lifesum also has a 9x affinity with this audience. Inbetweeners who use sleep tracker and meditation apps show a 24x affinity for the self-improvement app Deepstash and they have a 32x higher affinity with yoga app Down Dog.

3. The Nesters (35-44): Focused on optimising physical fitness and preventing ailments.

Nesters are focused on optimising physical fitness and preventing ailments. They also prioritise family healthcare and dieting, often undertaking major projects and lifestyle changes to improve their family’s fitness.

They like to improve their knowledge, enhance their physical health through herbal supplements, and their living space by redecorating.

To this group, physical wellness is all about being able to perform efficiently. They like to run, hike and train in the gym, and to track their progress with apps such as 42Race and ACTIVE SG. And they love shopping. Having to juggle what life throws at them, Nesters seek to organise and find efficiencies in their lives. Family life and career become priorities at this point. This demographic uses apps such as Blinkist, Coursera and LinkedIn Learning to stay on top of their game.

For Nesters, financial wellness plays a critical role in ensuring physical and mental wellbeing. They have a pronounced need for financial security and a strong urge to safeguard their own and their families’ future.

Fitness-interested Nesters have a 10x affinity for the Fitness&Bodybuilding app. They are 24x more likely than the average population to own the Fitbit app. They have a 11x affinity for cycling apps such as Togoparts and a 7x affinity for the National Parks Hiking app. This group takes major initiatives around health and has the highest skew towards health foods and drinks (60%), personal healthcare (48%) and vegan/ vegetarian food (30%).They are also 6x more likely to own the app IFTT, which helps them connect their devices. They efficiently manage their homes, entertainment and personal admin.

4. The Seen-it-Alls (45-55): Physical wellness takes three important forms.

This group is aware that the future brings a more physically vulnerable stage in life. Therefore, the physical takes precedence over all other forms of wellness. They like to travel for business and pleasure.

They also tend to be more religious than younger age groups.

Physical wellness takes three important forms: medical wellness, function and appearance. Seen-it-Alls want to minimise the need for medication, and to get enough rest and the right amount of food in order to function and maintain their physique. This group has a strong need to maintain a positive mental state and minimise any external stresses. Family is important and heavily influences their emotional state of being.

Seen-it-Alls strive to avoid any additional burdens. They prioritise spending quality time with loved ones. For Seen-it-Alls, financial wellness is all about securing quality of life. Because of this, they are more interested in business and finance, and invest more time in following the stock market using financial investment and trading apps.

Fitness-interested Seen-it-Alls are 10x more likely to own the GETGREAT app. 57% own a Fitbit. This audience has a 9x affinity for the Relive! Running app and 47% own the government’s Health365 app. They love the news and have a 9x affinity with The Economist app and have a 5x affinity for Google’s experiential Daydream VR app.

Take away for brands

Singaporean consumers have a highly developed and sophisticated approach to wellness and wellness brands, said the study. They are discriminating and show a purposeful approach to selecting the brands and services which fit their needs, lifestyles and aspirations. This makes for a highly competitive market. To succeed, wellness brands must develop a unified approach to advertising. From targeting through creative to campaign optimisation, advertising must be tailored precisely to the tastes and priorities of each target audience. Only by doing this can brands ensure that their message cuts through in the wellness marketplace.

The study added that the health and wellness categories have seen a transformation in the recent years, with consumers now more aware and eager to pursue a healthy lifestyle than ever before.

“If there is one industry that is taking centre-stage in current times, it is healthcare. The shifts in behaviour indicate that consumers play a more active role in their own care and we wanted to delve into the consumer mindset and their approach to health and wellness, with this study,” said Jacqui Lim, group CEO, Havas Singapore.

“The Singapore healthcare industry has grown massively. It’s a multi-faceted industry with unique nuances and only by understanding and harnessing the culture of health-promotion and wellbeing, can brands hope to connect with consumers on an individual level. We hope the insights in the report help brands with the burgeoning opportunities available in this sector and are delighted to partner with Havas Group to present this initiative,” said Niall Hogan, managing director South East Asia, Ogury.

The study included computer-aided telephone interviews with Singaporeans of both genders, in equal numbers, from the ages of 18 to 55, across two weeks to help gain a granular understanding of the perception of wellness in Singapore. The study drew insights from Havas’ research and mobile user behavioural data from Ogury Active Insights - Ogury’s proprietary data modelling and visualization solution.

Join us on a three-week journey at Digital Marketing Asia 2020 as we delve into the realm of digital transformation, data and analytics, and mobile and eCommerce from 10 to 26 November. Sign up for early bird tickets here!

(Picture courtesy: 123rf)

Related articles:

Study: Social divide and racism are biggest concerns of global respondents amid COVID-19

Study: What platforms are advertisers spending on?

AWARE & R3 Study: 10 ads that champion gender equality

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window