Opinion: Coping with the change in digital behaviour

share on

Consumer purchasing behaviour has taken a digital turn since the COVID-19 pandemic, with more people turning to online platforms for their purchases. There are new digital behaviours surfacing rapidly and it may get quite daunting for companies who aren't clear of their strategies ahead. Simon Kemp, founder and CEO of marketing consultancy Kepios, spoke to Marketing about how both B2B and B2C companies can future-proof themselves as they navigate through the changing landscape of marketing, and also shares some tips that marketers should look out for when deciding how to invest their marketing dollars.

Kemp (pictured) established Kepios in Singapore back in 2015, and has helped to develop brand and marketing strategies in companies including Unilever, Google, Coca-Cola, Nestlé, and Diageo. Prior to launching Kepios, Kemp was the chief analyst at DataReportal, according to his LinkedIn page. He also helmed the roles of global consultant, regional managing partner Asia, and managing director in his eight years with social and creative agency We Are Social.

Watch Kemp's in-depth presentation on-demand at our "Modern Commerce in Asia Pacific" virtual summit archive. Available now until 25 August, this online resource for commerce, marketing and IT professionals features top-notch commerce experts from across the region, who discussed commerce and marketing success strategies for 2020 and beyond. Click here to check it out now. Sitecore's virtual summit is done in partnership with Marketing.

Marketing: What are some new digital behaviours you’re seeing in APAC and how do you think B2B and B2C brands should respond?

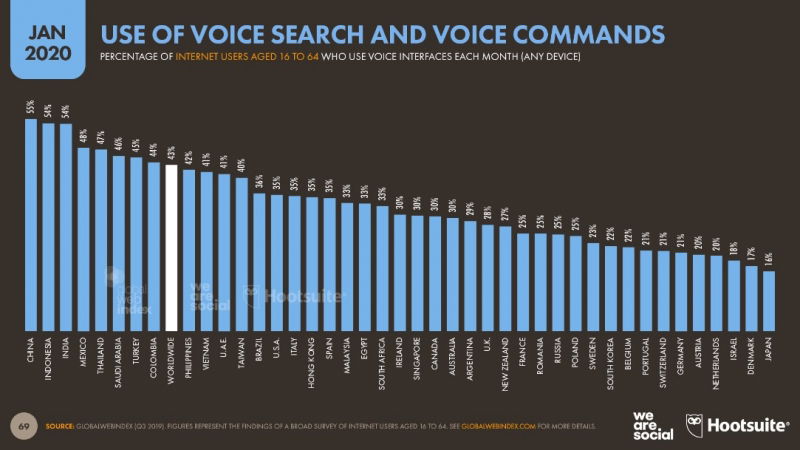

Kemp: Some of the most interesting trends relate to new technologies. For example, we’re seeing widespread adoption of voice search and voice commands on mobile devices across APAC, with people in our region embracing these new interfaces far more quickly than people in the West. This has some really interesting implications for brands, especially because the way people search with their voice is quite different to the ways they’d search using text-based queries.

There are some important differences between how people search when they use voice compared to when they use text. Voice queries tend to use far more natural language, so search engines may favour content that is written in more "natural" language for voice queries, as opposed to web pages featuring a list of technical specifications. Google also notes that interactions with voice interfaces are much more varied. For example, the company reports that they’ve seen more than 5,000 variations in ways people use the Google Assistant just to set an alarm.

Meanwhile, GlobalWebIndex’s data suggests that eCommerce adoption is much higher in APAC compared to the global average, with Southeast Asian countries showing some of the highest rates of adoption in the world (albeit at lower average spend levels than we might see in places like the US or Europe).

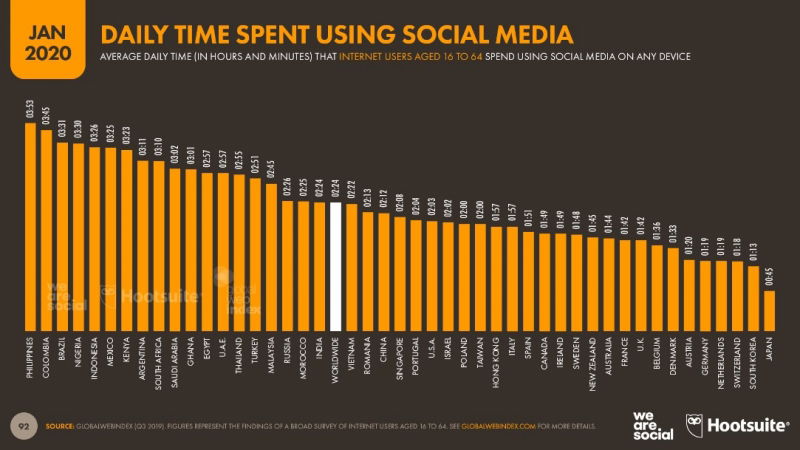

Asia’s internet users are also big fans of social media. In particular, people in Southeast Asia spend more time on social media each day than people in any other region in the world.

It’s worth noting that not everything is about "shiny new platforms" either. For example, Yahoo! is still popular throughout the region, especially in countries like Japan, and despite the rise of platforms like Spotify, we’re still seeing plenty of people searching for terms like "MP3".

Marketing: Given that marketing dollars spent today all have to show ROI, where should organisations be investing their marketing dollars - building brand, generating demand, (re)designing a customer experience, or something else?

Kemp: This is one of my favourite questions in marketing. It’s a bit like asking a doctor, “What medicine should I take?” The answer depends entirely on which symptoms you’re hoping to treat. Different brands have different challenges, and these challenges will relate to different audiences, so there’s no “miracle cure” that will help all brands to achieve all things. So, just like a doctor, marketers need to spend time diagnosing their issues before looking for a medicine. Some of the important questions include:

- What are you trying to achieve as an organisation? (i.e. What does success look like?)

- What makes it difficult for you to achieve that outcome today? What barriers stand in your way?

- How can marketing help you to overcome those challenges, and accelerate your path to success?

My advice is to over invest in getting the best possible answers to these questions upfront, because better answers here will ensure that all your subsequent activities are focused on delivering your brand’s specific needs. Once you’ve identified these priority challenges, you’ll have a better idea of whether awareness is your issue, or whether you need to focus further along the purchase journey. However, in the absence of answers to those questions, my general advice would be similar to a doctor’s for healthy living: aim for a “balanced diet” of different activities and media channels, and be sure to exercise regularly (i.e. try to avoid going for long periods without engaging with your audiences).

Marketing: How will consumers' concept of “experience” evolve in this new world we’re living in? What are some areas marketers need to look out for?

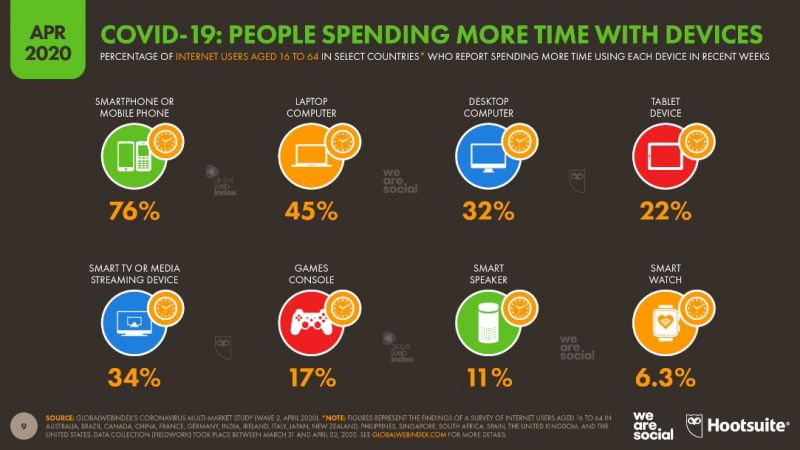

Kemp: COVID-19 and the associated lockdowns have had a significant impact on people’s everyday lives, and this has been particularly apparent in their digital behaviours. For example, despite already being our “devices of choice”, new data from GlobalWebIndex shows that we’ve been spending even more time on our mobile phones in recent weeks, even compared to other devices. This might come as a bit of a surprise, considering that so many people have been stuck inside at home during the past few weeks.

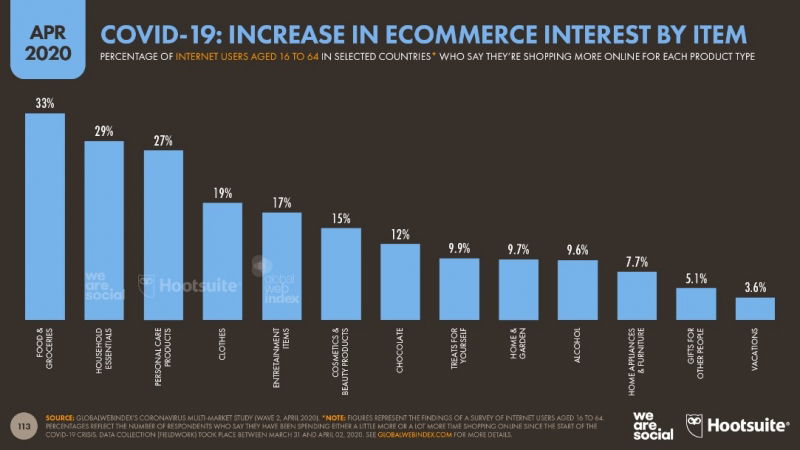

People have also been relying significantly more heavily on eCommerce, especially for categories that historically had lower levels of penetration in Southeast Asia such as groceries. What’s more, because lockdowns have lasted a month or more, and because people in this region typically shop for groceries at least one per week, people have had a chance to develop new online shopping habits. As a result, there’s a good chance that many of these new behaviours will endure, even once lockdowns have been lifted.

Kepios’ analysis also suggests that when we see an increase in online grocery shopping, this has a wider benefit for eCommerce at large. This is potentially because the frequency associated with online grocery shopping builds familiarity and trust in ecommerce as a whole, with the result being that people are subsequently more comfortable buying products in range of other categories too.

From a B2B perspective, I’d be very surprised if our newfound love affair with video conferencing doesn’t survive the transition out of lockdown. I think many people have now overcome their initial resistance to these tools, and while they may never quite replace the value of a face-to-face meeting, they’re infinitely better than conference calls, and they’re also significantly more friendly to budgets and the environment than flying around the world just for one meeting.

Marketing: Will the digital shopfront replace the physical one? How should organisations pivot and what are the implications for categories like luxury which had a high reliance on physical touchpoints to make a sale?

Kemp: No, it’s unlikely we’ll see any binary replacements. Hybrid models will continue to be a great choice for brands with an existing physical retail footprint, and we’re seeing some of the “pure-play” online retailers like Amazon expand into physical retail too, so all the evidence seems to support a “blended” approach.

The good news, however, is that digital storefronts are an additional opportunity for your brand. While you will see some sales move from offline to online, a stronger digital presence shouldn’t result in a total cannibalisation of your offline channels (unless you’ve designed it to do so). The balance will vary considerably by category, though. For example, music revenues have moved almost entirely online in many countries, but impulse purchases like confectionery will continue to see a strong component of offline sales (at least once lockdowns have been lifted).

For categories like luxury, we’re seeing plenty of growth in digital traffic and transactions, both for “hard” luxury like jewellery, and “soft” luxury like clothing and bags. However, the in-store experience is a big part of luxury shopping, so my advice would be to use the two to compliment each other. Most shoppers want to do both, so think about where digital fits in the mix – from comparing prices, to admiring beautiful product photos, to chatting with other people who share their passions (e.g. watch collectors). This represents an opportunity for brands to increase audience engagement – and potentially increase revenues into the bargain – so why wouldn’t you want to seize that opportunity?

Related Articles:

Opinion: What does the future hold for modern commerce?

Forrester: B2B firms risk losing 19% of revenue when content marketing misses the mark

How LinkedIn's Stories feature can help B2B brands to humanise

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window