Opinion: 7 factors to equalise the eCommerce playing field

share on

ECommerce was seen as a channel of the future a few years back, but has catapulted to the front and centre because of busy consumer lifestyles, continuous investment from brands and platforms driving shopper adoption, and technological advancement from platform giants making shopping frictionless and fun.

Alibaba and JD.com have driven China to pole position in eCommerce, while Lazada and Shopee are accelerating channel penetration in Southeast Asia. The pandemic has been a tailwind not just for these pure play platforms, but also for traditional supermarket chains that have expedited into click and mortar setups. In China, it is common to have eCommerce contributing 40% to 60% of an FMCG brand’s annual sales. In Southeast Asia, brands are fast growing sales contribution from this channel. I have distilled my experience into a framework called FACTORS on what it takes to win in eCommerce:

1. Festivals

More than 10 years after Alibaba created the first 11.11, mega sale festivals have become a must-win opportunity for brands. There are mega sale festivals every year (such as birthday sale, mid-year, 9.9, 11.11, 12.12), with each festival consisting of a 10-day teasing period, one to three days of mega sales, and an after-party for final sales push. There are also double date festivals, brand grand launches, and super brand days up for grabs.

Shoppers have been conditioned to expect great deals during these festivals, and especially during key time slots such as 12am to 2am, which can generate up to 40% of festival gross merchandise value (GMV), when planned and executed well. Traffic, conversion rate, and order value are noticeably higher during festival days, and can contribute 25% to 30% of a brand’s annual GMV. Therefore, participation in festivals is critical for brands.

2. Assortment

ECommerce platforms have depended on deep discounts, flash sales, and free shipping offers to attract shoppers and grow user base. While brands are playing sport, this will not be sustainable for both platforms and brands in the long term. There are many ways to evolve assortment, from digital-first launches and online limited editions to extra-large bundles without the hassle of lugging it home. I have also had success with shop-the-recipe bundles and exclusive freebies. Needless to say, this assortment needs solid inventory management to maximise availability and sales opportunity.

3. Content

Getting this right is fundamental, and yet it is never fully over.

Once you have the basics completed, focus on enhancing the product pages with eye-catching visuals, demonstrations, product superiority claims, recipe ideas, nutrition information, usage tips, influencer reviews, and FAQs.

In the foods space, you could even go the extra mile to talk about how your ingredients are sustainably sourced and processed. You could also include post-use recyclability guidelines. Since shoppers are increasingly using mobile devices to shop, brands need to ensure that the content is mobile optimised and tested for kinks before rolling out.

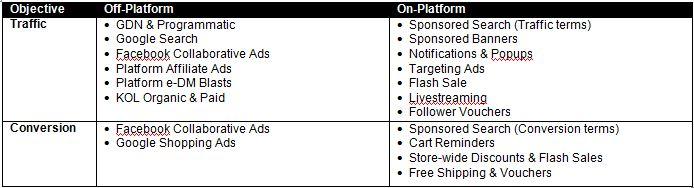

4. Traffic and conversion

There are a host of capabilities available on and off platform to drive shopper traffic, encourage an add to cart, and close the sale. From personal experience, about 80% of traffic has been generated on-platform, and sponsored Search is the biggest contributor to this traffic. In the case of driving conversion, 15% to 30% of festival GMV in the campaigns I have led have been generated by Facebook Collaborative Ads, with up to infinite ROI. Lazada and Shopee are increasingly offering new capabilities with compelling ROI, and that is attracting marketing dollars from brands.

5. Order value

While building a user base in Southeast Asia has been job number one for the platforms, improving profitability is important for long term sustainability. Increasing the average order value is the key to offsetting operational costs and shore up profitability. This is especially important in FMCG and grocery verticals, and platforms will appreciate brands that are proactive about it.

You could implement assortment ideas discussed above to feature big size packs, extra-large bundles, or even digital-first launches and online exclusives that do not need deep discounts.

Freebies are also an effective way to drive shoppers to spend more. You could also work with the platform to harness the power of the algorithms: create virtual bundles of products that have high correlation for purchase, propel products with seasonal relevance, eg. baking ingredients for the holidays and sun protection range in time for summer, and even personalise offerings for loyal platform users.

6. Reviews

In offline shopping, you can touch the product you are about to purchase, use a tester or even speak to the promoter to clarify questions. You have multisensorial cues guiding your decision, which is missing in online shopping. You may be wondering if it is a quality product, will it suit you, does it do what it says, and is the seller trustworthy.

And that is why shopper reviews are important to close the sale. It is ideal to get a five-star ratings and glowing reviews, but in reality, a few neutral and negative reviews do not hurt, as long as it is evident that the brand has addressed shopper feedback swiftly. On their part, platforms are encouraging shoppers to write reviews: Lazada and Shopee offer "coins" that can offset future purchases whereas Amazon’s Vine program enables paid reviews. There is anecdotal evidence that highly rated and reviewed products are propelled by platform algorithms.

7. Seller tools

Sponsored search and Chat have had outsized importance among the tools available on the platform. We have covered search earlier. Chat enables brands to creates a real time connection with shoppers. It is important to respond swiftly, and proactively engage the shopper if the issue is particularly tricky. Responses need to succinctly answer queries and address grievances.

Chat is extremely important during festival periods, and can be the difference between a successful sale and an abandoned cart.

Livestreaming was the star feature in Alibaba’s 11.11 in 2019, and Lazada and Shopee have picked up on this trend, with KOLs demonstrating product features and offering vouchers and giveaways to drive purchase. Mini-games and shopper missions are turning eCommerce platforms into shoppertainment hubs. With 5G not far away, these interactive features have a bright future ahead. E-wallets are the latest platform capability aimed at making shopping frictionless, and brands are partnering with platforms to drive adoption.

There you have it - FACTORS - I hope this framework will be of help in your eCommerce journey. These perspectives are underpinned by a solid enabler to manage inventory, third-party logistics partners, and front end. Your creative and media partners are key for off-platform content and media ROI. Carpe Diem!

The writer is Shreyas Subbaraya, regional marketing director, Asia Pacific, Equal.

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window