Indomaret and Alfamart among top 50 fastest-growing retailers globally

share on

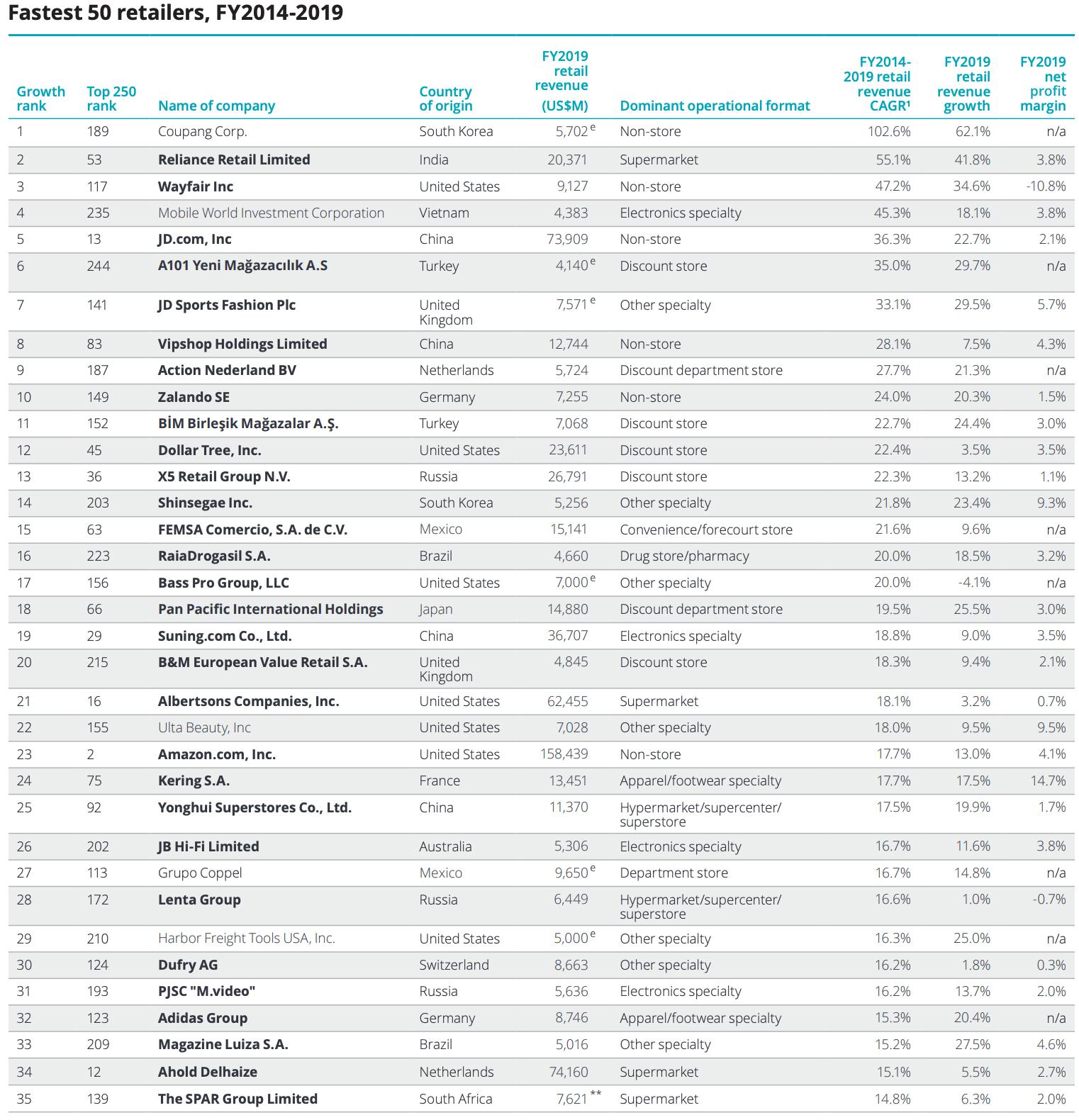

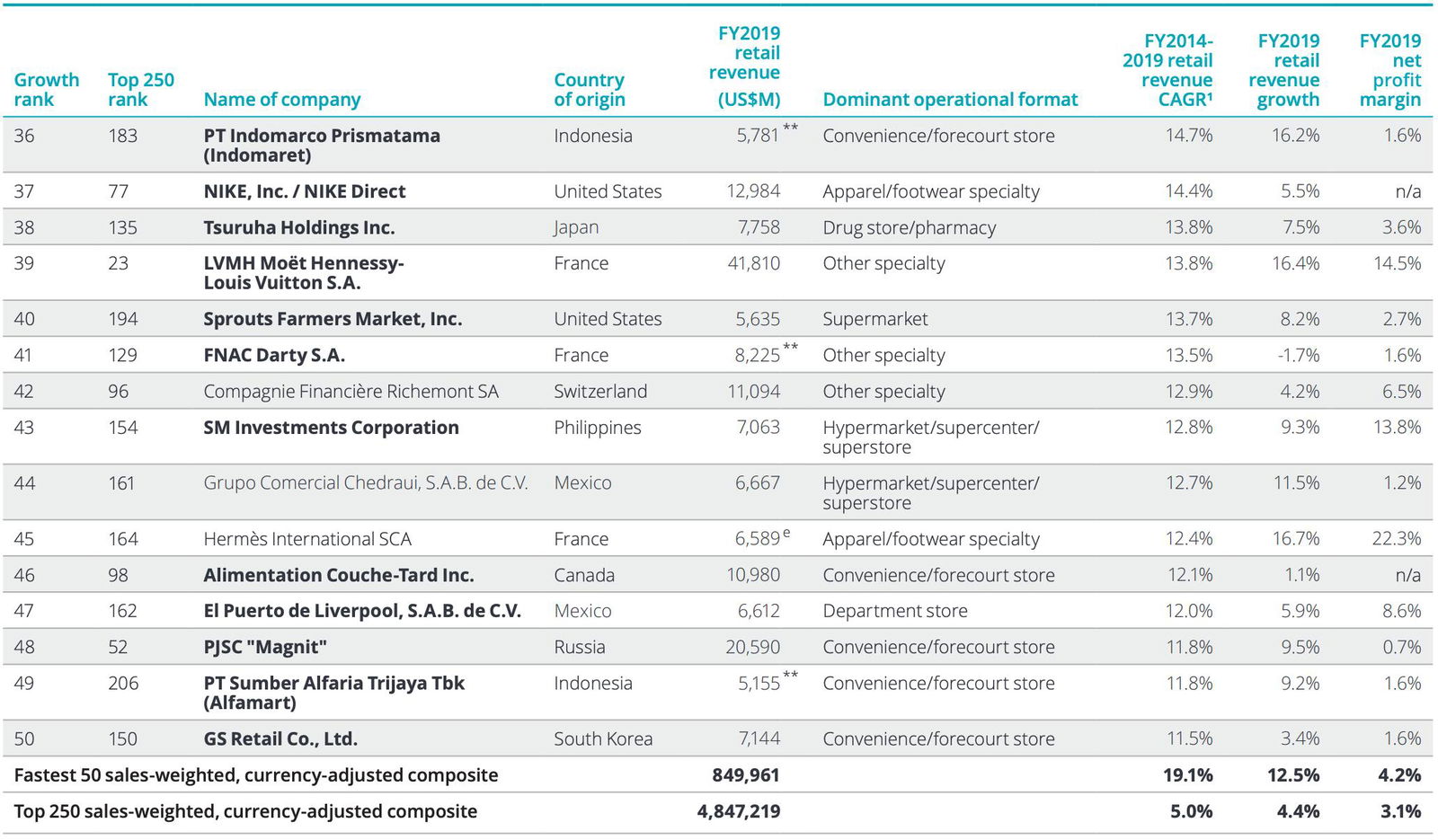

Indonesia’s Indomarco Prismatama (Indomaret) and Sumber Alfaria Trijaya (Alfamart) have been ranked among the top 50 fastest-growing retailers, alongside the Philippines’ SM Investments Corporation and Vietnam’s Mobile World Investment Corporation. According to Deloitte's "Global Powers of Retailing 2021" report, these companies belong to the three categories of convenience/forecourt store, hypermarket/supercentre/superstore, and electronic speciality.

Globally, Indomaret (183rd) and Alfamart (206th) have been ranked among the top 250 retailers, along with SM Investments Corporation (154th), Mobile World Investment Corporation (235th), and Thailand’s CP ALL (58th) and Central Retail Corporation Public Company (176th)

This result is in line with Deloitte's research which also showed that the onset of the COVID-19 pandemic has resulted in a shift in consumption habits as consumers adapt to new ways of living and working. As consumers spend more time at home, they are increasing their expenditure on self-prepared meals, and investing in better connectivity and smart appliances to more effectively work or study from home.

Deloitte Southeast Asia's consumer industry leader Pua Wee Meng said Southeast Asian consumers are shifting their priorities towards necessities such as groceries, and are becoming more prudent with their expenditures in at least the short-term. Hence, consumer companies must focus on achieving price competitiveness, including streamlining processes and diversifying their offerings.

He added that the pandemic’s acceleration of digital behaviours is likely to be long-lasting, if not permanent. Across all consumer segments – even amongst those often perceived to be somewhat less digitally savvy – Deloitte has observed a palpable shift towards the use of digital and eCommerce channels. "Businesses should therefore also consider how they can better leverage next-generation technologies to improve their offline-online customer experiences," he added.

For Thailand in particular, Deloitte's report noted that the downloads of shopping apps rose by 60% in a single month last March. Meanwhile, the online share of retail in China rose to 24.6% last August, up from 19.4% in August 2019. In general, companies from China, Japan and Hong Kong had the highest representation amongst Asia Pacific retailers. Brands such as China’s JD.com (13th), Suning.com (29th), and Vipshop Holdings (83rd); Japan’s Aeon (14th), Seven & I Holdings (18th), and Fast Retailing (51st); and Hong Kong’s A.S. Watson Group (49th) and Alibaba Group (86th) were among those from the three countries that made the list.

Retailers based in the Asia Pacific region increased their share of the global top 250 revenue by 0.8% percentage points to 16.2%, with more new entrants than any other region. They also achieved the highest FY2019 year-on-year growth at 7.1%, Deloitte said. Meanwhile, Europe had the highest number of top 250 retailers, with 87 companies based in the region. North American retailers contributed nearly half of the total top 250 revenue in FY2019 and had the largest average retail revenue, US$28.6 billion, which is much higher than the average top 250 size of US$19.4 billion, the report said. The top 250 global retailers, in general, generated aggregated revenues of US$4.85 trillion in the fiscal year 2019, representing composite growth of 4.4%.

Ira Kalish, Deloitte's global chief economist, said the challenge for policymakers will be to control the pandemic outbreak, protect those who have been disrupted, and speed up the distribution of vaccines. Kalish added that the success of these imperatives will determine the path of the global economy in the year ahead.

Related articles:

Deloitte agrees to pay MY govt US$80m to resolve 1MDB scandal

Verizon and Deloitte bring 5G to retail

Oglivy nabs former global head of Deloitte Digital as new CEO

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window