HK to ban Japanese food imports on Fukushima discharge: Can creative messaging allay potential fears?

share on

Japanese eatery owners in Hong Kong will need to cope with the upcoming ban on all aquatic products originating from the ten metropolis including Tokyo, Fukushima, Chiba and Tochigi from Thursday, after Tokyo decided to discharge treated waste water from the Fukushima nuclear plant into the Pacific Ocean.

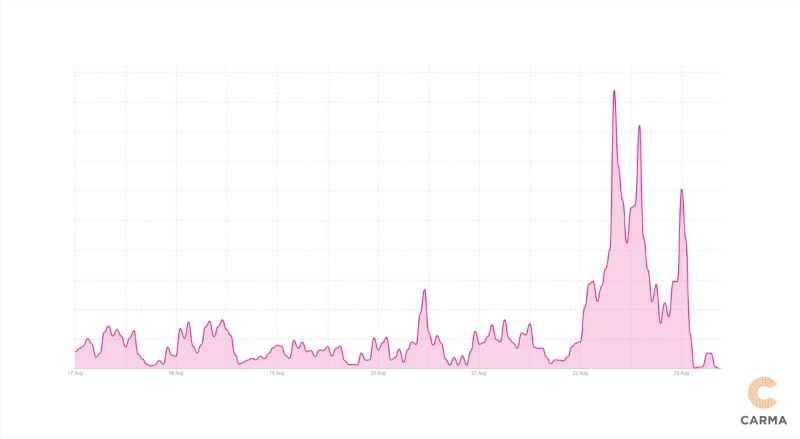

The controversial plan has triggered public outcry as media intelligence firm CARMA saw more than 2,000 media mentions originating from Hong Kong concerning the Fukushima seafood ban over the last seven days, with only 5.9% positive and 33% negative sentiments.

Netizens displayed a general sense of empathy towards Japanese restaurant owners who heavily rely on seafood items in their menus, said Charles Cheung, general manager of HK, CARMA. He added:

Some individuals believe that the ban, coupled with the recent airline ticket giveaway campaign, indirectly encourages Hongkongers to travel to other countries to boost their economies.

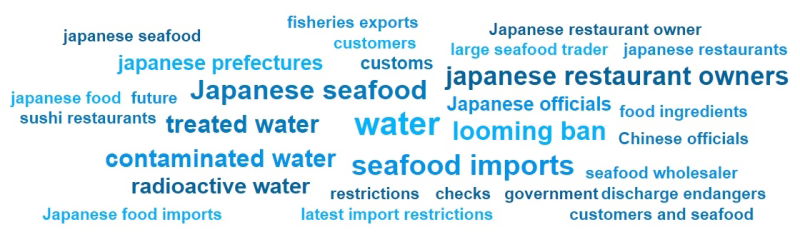

Meanwhile, social monitoring firm Meltwater saw a total of 505 mentions across global social platforms over the past month, with only 1.2% positive, 51.1% neutral and 47.7% negative sentiments. Keywords associated with the incident include "Japanese seafood", "contaminated water", "customers" and "sushi restaurants".

The blacklisted aquatic products include all live, frozen, chilled, dried, or otherwise preserved aquatic products, sea salt and unprocessed or processed seaweed. Meanwhile, the Centre for Food Safety (CFS) of the Food and Environmental Hygiene Department will continue enhancing the testing on imported Japanese food to achieve dual protection.

The Hong Kong government expressed its “strong opposition” to the discharge plan on Tuesday, which the city’s leader John Lee said Japan ignored the inevitable risk on food safety and the irreversible contamination and damage to the marine environment.

“Food safety and public health are the primary concerns of the HKSAR Government. The Japanese Government insisted on proceeding with discharging the nuclear-contaminated water which has been in contact with the nuclear fuel[…]It is an irresponsible act which shifted the issue from oneself to another,” he said.

What does it mean to advertisers?

Hong Kong is Japan's second largest market for agricultural and fisheries exports. Back in last year, Japan exported 75.5 billion yen (HK$4.1bn) of fishery products to Hong Kong, according to government statistics. The looming ban may lead to heavy losses or even closure of some Japanese restaurants in Hong Kong that rely on seafood imported from Japan.

In a conversation with MARKETING-INTERACTIVE, a spokesperson from Japanese gourmet brand Uo-Show said its commitment to food safety and quality is paramount. "We meticulously select all our ingredients and do not use any Japanese ingredients that are subject to the import ban imposed by the government."

The spokesperson added that Uo-Show will continue to closely monitor the situation, maintain regular communication with relevant local government departments and strictly adhere to the guidelines set by the Centre for Food Safety.

We actively source high-quality, seasonal ingredients from around the world to continue providing a satisfying dining experience for our customers.

While we’re unsure to what extent Japan’s move will impact Hong Kong’s Japanese restaurants or the food and beverage industry, industry players MARKETING-INTERACTIVE spoke to believed that adland players in Hong Kong can lend a helping hand to local Japanese eateries in this case.

Kevin Kan, chief experience officer, Break Out Consulting Asia, said this could actually mean more work for advertisers who help Japanese restaurants market their fresh sushi dining. “Their job is to convince patrons that their seafood is fresh from alternative sources, and they have nothing to fear,” he added.

Creative advertising campaigns can also be launched to let diners know their favourite sushi has been sourced from other locations and is safe to eat. He added:

Advertisers will need to cover the whole gamut of advertising from social media to the use of influencers dining on the sushi sourced from alternative locations to boost public confidence in eating sushi.

An alternative approach is to create new sushi menu items sourced from alternative locations to provide variety to traditional sushi fare, Kan added. “This might help provide some level of differentiation for the various Japanese restaurants and drive more traffic,” he said.

On the other hand, for advertisers who provide imported seafood from Japan as their core product supplier, the impact would be profound, said Rudi Leung, director and founder of Hungry Digital. “They include those Japanese restaurant chains and Japanese goods supermarkets," he said.

But this sector’s share in overall advertising spending is not as significant as top spenders such as insurance and banks, so I don't see there will be a significant impact on our industry.

Related articles:

Jumbo floating restaurant exits Hong Kong due to cost crunch

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window