Survey: HK's health and beauty food advertising sees highest growth rate

share on

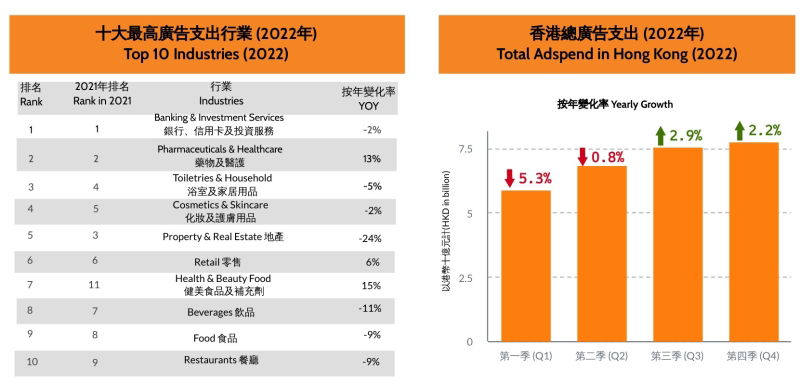

Hong Kong’s ad spend last year was similar to the previous year, with a total spending of HK$28.1bn. Amongst various industries, the ad spend of health and beauty food industry recorded an impressive YOY growth last year, according to admanGo.

Although local ad spend recorded a 5.3% decline in Q1 and remained flat in Q2 last year, there was an upward trend in Q3 and Q4 as the epidemic gradually eased, the report revealed.

The relaxation of social distance in last April, new consumption voucher in last April and last August, together with the relaxation of overseas entry quarantine arrangements in last July, all contributed to the growth of local ad spend with a YOY increase of 2.9% and 2.2% in Q3 and Q4 respectively.

Looking forward to 2023, as most of the epidemic restrictions have been lifted in mainland China and Hong Kong along with the arrival of the long-awaited quarantine-free travel, the local ad spend is expected to grow.

In terms of media outlets, digital media (desktop and mobile) together went up by 7% YOY, and social media recorded an increase of 8% YOY. For traditional media, TV ad spend recorded a YOY increase of 1% in 2022.

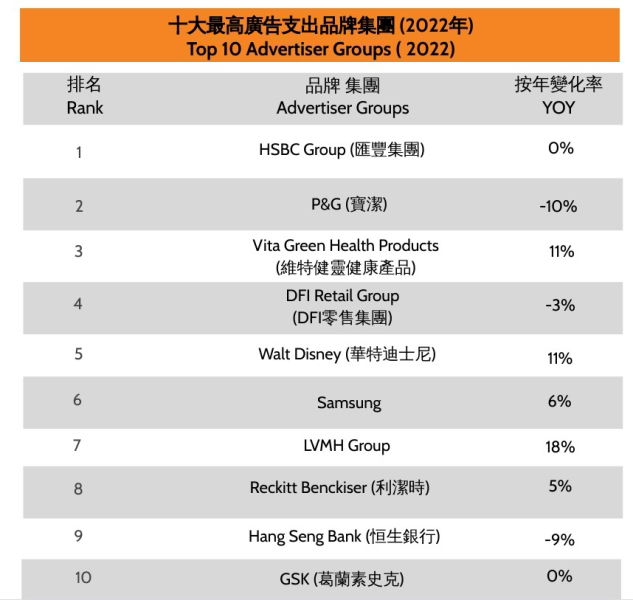

Among the Top 10 industries in ad spending, banking and investment services ranked first with the highest ad spend, yet recorded a YOY decline of 2% in 2022. The category is represented by HSBC Group whose ad spend topped all advertiser groups; while Hang Seng Bank ranked the ninth.

The ad spend in pharmaceuticals and healthcare industry recorded an increase of 13% YOY in 2022. The ad spend of biotech company GSK ranked 10th among the Top 10 advertiser groups.

The retail category, recording a YOY increase of 6% in 2022, benefited mostly from the distribution of the two rounds of consumption voucher in April and August. The ad spend of DFI Retail Group, which operates Wellcome supermarkets, Mannings and 7-Eleven, marked a 3% YOY decrease in 2022 and ranked 4th among the Top 10 advertiser groups.

Meanwhile, health and beauty food category recorded an increase of 15% YOY in 2022 and ranked the first among the Top 10 industries in terms of growth rate. In particular, Vita Green Health Products from the Top 10 advertisers group recorded a 11% YOY increase.

Among the Top 10 advertiser groups, LVMH Group had the highest growth with an increase of 18% YOY in ad spend. The ad spend of Walt Disney increased by 11% YOY, the company spent most on promoting its streaming platform and theme park. The ad spend of the sixth-ranked Samsung increased by 6% YOY. Its Galaxy Z Flip4 smartphone accounted for the largest proportion of the group's ad spend. Other Top 10 advertiser groups that recorded YOY growth included Reckitt Benckiser in eighth (5%).

Related articles:

MAGNA report: Ad spend for 2023 and a breakdown of the mediums

Hong Kong's ad spend on digital media sees positive YOY growth

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window