Going beyond transactions to experience driven commerce

share on

Shopper trends post COVID-19 have given brands plenty to ponder. A rapid increase in online commerce adoption, fuelled by heightened social distancing measures, is highlighting the need for brands to get a head start on what the future of experience-led commerce will look like. Speaking to Marketing, Adriana Chia, director and head of analytical consulting, consumer insights at Nielsen, shares some insights in recent shopper behaviour, as well as thoughts on what kind of experiences consumers will be looking for along their shopper journeys.

Based in Singapore, Chia brings more than 17 years of experience in market research to her role. Currently focusing on quantitative customised research, she has worked extensively on several industries, including financial services, government and public services, education, FMCG and durables.

Watch Chia's in-depth presentation on-demand at our "Modern Commerce in Asia Pacific" virtual summit archive. Available now until 25 August, this online resource for commerce, marketing and IT professionals features top-notch commerce experts from across the region, who discussed commerce and marketing success strategies for 2020 and beyond. Click here to check it out now. Sitecore's virtual summit is done in partnership with Marketing.

Marketing: Marketers across the region are still adjusting to the "new normal". How have consumers' shopping and consumption behaviour changed online and offline over the last few months?

Chia: Since the pandemic, we have witnessed significant changes in the way consumers have shopped and what is being purchased. Hypermarkets have benefitted from this situation due to panic buying, as consumers urgently bought in bigger baskets, while online retailers did not have sufficient delivery resources to meet this sudden increased consumer demand.

But as the pandemic deepened, combined with severely restricted shopping trips, we observed declines in store visits and significant upliftsin online shopping.COVID-19 has accelerated adoption for consumers worldwide. Based on our Nielsen Global Covid-19 survey, we saw that two in five consumers in Asia Pacific used online shopping more often than before the outbreak.In Asia Pacific, consumers expect themselves to shop more often online, up to six months at least and nearly one third expected this to last longer than six months.

ECommerce sales will keep rising as consumers are likely to lean towardssafer, non-physical stores. Availability, regardless of channel, is key. At the start of the pandemic there were delays for consumers purchasing products online – some even gave up when they faced delays in restocking and delivery.Driven by the out of stock situation and restrictions in physical movements, many added more retailers (e.g. the smaller convenience stores, local neighbourhood stores on top of their usual hyper/supermarkets) into their store repertoire.

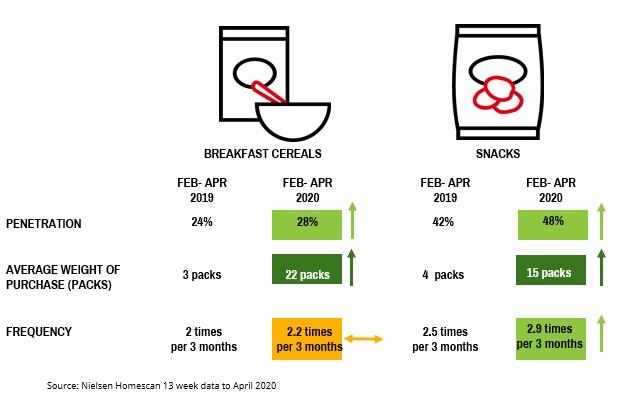

With more time at home and with the restrictions in movements, findings from our COVID-19 Global Survey conducted, 50% consumers in Singapore claimed to be eating/cooking more at home and 72% are purchasing packaged foods online. Indeed,home cooking and meals consumption at home trends has emerged since they are alsousing this as an opportunity to be with the family together in the kitchen. For instance, in Singapore, we saw an increase in the penetration of breakfast cereals (past three months purchase) from 24% to 28% and average weight of purchase increased from three to 22 packs (February to April 2019 as compared to February to April 2020). In this same period, consumption of snacks has also increased from four packs to 15 packs on average. As consumers continue to work or eat more at home, brands and retailers would need to rethink how to leverage and adapt this new trend to win.

With more home cooking or eating at home, this brings about opportunities for brands, not just on the meals that households are preparing at home, this will also imply that households will be washing their dishes more, bringing more business opportunities to home cleaning products and storage/container products or related categories.

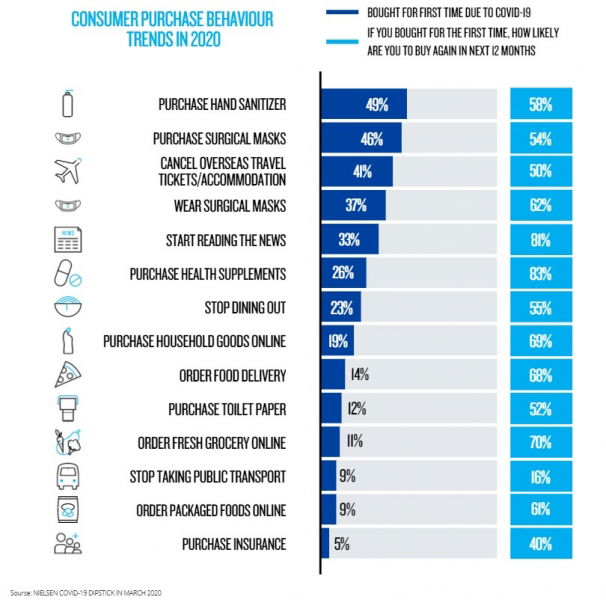

Other than the changes in consumption behaviour, there has also been a shift of priorities among shoppers, for instance health and hygiene aspects. Health and wellness products have been growing since the outbreak. Before the outbreak, there was already a long-term shift towards healthier products and categories. Even as COVID-19 subsides, consumers are expected to continue to look after their health and wellbeing.

In Singapore, eight in 10 are likely to buy health supplements again in the next 12 months, and more than half (58%) of consumers will continue buying hand sanitisers.

Marketing: What are some of the categories that will see more digital acceleration than others?

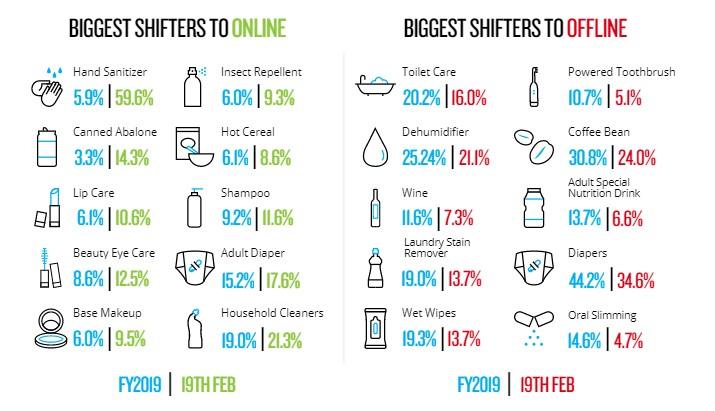

Chia: During COVID-19, compared to the same period in Feb 2019, we saw interesting shifts online and offline across different categories. In Singapore, for instance, the top shifters online were hand sanitisers and household cleaners while the non-essential categories like coffee beans, diapers and dehumidifiers saw the largest shift to offline.

The convenience of shopping for products online has not only increased online shoppers’ spend but also converted many offline shoppers to online. COVID-19 drove higher penetration of online shopping for FMCG products including packaged food, personal care products, and health and wellness products.

Even for non-FMCG products, while online adoption is lower than personal care products, health and wellness products or packaged foods, the electronics durables category saw the highest increase, from 44% to 50% in online purchases after the outbreak.

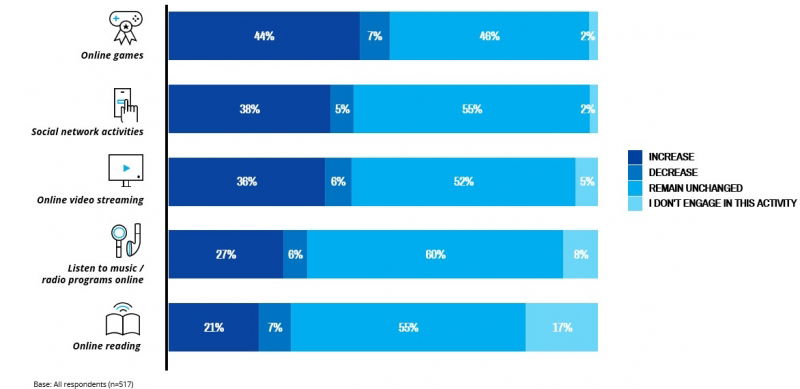

The increase in online purchases for electronic durables is expected. While consumers are staying indoors to keep themselves occupied and engaged, online entertainment has become more popular. Two in five consumers in Singapore are playing more online games, followed by social network activities and online video streaming.

Marketing: Whilst sales are being impacted for most industries, this doesn’t necessarily mean brands should stop marketing, correct? Is this now the time for experience-driven commerce, as opposed to transaction commerce?

Chia: Yes, it is very clear that transaction commerce will not be sufficient for consumers today. It is just the bare minimum for retailers or brands if they want to get online. To win, they would need to go beyond transactions to an experience driven one, offering them the complete shopper journey, from offline to online.

In the past, when consumers shopped online, they just wanted to search or buy the products they needed and check out as fast as possible. But new technology is disrupting how consumers discover, evaluate, experience and purchase products. Online will need to get more immersive to keep shoppers engaged.

In our Nielsen Tech Transformed Consumption Global Survey 2019, findings point towards the fact that consumers now crave for immersive, real-life, and personalised technology experiences. In fact, consumers have already started to use augmented reality (AR) to try on makeup and see products at home. Not only AR or virtual reality (VR) will continue to provide consumers with risk-free shopping trials, these will enable consumers to receive highly personalised experiences that will completely transform how they engage with brands. Tech-tainment will need to be integrated more into the shopping experience to deliver more engaged and enjoyable experiences for brands that want to stand out and win consumers.

To create relevant and meaningful experiences online, brands must find ways to personalise and recommend products based on shoppers’ habits and preferences. For instance, to decide what to buy, shoppers rely on a mix of information sources. For online, shop website and brand websites are the top key information sources that influence shoppers’ buying decision.

When it comes to eCommerce, consumers are looking for flexibility and reassurance – they want same-day product replacement services and free delivery for purchases. Hence, for retailers and brands, just transactions will not be sufficient, we would need to consider their end-to-end journey, from pre-purchase to post-purchase and engaging them from the start, even at the information gathering or research/product review stage.

Related Articles:

Modern commerce and the art of personalisation

What to look out for when deciding on the right technology partner

How first-party data can revolutionise consumers' commerce experience

Barriers to the perfect commerce experience: What's standing in your way?

Is your eCommerce platform getting lost in the sea of online stores?

The true marriage of experience and commerce

Opinion: What does the future hold for modern commerce?

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window