Attrition and salary bumps: How optimistic can we be in 2024?

share on

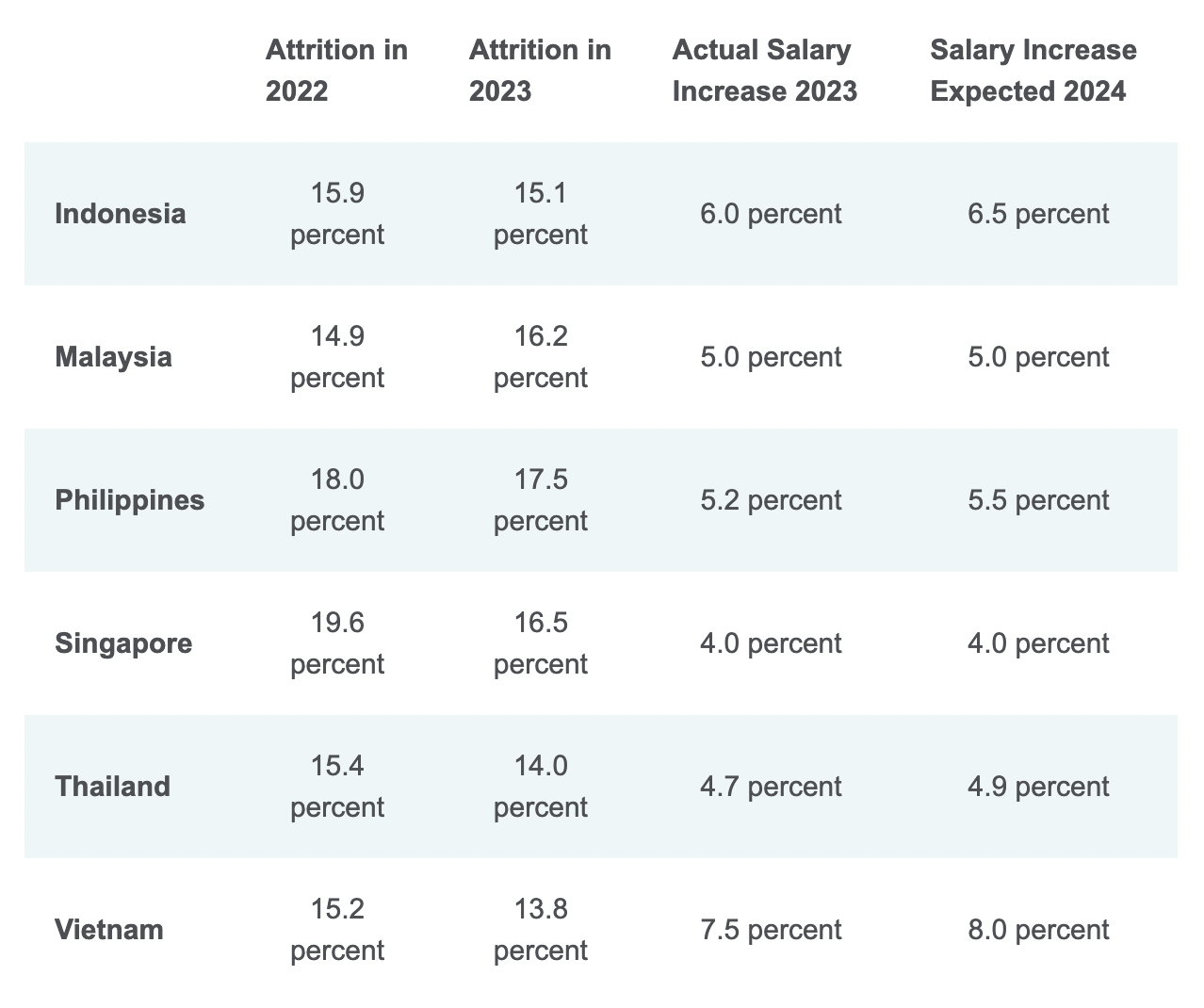

A recent study has revealed that salaries are projected to increase in 2024 in Southeast Asia despite concerns regarding an economic slowdown. This is particularly so for Indonesia (6.5%), the Philippines (5.5%), Thailand (4.9%), and Vietnam (8.0%). Meanwhile, the salary increases for 2024 in Singapore and Malaysia are expected to stay at 4.0% and 5.0% respectively, maintaining the actual rates seen in 2023.

In fact, more than half of the roles in Southeast Asia have had salary increases outrunning inflation. Singapore and Philippines saw 71.7% of salary increases outrunning inflation, with Malaysia at 56.4%. However, 70% of salary increases lagged inflation on average in Indonesia, Vietnam, and Thailand.

Don’t miss: 10 media trends marketers should take note of in 2024

These were the findings by global professional services firm, Aon, in its 2023 Salary Increase and Turnover Report for Southeast Asia. The survey, which was conducted in the third quarter of 2023 on 950 companies across Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam, also revealed that attrition rates across the region have generally dropped in 2023.

That said, attrition rates still remain in the double digits, which was attributed to the ever-changing talent strategy of firms in the region as well as the ongoing gap between supply and demand for talent. In particular, the Philippines saw the highest attrition rates at 17.5%, while Vietnam came in lowest at 13.8%.

Meanwhile, business across the region appear cautiously optimistic about hiring. Around 40% of companies surveyed indicated no changes in their recruitment numbers, while 40% had hiring restrictions. Despite an increase in layoffs earlier in 2023, Aon’s data indicated that headcount numbers across industries still surpass pre-pandemic levels. The layoffs were largely attributed to non-core or expansion areas, while firms continue to hire for other business lines.

From an industry point of view, salaries are also projected to vary in 2024, with the retail industry expected to have the highest budgeted salary increases (6.1%). Other industries included in the study were technology (6.0%), life sciences and medical devices (5.9%), manufacturing (5.8%), and financial services (4.8%).

How can companies maintain a resilient workforce?

Given these talent-related findings, companies will need to holistically consider factors such as profitability and people costs, according to Alina Cheng, head of data solutions for Southeast Asia at Aon. She highlighted the need for a “holistic total rewards strategy based on data and analytics” that would help firms to maintain a resilient workforce amidst economic uncertainty.

“In these challenging times, simply increasing salaries is unsustainable for firms.”

“Southeast Asia has long been a hotbed of economic growth, attracting talent from across the globe. As it confronts the prospect of a looming recession, the dynamics of salary increases, turnover, and workforce stability take on greater significance,” she added.

She also stated that firms will need to address pay compression actively in order to maintain an engaged, competitive, and resilient workforce. Pay compression refers to the gap in pay between employees regardless of experience and talent, such as when new hires receive higher compensation than long-term employees. This issue can lead to higher attrition and a decline in employee morale.

“By focusing and nurturing talent from within, firms can subsequently decrease the need for new hire premiums while enhancing their organisation's employee value proposition," she explained.

Rahul Chawla, partner and head of talent solutions for Southeast Asia at Aon, similarly highlighted the importance of advanced analytics for firms to stay competitive in compensation strategies.

"As companies navigate new forms of volatility including focusing on costs and investments, salary-increase planning has become challenging across the region,” he said.

“By leveraging data from within their own organisations as well as the market, companies can make more informed decisions."

He added that using the insights from data will enable firms to not only weather the challenges of an uncertain economic climate, but to also thrive in an evolving workforce landscape.

As we gear up for the new year, firms are looking towards the strategies and trends that could bring a competitive edge. For example, amidst the digital transformations seen in 2023, companies are adopting technologies such as artificial intelligence (AI) to stay competitive.

For example, market researcher Forrester highlighted how AI-enabled skills intelligence might become a tool for firms to mitigate talent gaps. To address the ongoing talent shortage, firms are moving from credential-based hiring to a skill-centric approach to ensure that skills align with short- and long-term business needs.

To maintain an agile and skilled workforce that is aligned with future business goals, firms will need to shift towards this type of measured innovation that incorporates skills intelligence.

The biggest conference is back! Experience the future of marketing with 500+ brilliant minds at Digital Marketing Asia on 28 - 30 November in Singapore. Uncover groundbreaking strategies that connect leading brands with their target audiences effectively.

Related articles:

5 digital trends APAC marketers should look out for in 2024

5 areas marketers need to prepare for in 2024 as consumer needs change

5 ways for brands to balance commodification and creativity on social media in 2024

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window