DBS brand sentiments plummet (again) as customers face new disruptions

share on

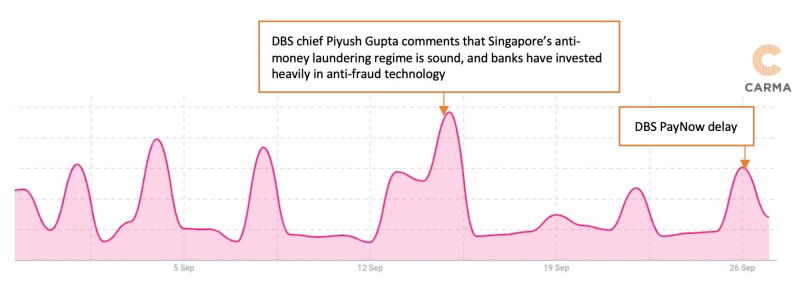

Local bank DBS PayNow's service was impacted on Tuesday with customers reporting delays in their FAST or PayNow transactions from early in the afternoon. The issues, which come alongside a string of outages this year alone, caused DBS' brand sentiments to plummet.

According to media intelligence firm CARMA, sentiments of conversations on social media around DBS prior to the incident stood at 25.6% positive and 19% negative. Its word cloud also largely revolved around its services with words such as 'brand, 'credit' and 'account' popping up.

Don't miss: DBS' digital banking disruption caused by 'human error', according to preliminary investigations

However, after the incident, sentiments of conversations on social media around DBS plummeted to 17.3% positive and 36.3% negative. Its word cloud also shifted drastically to include words such as 'complaints', 'error' and 'uninstall'.

"It shows that no matter how small an incident, it can have an impact on a brand's reputation," said Divika Jethmal, head of marketing at CARMA. "Companies can manage this by identifying the reputation pillars that they are best known for, and continuing to build on those during the year so that they can ride the wave easier when facing an issue," she added.

The delays began early yesterday when customers began reporting issues with making transactions through FAST and PayNow.

"We are aware that some of our customers faced a delay in their FAST and PayNow transactions earlier this afternoon. The issue was rectified at 4.30 pm," said DBS in a Facebook update at 6.02 pm yesterday.

While DBS fully restored affected services after six and a half hours, MAS has stated publicly that it regards this second disruption within a period of two months as unacceptable, and that DBS had fallen short of MAS’ expectations for banks to deliver reliable services to their customers. MAS was referencing an incident that happened days before where DBS PayLah users faced delays in receiving their cashback for a SG$3 meal subsidy initiative.

The impact on trust factor

In a prior conversation with MARKETING-INTERACTIVE, industry players commented that trust in the tech space is currently low. For products that impact everyday life so pervasively, this could become a frustration point for users as noted by some netizens.

Charu Srivastava, the corporate affairs lead and chief strategy officer at TriOn & Co, a strategic communications consultancy, noted that timeliness and accuracy in messaging are the most important when it comes to service outage, especially when it comes to a financial institution. "A majority of people in Singapore rely on digital banking so any kind of disruption has a huge impact," Srivastava said.

In such cases, it is important for the communications team (offline and online) to as quickly as possible allay any concerns through an accurate reporting of the situation. It is best to be honest instead of trying to cover up the incident.

She added that it is important that the response come from combined efforts across communications, legal, IT, operations, customer service and others. "It is then crucial to have a clear flowchart of what to do and what not to do, who leads what action and who is responsible for each step."

A crisis is best managed when it has already been thought through before the incident even happens, she said. It is too late if communications teams start to think of a plan of action after an incident has occurred. Half the battle is won before anything even happens.

Lars Voedisch, principal consultant and managing director of PRecious Communications added that in such a situation there are four key rules:

1. Get it fast - Acknowledge quickly that you are aware of the situation and that you’re working on it.

2. Get it out - Talk about it maybe through an SMS alert; or maybe have a tracker on which branches are more or less crowded. You don’t want customer to waste their time getting stuck with online services and only then check if the services are down. Update about the progress frequently, and always show empathy.

3. Get it right - Fix the issue at hand (which took longer than expected) and make sure it doesn’t happen again.

4. Get it over - Share what really happened and how you fixed it sustainably so that everyone can move on

Related articles:

DBS Paylah! wants you to vote for our hawkers

DBS unveils new metaverse game to highlight global food waste issues

DBS Bank relinquishes majority stake in AXS to Tower Capital Asia

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window