Survey: Consumer confidence reaches historical high in luxury market across China and HK

share on

Consumer confidence in the luxury market across mainland China and Hong Kong has rebounded as nearly half of Hong Kong respondents are going to spend more on luxury goods in the coming year, according to a survey by Ruder Finn and Consumer Search Group.

Conducted between December 2022 and January 2023, the report surveyed 2,000 consumers in mainland China and 500 in Hong Kong, whose average annual household income was RMB1,402,000 and HK$1,193,000 respectively. The report aims to explore key indicators of the luxury market in two places and reveal market trends based on consumer behaviors and preferences.

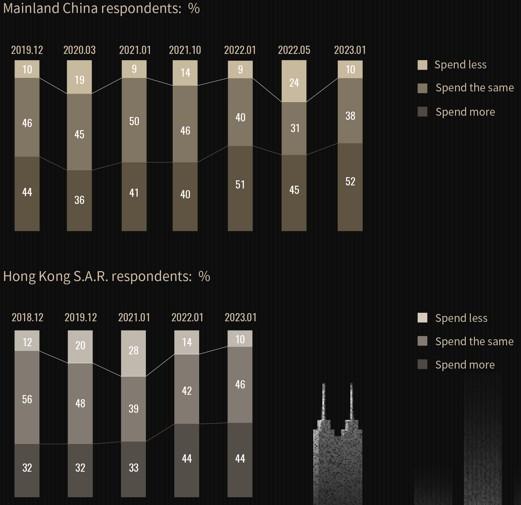

The survey revealed that 52% of mainland China respondents indicate that they would “spend more” on luxury items, going well beyond the pre-pandemic figure of 44% in 2019. The proportion of respondents who expect to “spend less” fell back to 10%, same as 2019. Meanwhile, consumer confidence in Hong Kong rose steadily and reached a historical high since January 2022. 44% of Hong Kong respondents said that they would spend more on luxury goods over the next 12 months, an increase of over 10% before the pandemic, while only 10% said they would “spend less”.

Moreover, the survey finds that personalised one-on-one live streaming and new product presentations have become increasingly popular in both Mainland China and Hong Kong, with 26% and 22% of respondents respectively reported to be enjoying these services.

“After facing severe challenges such as the impact of the pandemic and economic downturn, the Chinese luxury market in 2023 is recovering with the optimisation of COVID-19 restrictions. The vitality of the market is expected to be restored within the year,” said Simon Tye, executive director of CSG Hong Kong.

Don't miss: Livestream retailers get creative with male models after China bans female lingerie models

Furthermore, the survey shows that the three channels that Chinese consumers feel the most comfortable with for purchasing luxury goods are the brands’ official websites (54%), JD.com (56%) and Tmall (53%), showing a significant increase of 10% to 30% across different categories compared with 2021. Meanwhile, Hong Kong consumers’ confidence in online shopping has relatively increased, with 34% of consumers preferring to browse online before purchasing luxury goods in physical stores. Online marketplace websites which respondents are likely to use more in the next 12 months to purchase luxury goods include the brands’ official websites (52%), Amazon (46%) and brands’ official app (41%).

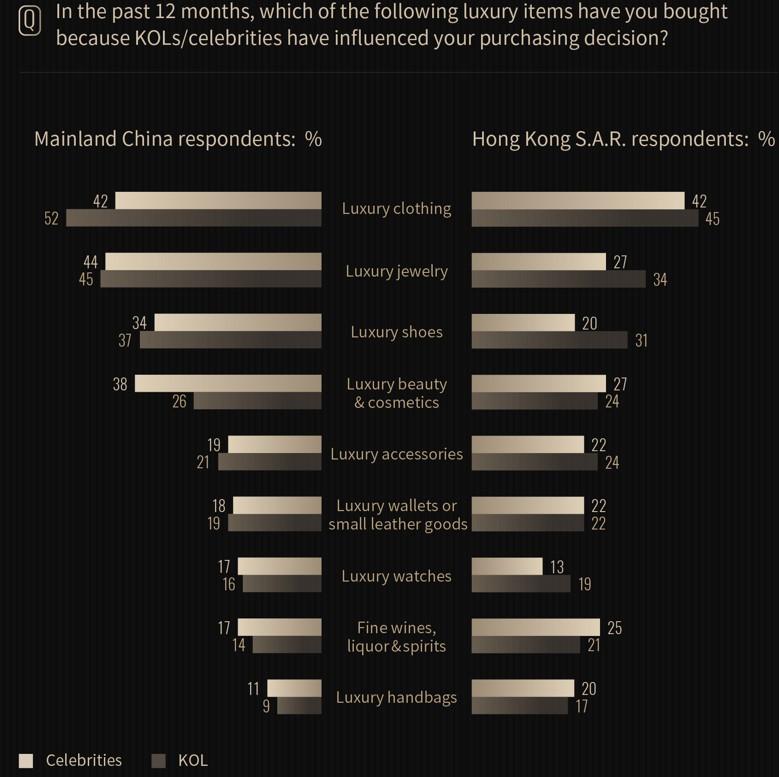

In terms of KOLs and celebrities, only 2% of mainland China respondents and 5% of Hong Kong respondents chose “It decreases my purchase intention” when knowing that the celebrity is sponsored by a brand. With regards to the KOLs, only 4% of mainland China respondents and 7% of Hong Kong respondents would reduce their purchase intentions. The survey reflects that the celebrities in mainland China (58%) or Taiwan (51%) are the most influential to mainland China respondents’ purchase intentions, whilst the celebrities in Hong Kong or Taiwan (57%) and those in Japan or Korea (43%) are the most influential to Hong Kong respondents’ purchase intentions on luxury goods.

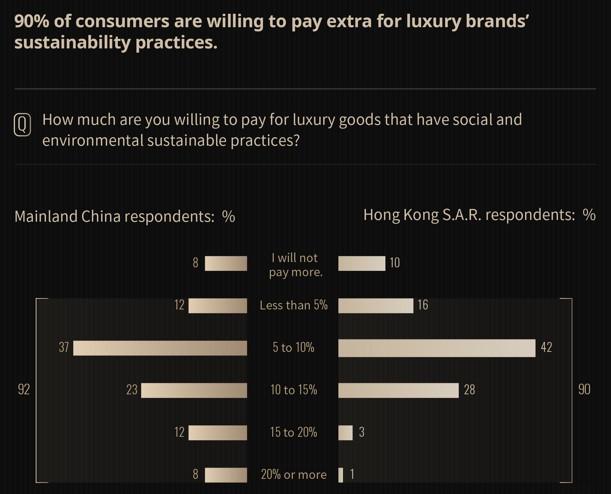

When it comes to sustainability, 80% of respondents in both mainland China and Hong Kong agree that luxury brands should play an important role in sustainability. However, only 73% of mainland China respondents and 66% of Hong Kong respondents believe that luxury is sustainable, which decreased by 20% and 9% respectively compared with the previous year. Among them, only 52% of Gen Z respondents from mainland China agree with this, reflecting that young consumers’ are deepening understanding of the concept of sustainability. In addition, approximately 90% of respondents in both mainland China (92%) and Hong Kong (90%) are willing to pay extra for luxury goods to support the practice of socially and environmentally sustainable development.

In recent years, the concept of "circular fashion" has gained attention for its alignment with "low-carbon" values. According to the survey, jewelry (21%), small leather goods (18%) and clothing (17%) are the most purchased second-hand luxury items amongst mainland China respondents. Hong Kong respondents spent more on second-hand luxury clothing (26%), jewelry (23%) and shoes (22%). At present, second-hand luxury items are still far from widely accepted in China and Hong Kong. The main reasons include “dislike of used goods”, “hygiene concerns” and “product authenticity”.

Gao Ming, senior vice president and managing director, luxury practice Greater China, Ruder Finn Group, said, “Although domestic luxury consumers' confidence has shown a strong rebound with the optimisation of COVID-19 restrictions, the normalisation of overseas travel may also exert pressure on the growth of domestic luxury consumption. As opportunities and challenges coexist, it is necessary to further narrow the price gap between the Chinese market and foreign markets, and provide attractive value-added services. We must also accelerate the pace of digitalisation to deal with the complex and changing market environment by integrating communications and e-commerce.”

“Meanwhile, we must also optimise our collaboration with KOLs, celebrities and the media, and carry out accurate communications according to the local conditions at different stages of consumption decision-making. We can also provide a more diversified value for Chinese consumers through sustainable concepts”, Ming suggested.

Related articles:

China's market watchdog introduces new guidelines on endorsement in advertising

Livestream retailers get creative with male models after China bans female lingerie models

Study: 80% of ad spend in China will come from digital media by 2024

China panel launches inquiry into Amcham's promotional video of HK

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window