APAC ad market to rebound in 2021, MY and HK still struggling with lowest ad growth

share on

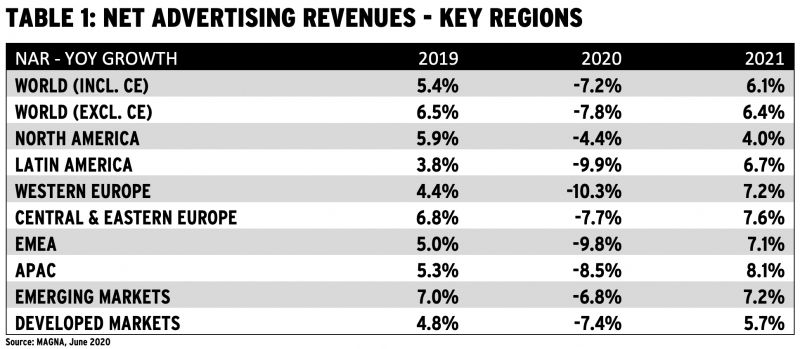

In 2021, Asia Pacific's ad economy is expected to rebound by 8.1% to reach US$175 billion. This comes as the ad revenue of Asia Pacific media owners is predicted to dip by 8.5% this year to reach US$163 billion, worse than the global average dip of 7.2%. According to the latest Magna Advertising Forecast, this number is “significantly below” previous expectations due to the impact of COVID-19 and the accompanying economic shutdowns. This will result from linear ad formats shrinking by 16.5% and digital ad formats remaining flat year-on-year (YoY).

Despite the significant decline in ad spending in 2020, Asia Pacific is forecasted to remain the second largest global region behind North America, comfortably ahead of Europe, Middle East and Africa which will have just US$131 billion of spending in 2020. Because EMEA’s decline is expected to be even larger than that of Asia Pacific, the gap between the regions will continue to increase, Magna said.

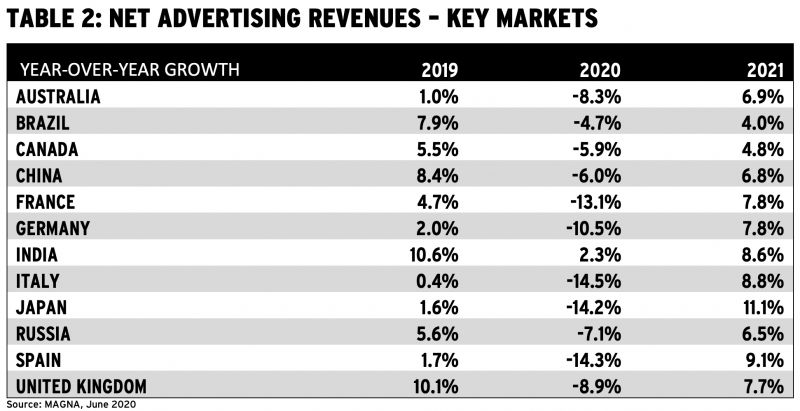

Hong Kong will face the slowest advertising growth (-24%) due to the impact of COVID-19 and consistent and prolonged protests. After Hong Kong comes Malaysia (-18%), Philippines (-17%) and Japan (-14%). On the other hand, China and Japan combined form 68% of the total regional spending. Meanwhile, while the Indian sub-continent is the least developed portion of Asia Pacific in ad spend per capita terms, Magna said that is where ad spend consistently grows the fastest. In 2020, the strongest growth will come from India (+2%) and Pakistan (-2%).

Singapore

Singapore's ad sales is expected to dip by 5.5% this year to reach US$1.5 billion, while its economy will shrink by 3.5% on a real GDP a basis in 2020, in line with the global average. Magna predicted that linear advertising format spending declining by 9%, and digital ad spending increasing by 5%.

Meanwhile, TV spending will increase by 4% in 2020 despite the COVID-related shutdowns and the global recession.

According to Magna, there are several reasons behind this. Firstly, TV declined by 10% in 2019 due to Mediacorp cutting prices to meet dwindling demand. This created an easy comparison for 2020 spending. In addition, the Singapore government stepped in to purchase significant television inventory at market prices to support COVID messaging. Singapore’s government increased its spending by 50% in linear media YoY in Q1, and represented 20% of total spending in the entire market. This aggressive information response could be a contributor to Singapore’s 25 total deaths, which were low compared to many markets, Magna said.

Other linear formats will not fare quiet as well, with print (-21%), out of home (-20%) and radio (-6%) all declining, but government purchases were across other linear media formats too, cushioning declines. Digital ad spending strength is led by social (+9%), search (+5%), and video (+5%) with only static banners (-8%) showing declines across digital formats.

Malaysia

In Malaysia, media owners ad revenues will see a 18% dip to US$1 billion. Malaysia’s economy is expected to decline by 1.7%, slightly better than the global average of -3%. The weakness in advertising spending will come from a combination of linear advertising spending shrinking by 32%, and digital ad spending growing by 8%. According to Magna, this is one of the highest differences between linear and digital advertising spending growth across all markets.

Meanwhile, digital ad spend in Malaysia will be driven by spending on mobile devices, which will still grow by 16% this year to represent 67% of total digital ad spending.

By format, digital strength will come from social (+15%), video (+12%), and search (+2%). Only static banner display (-6%) will see absolute spending declines despite the global recession.

On the other hand, linear media will be much more significantly hurt in 2020. TV spending will decline by 18% although this is mild compared to print (-48%), out of home (-24%), and radio (-34%). Malaysia’s COVID quarantine started in mid-March and extended through mid-May. While this is consistent with what happened in other markets, Magna said Malaysia has one of the largest exposures to critical industries that were hurt by COVID shutdowns. Restaurants, retail, and travel, represent 62% of small and medium businesses in Malaysia, and many cut ad spend despite mild and temporary declines in business performance.

Furthermore, Malaysia had one of the sharpest declines in population mobility, with transit decreasing by 80% within a few days of the beginning of quarantine. Even today, mobility is still down by 55% compared to 2019 as consumers are reluctant to return to normal day to day activities.

Indonesia

The Indonesian ad market will shrink by 12.6% in 2020 US$6 billion. Meanwhile, Indonesian GDP will grow by 0.5% in 2020, significantly above the global average of -3.0%. Despite that outperformance, Magna said linear advertising sales will decline by 17% this year, and digital ad sales will remain flat.

Some of the relative weakness in the Indonesian market is due to the low adoption of digital advertising compared to developed markets, where larger digital budgets are able to better offset linear ad spending declines as a result of the COVID global recession. TV ad spending will decline by 12% but still represent 55% of total budgets. Magna explained that not only was there weakness from COVID-19 lockdowns, but this year's TV spending was also going up against the tough comparison from 2019 with general elections that were held in April 2019 having boosted TV spending.

Meanwhile, print ad spending will decline by 30%, radio ad spending will decline by 50%, and OOH will also decline by 30%.

Despite there being a relaxed official restriction on movement because of COVID, Indonesian consumers have self-regulated more significantly than in other areas with lighter official restrictions. Mobility in Indonesia declined nearly 70% from 2019 baselines in early May, and mobility is still more than 50% lower than it was in prior years.

The only reason that OOH ad spending is not down further is because many commitments are for a year or more. As a result, Magna said there was remaining carry-over spending from 2019 buoying early 2020 OOH spend. Digital advertising formats will remain flat in 2020, and represent nearly 30% of total budgets. Strength comes from mobile device spending, which will increase by 12%. By format, strength comes from social (+7%), and video (+10%). In 2021, Indonesian ad spend will increase by 10%, although it will take until the end of 2022 for the prior high-water mark of spending in 2019 to be surpassed.

Hong Kong

Its ad sales is expected to dip by 24% while real GDP is only expected to decline by 4.8% in 2020. Based on this, Magna said the driver of this "extreme weakness" is not economic and not entirely COVID-related either. Instead, the weakness is driven by public protests at new regulations that have been going on since 2019 creating an environment of significant uncertainty and making brands reluctant to spend. This significant uncertainty and overhang throughout 2020 will augment the declines already caused by the global COVID recession.

Weakness is coming primarily from linear advertising which is expected to decline by 34% and represent just 65% of total advertising revenues. This is a sharp decline from 2019’s 74% share.

TV will decline by 40%, including a huge drop in TVB spending which has 80% share of voice in free TV. Other linear formats such as print (-26%), out of home (-32%), and radio (-20%) will also suffer, but not the extent that TV has and will throughout the remainder of the year, Magna said.

On the other hand, digital ad formats will see spending growth of 3% to surpass one-third of total advertiser budgets. Digital strength will come from video (+9%), and search (+1%) primarily. In 2021, Hong Kong spending will rebound but only by 11% to reach US$2.7 billion. Due to the extremely sharp weakness this year in 2020, Magna predicted that Hong Kong’s advertising economy is not expected to surpass the 2018 high water mark at any time through the end of the forecast period in 2024.

China

Chinese media owners advertising revenues will decline by 6% in 2020, marketing the first decline in the history of Magna’s spending records. Total Chinese spending is expected to fall to US$75 billion, making China the second largest country for ad spending behind the US. This year's weak performance comes on the back of real GDP in China expected to barely increase by 1%, and the first negative quarter of growth in Q1 during the height of the Wuhan lockdowns in four decades.

According to Magna, the fact that a terrible growth year for the country is still slightly positive is telling for the strength of the Chinese economy on the global stage. That said, the future of the Chinese economy is less certain than it has been in recent years given tensions with Hong Kong and the continued potential for a trade war with the US. However, Magna said future growth expectations remain more robust than any other developed economy.

In addition, consumption is increasingly a significant driver of the Chinese economy, and although consumers are hesitant to spend during this period of global uncertainty, GDP is expected to recover by 9.2% next year. Growth will be driven by digital ad sales which are expected to remain flat YoY in 2020 despite the global recession.

Digital spending will reach US$52 billion and will represent 69% of total spending. Digital ad spending growth will come primarily from mobile devices which will see spending increase by 6% in 2020.

By format, search remains by far the largest portion of spending, and represents 57% of total budgets in China. Search ad spending will decrease by -3%. This includes more substantial declines in core search advertising spending, offset by continued strength from eCommerce search advertising giants Alibaba and JD.com. In fact, Magna said that the five digital giants - Alibaba, Tencent, Baidu, Sina, and Sohu - together control more than three quarters of total digital advertising revenues in the only market where Google, Facebook and Amazon are completely absent.

Growth will be the strongest in social media advertising, which will see spending increase by 17% even in the COVID-driven recession.

This comes as consumers improve engagement with social media during lockdowns and beyond. Finally, video advertising will increase by 4%. The only significant declines in digital media formats will come from static banners, which will see spending decline by 15%. Linear advertising formats will decline by 17% and will represent just 31% of total budgets in China in 2020.

The largest share of that spending is TV, which Magna said will see spending decline by 14% to reach 22% of budgets this year. According to Magna, TV saw significant increases in consumption during the COVID lockdowns in Q1. Chinese viewers increased their TV viewing consumption by 50% YoY in the early stages of lockdown. However, by early April, that had fallen to just a 20% premium YoY and as life returns to normal, so has viewing.

In fact, only consumers aged four to 17 years old continue to watch more TV YoY than they did in 2019, with average time for kids still +50% YoY in May. Other linear advertising formats did not see significant spikes in consumption during quarantine. Radio consumption remained stable around 57 minutes per day, only slightly higher than 53 minutes per day in 2019. Spending is expected to decline by 10% in 2019 to just 3.2% of total budgets. This is strong relative to print, however, which will decline by 42%, as well as OOH which will decline by 25%, and cinema, which will see declines of 48% as cinema viewership collapses.

By industry, weakness will come from travel (-31%), as well as auto (-21%) and retail (-12%). Chinese car sales declined almost to zero during the quarantine, and travel and retail will have an overhang for the full year from both formal restrictions as well as consumer reluctance in some areas to expose themselves to public spaces. Strong industries include F&B (-1%), as well as personal care (-1%), pharmaceutical (-1%), and tech (-1%). In 2021, the Chinese market will rebound by 6.8% to reach US$80 billion, slightly ahead of the 2019 total. According to Magna, this is only possible in a market where real GDP is not expected to shrink as a result of COVID. Usually, most large markets will take longer to reach their previous 2019 spending total.

Digital remains strong while TV and print dip

Ad spend and growth in Asia Pacific will continue to be driven by digital formats, with strong performance being driven by social (+10%), video (+4%), and search (-2%). Only banner display (-11%), and other digital (-16%) will truly see significant declines this year. Mobile formats continue to be where most growth in consumption and spending is, and in 2020 mobile ad spend is expected to increase by 6%.

Smartphones and feature phone continue to play a larger role in the digital life of Asia Pacific consumers, and the Chinese market is one of the most advanced large mobile digital market globally, in terms of both features and in share of digital spending. In 2021, Magna predicts that digital spending growth will rebound to 13% due to the easy comparison in 2020 and will reach US$98 billion.

Like in most global regions, lower funnel direct digital ad formats in Asia Pacific held up better as a result of COVID slowdowns compared to upper funnel brand advertising. According to Magna, paid search remains by far the largest portion of digital ad spending in this region, representing almost half of total digital budgets, and whatever weakness there is in core search engines is offset by continued strong growth in eCommerce related product listing ads.

Meanwhile, TV advertising is predicted to dip by 13% this year to reach just 30% of total budgets. TV budgets already dropped by 3% last year, the first decline since 2009, and the tremendous impact of the global recession and COVID lockdowns in 2020 accelerates the shift to digital advertising. Furthermore, the Olympics in Tokyo were expected to be a supporting factor for TV ad spending in 2020, but its delay until 2021 means that 2021 spending is expected to be stronger (+3.1%), but only compounds the pain felt this year in the Asia Pacific TV industry.

Print advertising sales will also continue to decline, with newspapers (-23%) and magazines (-28%) both expected to be weak this year. Print represents only 7% of total ad spending in Asia Pacific that spending declines are starting to bottom out, Magna said. Many brands that might consider deeper print cuts have already cut print formats entirely from their media plans. Radio is expected to decline by 13% in 2020, following 3% in 2019. Finally, out of home has traditionally been strong in this region, but due to quarantines and shutdowns out of home ad spending will decline by 25% this year, to fall to just 6% of budgets.

Media owners to lose US$42 billion globally in 2020

On a global scale, Magna predicted that media owners’ advertising revenues will decrease by US$42 billion in 2020, from US$582 billion to US$540 billion. This comes as advertising spending shrinks due to the severe economic recession triggered by the COVID-19 pandemic, and as GDP is expected to contract between -5% and -12% across the world’s largest markets. Global advertising revenues will decrease by an estimated 7%, as the 16% decline of linear ad sales - linear TV, print, linear radio, OOH, cinema - to US$238 billion, will be mitigated by the stability of digital formats, which will increase by 1% to US$302 billion.

Leigh Terry, CEO IPG Mediabrands APAC, said ad spend and growth in Asia Pacific continues to be driven by digital formats. As budgets were adjusted to reflect the new post-Coronavirus economic reality, brands consistently prioritise spending that is easiest to attribute directly to sales.

"As a result, search and social as well as performance video remain the bastions of digital ad spending strength in the region, demonstrating continued strong growth in eCommerce," he added

Meanwhile, managing director Magna APAC, Gurpreet Singh, said in Asia Pacific, decline in ad spends in 2020 will mostly come from linear media, while digital will show relatively more resilience which will help digital media to gain share of spends faster than previously expected," Singh said. He added that digital is expected to achieve the highest share of spends in almost half of the APAC markets this year, and it will close the gap faster in some of the other markets.

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window