4 tips for brands in Malaysia during this out of the norm Ramadan

share on

Ramadan is around the corner, but with the Movement Control Order extended until 28 April annual bazaars have had to hit pause during this festive season. Considering this, brands such as Grab Malaysia have stepped up in their act for the community, partnering with the governments of Selangor and Kuala Lumpur to digitise Ramadan bazaars this year.

According to Sean Goh, country head of Grab Malaysia, the company hopes to support micro-entrepreneurs and social sellers who usually participate in neighbourhood Ramadan bazaars or organise pop-up stores across the country. Grab will be using its GrabPay, GrabFood and GrabExpress services to help these merchants sell and deliver items directly to Malaysian homes, be it Ramadan favourites, cookies or Hari Raya outfits.

While this period is no doubt hard on retailers and micro-entrepreneurs, here are ways FMCG brands and retailers in Malaysia can fulfill consumers' needs this Ramadan and Hari Raya.

1. Price fairly

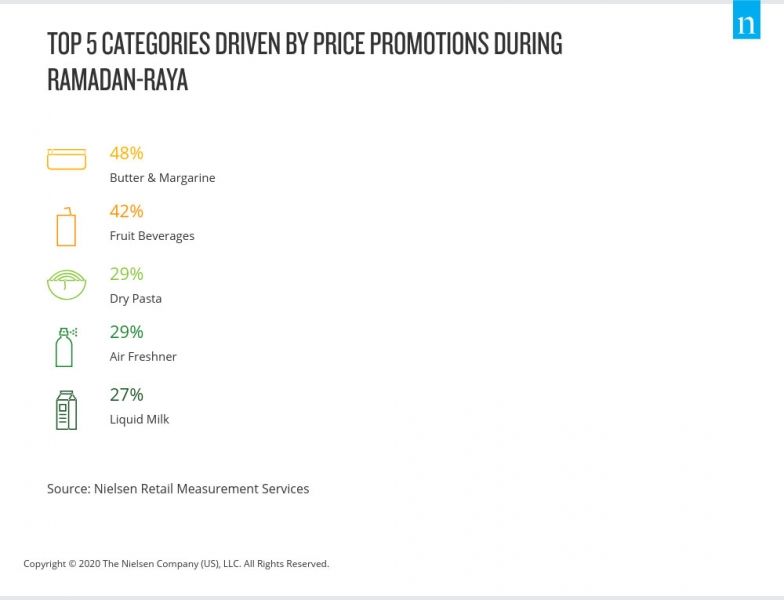

Price promotions drove 30% of Raya sales in 2019, which is higher than 22% posted during non-festive periods. Beverages and dry groceries formed the bulk of products with price reductions, with butter and margarine leading all Raya categories last year at 48% sales derived from price promotions.

Likewise in 2020, Nielsen predicts products with competitive price promotions to do even better. According to the research firm, two in five Malaysians have lost some of their income as a result of the MCO, and will therefore be more price conscious.

2. Engage with social media

One in two Malaysians are cooking at home more than once again since the start of the MCO, according to a recent survey by Nielsen. With Ramadan just around the corner, brands can seize this opportunity to inspire and empower consumers to recreate their favourite Ramadan bazaar favourites in their own kitchens. Nielsen's survey also found that 76% of Malaysians spend more time on social media under the restricted movement order.

Brands should leverage social media to communicate and directly engage with consumers through recipe videos and home cooking contests, among others.

Additionally, rather than increase unit sizes of products, manufacturers should consider bundled promotions on favourite Ramadan products such as rose syrup and evaporated milk, or butter together with a butter container. MD Luca De Nard explained that without the usual buka puasa gatherings and Raya open houses this year, consumers are not required to purchase in large quantities. This means manufacturers do not need to enlarge unit sizes this year.

Meanwhile, retailers can also produce DIY meal kits with ingredients for Malaysians' favourite recipes that can be delivered to consumers' homes. According to Nielsen, this is a good way to discourage wastage and unnecessary panic buying, as consumers will buy what they require to prepare their meals.

3. Customer experience matters

Brands are pressured to demonstrate their relevance in consumers' lives now that there is limited access to physical stores and an expanded reliance on digital connectivity.

“Retailers and manufacturers have a golden opportunity to meaningfully connect and engage with consumers during this upcoming festive season,” De Nard said. He added that those who have a solid understanding of the changes in shopping, usage and behaviour during this period will no doubt contribute to Malaysians’ Ramadan-Raya period being a happy one.

4. Ramp up online capabilities

Besides embracing home cooking, the MCO has caused Malaysians to turn to online shopping and frequent smaller format shops closer to hope, such as mini-markets and provision shops. Due to the increase in demand for eCommerce, retailers will need to strengthen their online shopping and delivery capabilities.

De Nard explained that the MCO could be a catalyst for growth in online shopping, but only if retailers can demonstrate the soundness of infrastructure and supply chain. “Retailers that can ramp up their online capabilities and provide seamless customer experience ahead of the festive shopping period will be able to convert ‘forced trialists’ into frequent online shoppers even after the restriction movement measures are lifted,” he said.

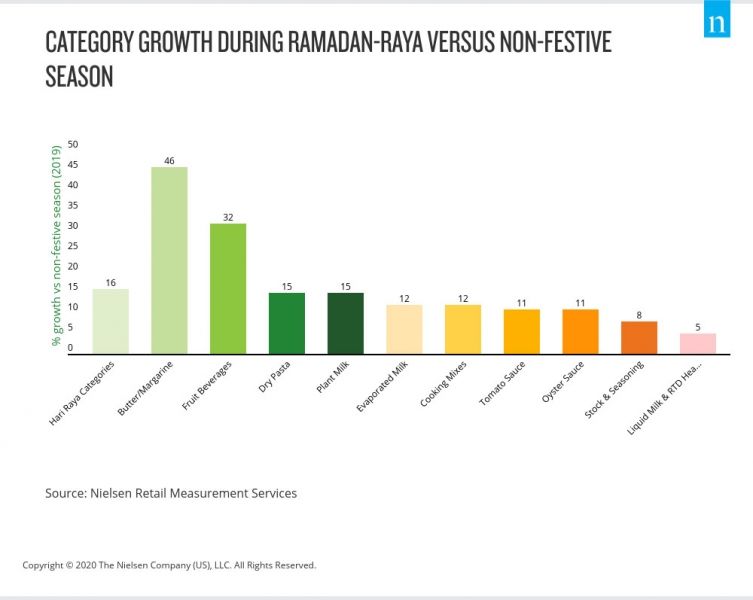

Meanwhile, FMCG manufacturers of categories that are popular during Ramadan, such as butter and margarine, fruit beverages and dry groceries, should ensure that their products are present and constantly well-stocked in smaller format stores.

Out-of-stocks are lost opportunities, particularly for manufacturers, as one in four consumers have indicated their willingness to switch brands when faced with out of stocks.

For crucial pandemic pantry items such as hand care, snacks, body care and household cleaners, the percentage of consumers willing to switch to new brands increases to 40% to 50%, according to Nielsen.

Local manufacturers can also boost production and distribution of premix products associated with Raya, taking into account the scarcity of raw ingredients. Cooking mixes jumped 14% during last year's festive season compared to 2018, and Nielsen expects even stronger growth during this period.

A+M's Content 360 conference is going virtual, and will bring together industry leaders to discuss challenges and share insights on future content marketing trends, as well as successful strategies to help tackle the complex marketing landscape. Sign up here!

Related articles:

How Malaysian brand and agencies are evolving their Ramadan executions in light of COVID-19

Grab MY digitises Ramadan bazaars to support micro-entrepreneurs

5 app categories you should consider spending on during Ramadan

7 Ramadan trends for brands in Malaysia and Indonesia to take note of

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window