Expanding the boundaries of ‘proptech’

share on

This post is sponsored by Placewise.

Wikipedia defines proptech as "the application of information technology and platform economics to real estate markets". While many associate proptech with technology that supports smart buildings, at Placewise, we define proptech as any technology supporting physical real estate.

Today, proptech for retail real estate is pushing beyond the generally accepted boundaries of the past, opening up opportunities for shopping centres to redefine the economic fundamentals of the industry and providing shoppers with the convenience and personally tailored experiences they want.

The demand for proptech from retail real estate has seen a significant increase during the COVID-19 pandemic. Technology gives hope and solutions in a time where traditional shopping is being further challenged, and is a starting point from which to reimagine the role of the shopping centre and begin building the digital foundation necessary for its future health.

There are three main areas where we have seen a heightened level of interest from the industry:

- Crowd management – socially distanced shopping, shopping by appointment

- ECommerce – digital sales and fulfilment, click and collect, curb side pick-up

- Tenant relationships – communication, engagement, support

Crowd management

Whether imposed by government, or driven by socially-responsible real estate owners, the goal of discouraging a crowd is obviously opposite of the norm for retail destinations. So, the overall technology needs to meet the requirements of social distancing, while at the same time applying a level of logic that maximises total footfall potential. Early-stage solutions created bottlenecks where people had to queue, and queuing is not good for social distancing.

Tools such as advanced footfall counters, and heat maps from Wi-Fi routers have existed for a long time. The trouble is that none of these capture anything close to 100% of individuals on an identified basis. At best they give indications of crowds on a timeline. Many centres have defaulted to running their mall as an event where shoppers select specific time slots to visit.

Now imagine everyone visiting the mall must use an app, normally not ideal, but perhaps necessary under current circumstances. The app includes a live visualisation of crowds and a counter for a maximum number of visitors to specific sections of the centre. Tenant promotions and gamification aspects are used to point shoppers to the periods where there is availability for more density.

ECommerce

Another area of proptech, which has seen intense interest, is mall-enabled eCommerce. How do shopping centres engage in this? And what is the value proposition for tenants and shoppers? Having some kind of eCommerce offering on behalf of a mall is the difference of being in business or not, under certain and recently experienced situations. As an example, Placewise is now engaged in a project for a substantial new development in Europe where the ambition is that all products in the mall across all tenants are searchable and for sale in the digital channels of the mall. The products are offered for pick-up at the mall or for home delivery.

From a proptech perspective, the challenges with this ambition lean more towards data access and quality, and operational processes. The high level areas that need to be covered from a processing and customer journey perspective are fairly straightforward: product data from tenant, location level stock data, storefront, shopping cart, payment, fulfilment, services for returns, and settlement between the shopping centre and tenant. These are complex matters that are typically solved between a handful of partnering companies.

As an entry point to eCommerce we believe a robust digital consumer database is a first priority. Without a digital consumer database, the mall will spend substantial marketing dollars to fuel traffic to generate a significant level of online purchases.

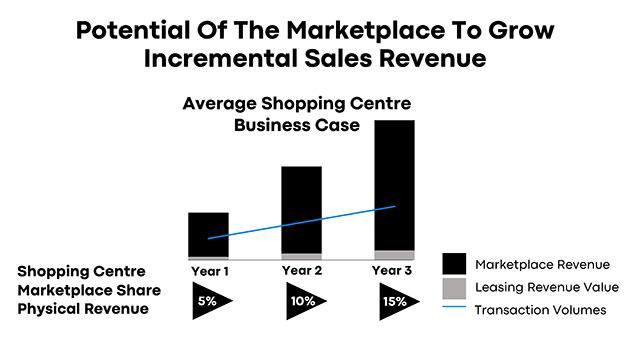

With a digital consumer database, typically reaching 10% to 50% of unique annual physical visitors and beyond, the shopping centre has as strong a value proposition towards tenants in the digital space as it does for those with physical stores, providing digital shoppers to tenants just as they provide physical shoppers at the shopping centre.

Get all this right and we believe a healthy three-year target for a shopping centre should be to generate 10% to 20% of total sales from online sales. Achieve that and your positioning for the next 10 to 20 years is managed!

Tenant relationships

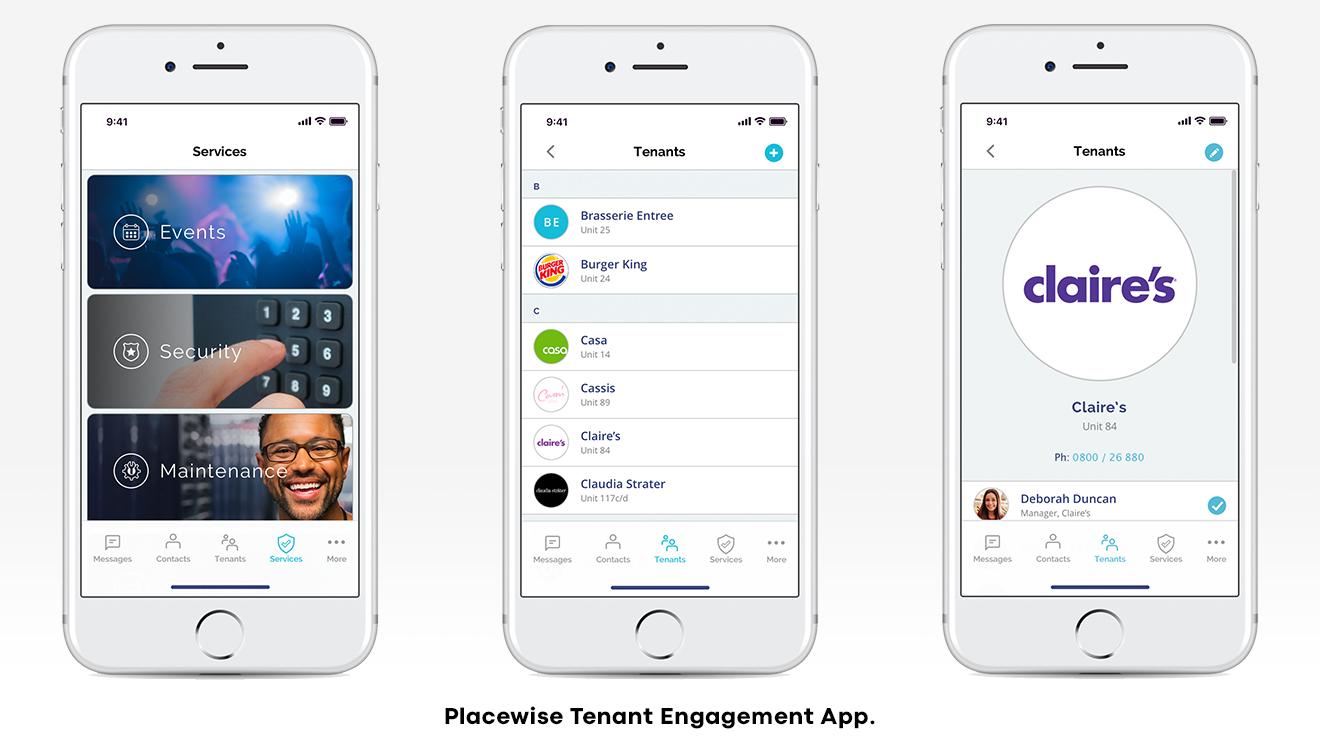

Connecting shoppers with their favourite retailers is the core of a shopping centre’s business. However, equally fundamental is the partnership between landlord and tenant. COVID-19 has highlighted a real need for shopping centre owners to connect with tenants and provide more efficient communication solutions.

Streamlining the operational communication between tenants and centre management, such as forms, permissions, waivers, repair requests, meeting schedules, security alerts or even financial reporting, is good business practice under normal operating conditions, and critical during a crisis.

As our definition of proptech expands, so too are the ways in which proptech can unlock future potential for shopping centre owners.

Shopper behaviour during the pandemic has provided us with a glimpse into the future. Not exactly a crystal ball, but rather a compass that can lead us in the right direction. A more holistic shopping experience for consumers, that is less about “channels”, online versus physical shopping, and more about the ability to choose the details of purchase and fulfilment. For shopping centres, it’s about connecting with shoppers, “owning” the relationship and embracing the financial potential of monetising beyond the square metre.

Here’s to the future supported by proptech!

Lead image credit: Getty Images

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window