eCommerce players are taking growth for granted, says new study

share on

Despite booming sales accelerated by COVID-19, eCommerce players have taken growth for granted at the expense of consumer experience, according to new research released today.

Within Singapore, over a third of consumers (39%) said they are less than satisfied with their digital commerce experience, citing delivery costs, product prices, and delivery time as their top three concerns.

Conducted by research agency Blackbox Research and consumer intelligence platform Toluna, the research report titled “Into the light: understanding what has changed for the ASEAN consumer during COVID-19” analysed current sentiments, expectations and behaviours of 4,780 consumers across Singapore, Malaysia, Indonesia, Vietnam, Thailand, and the Philippines.

The report found that Singaporean consumers reported a spike in online spending in response to COVID-19, with 63% of those surveyed now spending more online, and the total online spend for the average Singaporean consumer increasing by 31%. However, the findings also suggest that while major eCommerce brands are enjoying higher usage rates, this growth has come at the cost of greater scrutiny from consumers.

For example, while brands including Shopee (52%), Qoo10 (41%), and Lazada (39%) are widely used by Singaporeans, consumer satisfaction with Qoo10 and Lazada falls on the lower end, while Shopee only performed average on the spectrum.

Yashan Cama, international commercial director of Blackbox Research said that consumer frustrations about service quality could make or break major eCommerce brands. “We expect some of these cornerstone brands to experience a shake-up in the coming months if these existing problems are not quickly addressed. Consumers will only become more discerning in future. With 5G technology on the verge of transforming platform capabilities, current market leaders may wake to find themselves no longer at the front of that queue if they don’t address concerns and work to deliver a more frictionless experience.”

However, Cama added that this presents Singapore with a unique opportunity to act as the innovation incubator for brands to develop best-in-class eCommerce platforms and services to address these newfound challenges.

“Singapore has always been an important market for both global and regional brands due to its strategic location, as well as its developed financial and legal system. We foresee Singapore becoming increasingly attractive as a tech and innovation hub, as trade tensions and hostility between markets like US and China continue. Singapore has every potential to become the testbed for new eCommerce players as they look to achieve a greater understanding of consumer sentiments – within Singapore and the region.”

Join us on a three-week journey at Digital Marketing Asia 2020 as we delve into the realm of digital transformation, data and analytics, and mobile and eCommerce from 10 to 26 November. Sign up here!

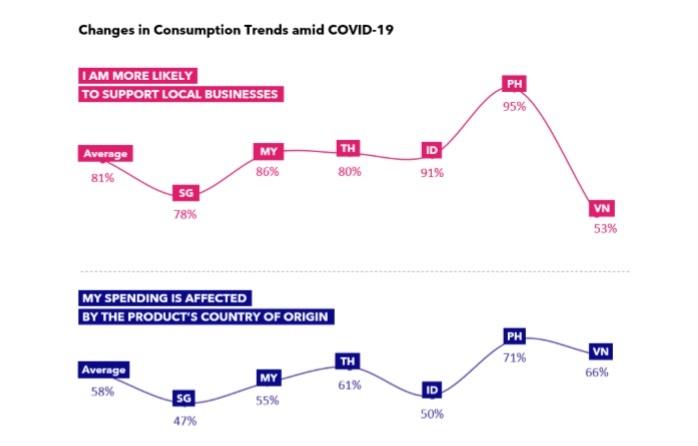

Local businesses emerge as pandemic heroes

The report also identified key trends as a result of the pandemic, notably a shift in consumer sentiment towards local brands. 78% of Singaporean consumers said they were more likely to support local brands in the future, driven by a desire to strengthen their local communities and economy. In fact, when asked to identify brands that they are pleased or impressed with during the COVID-19 crisis, Singaporeans named homegrown players such as Sheng Siong and Fairprice as their top local brands and overall, Singaporeans listed at least three local businesses in their top five.

“‘International’ might be on the verge of becoming a dirty word,” said Cama. “Local brands have truly stepped up to the plate during the pandemic, as demonstrated by the key roles these two grocery heavyweights have played during key milestones such as Singapore’s circuit breaker period, and their ability to manage customers and meet their needs in the best possible way.

“The resurgence in national pride can also be attributed to consumers looking to support their own economy.They are increasingly choosing to shop local over international.. International companies will need to reassess their brand portfolios and seriously consider how they can localise their brands to reflect the values that matter most to Singaporean consumers.”

According to Cama, COVID-19 is not only changing how and where consumers are spending their money, but it is also shifting how people are going about their day-to-day lives, which will have a tangible impact on future consumer behaviour.

“Since the onset of the pandemic, homes in ASEAN have emerged as the headquarters for learning, working and socialising. An overwhelming 95% of Singaporeans are happy working from home, and the majority aren’t missing going to the movies or shopping at retail outlets.”

“Consumers are not rushing back to their old habits, so this new sense of life revolving around the home hub means companies need to rethink how they build this into the consumer experience in future. These changes go right to the heart of consumer behaviour and require innovative approaches across the board from property developers, landlords, employers, through to retailers.”

Commenting on the significance of the study’s findings, Cama said, “What the study has shown us is that the pandemic has unequivocally shifted how we identify as consumers. If businesses fail to adapt, the stakes are high. Any negative interaction with a brand – particularly in times of crisis – can have longstanding effects on his or her sense of trust and loyalty.

“In order to build resilience, brands need to keep a real-time pulse on customer preferences, and at the same time reimagine customer experience for a post-COVID-19 world, with care and connection at the forefront. Organisations today have an obsession with data. This is not a bad thing. But only by choosing to value customers as more than digital units or data points, will brands emerge successful.”

Join us on a three-week journey at Digital Marketing Asia 2020 as we delve into the realm of digital transformation, data and analytics, and mobile and eCommerce from 10 to 26 November. Sign up here!

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window